60% of First Time Buyers believe estate agent or surveyor carries out legal searches

Two thirds of First Time Buyers believe an estate agent or a surveyor carries out legal searches when buying a home – New research reveals mass confusion among FTBs about home-buying process

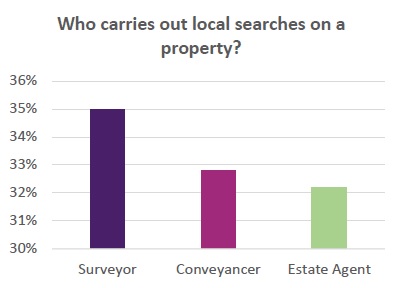

- 67% of FTBs mistakenly believe a surveyor or estate agent carries out legal searches

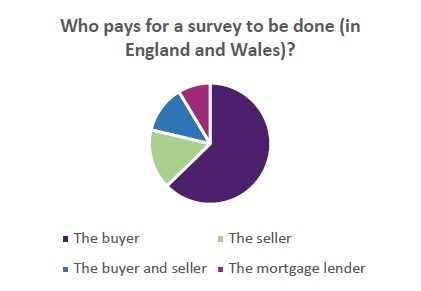

- Over a third of FTBs think someone else will pay for a survey on a property they wish to buy

- 37% of FTBS believe ‘exchange’ is the day they receive the keys and move in

First Time Buyers are extremely confused about the different stages of the home-buying process, the responsibilities of the professionals involved and what is expected of them as buyers, reveals new research released today by home move comparison site reallymoving.com.

In a survey of 500 people who are planning to buy their first home in the next three years, undertaken in February 2018, respondents were asked a series of questions which anyone buying a property should know the answer to.

When asked who carries out local searches on a property, two thirds, (67%) of First Time Buyers responded that it was the responsibility of the surveyor or the estate agent to carry out searches such as environmental, water/drainage and chancel repair liability, with only 33% correctly identifying the conveyancer as the professional responsible.

Misunderstandings about the costs involved when buying a home could lead to First Time Buyers being unprepared and underfunded, ultimately leading to transactions falling through. A large proportion (36%) don’t realise that they are responsible for paying for a survey, believing it to be the seller, the buyer and seller together, or the mortgage company who foots the bill. Just 63% know that the buyer pays for a mortgage valuation, HomeBuyer Report or Building Survey.

Many First Time Buyers are now exempt from paying stamp duty, since the Chancellor scrapped the tax on property transactions of under £300,000, but this game-changing tax giveaway may have been lost on a large part of its target audience, with almost a quarter (24%) believing stamp duty is paid by the seller.

A further 8% believe it is a payment the buyer makes to the seller, with a further 7.5% believing it’s a charge from solicitors.

When it comes to paying solicitors fees, however, First Time Buyers are in for a more pleasant surprise, with most respondents vastly over-estimating how much they will be charged for conveyancing. When asked how much solicitors fees are likely to be on a £250,000 property, 69% guessed around £1,500 when in fact the average is £550.

The jargon commonly used in the home-buying process can be confusing. Only 60% said they planned to secure a mortgage in principle in advance of offering on a property and only 55% understood the true meaning of ‘exchange’, with a worrying 37% believing it’s the date they collect the keys and move in.

Rob Houghton, CEO of reallymoving.com, said:

“Failure to grasp the fundamentals of the home-buying process will create big problems for first time buyers and could lead to unexpected costs and transactions falling through. Buying a property is rarely straightforward, but it is in the best interests of First Time Buyers to ensure they are as well prepared as possible, with a good understanding of the different roles of the professional involved, who pays for what and the likely costs.

“First Time Buyer activity is surging this year, thanks to changes to stamp duty and the huge popularity of Government schemes such as Help To Buy, so it’s more important than ever that they are going into the process with their eyes open.”

To assist First Time Buyers on their journey to home ownership, reallymoving.com has launched a comprehensive, downloadable First Time Buyer’s Guide, containing everything they could need to know about the home-buying process. They have also created an educational ‘Snakes and Property Ladders’ game based on the children’s classic Snakes & Ladders, highlighting the steps and possible pitfalls when buying a first home.

Kindly shared by Really Moving