Supply of Available Rental Stock Hits a Record High

Arla Propertymark has issued its March Private Rented Sector (PRS Report, which shows that the supply of available rental stock has hit a record high.

- The number of properties managed per letting agent branch rose by three per cent in March

- Demand from prospective renters increased

- The number of landlords exiting the market and rent rises both remained high

Supply of rental stock and demand from tenants

- The supply of properties available to rent rose to 203 per member branch in March, from 197 in February – the highest since records began in 2015.

- Year-on-year, supply is up 13 per cent, compared to 179 per branch in March 2018.

- Demand from prospective tenants also increased, with the number of house hunters registered per branch rising to 67 on average, compared to 65 in February.

Rent prices

- The number of tenants experiencing rent rises fell marginally in March, with 30 per cent of agents witnessing landlords increasing them, compared to 34 per cent in February.

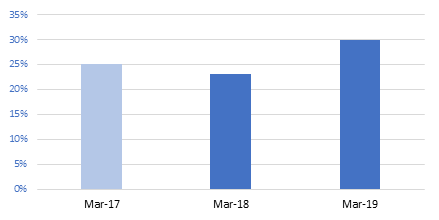

- Year-on-year, this figure is up 30 per cent, from 23 per cent in March 2018 [Figure 1].

Figure 1: Average number of tenants experiencing rent hikes in March year-on-year

Landlords selling their buy-to-let

- In March, the number of landlords exiting the market remained at four per branch. This is up from three last year.

David Cox, ARLA Propertymark Chief Executive, said:

“Whilst its really positive that the number of properties available per branch hit a record high last month, this may be the first signs of the industry consolidating ahead of the tenant fees ban as agents either sell-up or merge. This, coupled with landlords exiting the market and rent costs continuing to rise, means the overall picture is far from positive for renters.

“The full effects of the tenant fees ban have not yet been felt, and now the Government is introducing yet more new legislation which will deter new landlords from entering the market, such as abolishing Section 21. Until we have greater clarity on the changes planned, this news will only increase pressure on the sector and discourage new landlords from investing, meaning rents will only continue to rise for tenants.”

Kindly shared by Arla Propertymark