Industrials still in huge demand as retail fails to pick up

Conditions in the commercial property sector remain varied, with industrial property seeing solid growth and retail showing little sign of improvement, according to the RICS UK Commercial Property Market Survey for the first quarter of 2019.

Alongside this, feedback from surveyors suggests a lack of movement on Brexit continues to deter investors and occupiers across the board.

Headlines

- Domestic and overseas investment demand turns negative as Brexit weighs on decision makers

- Retail demand from occupiers continues to fall

- Split between appetite for prime and secondary office space remains

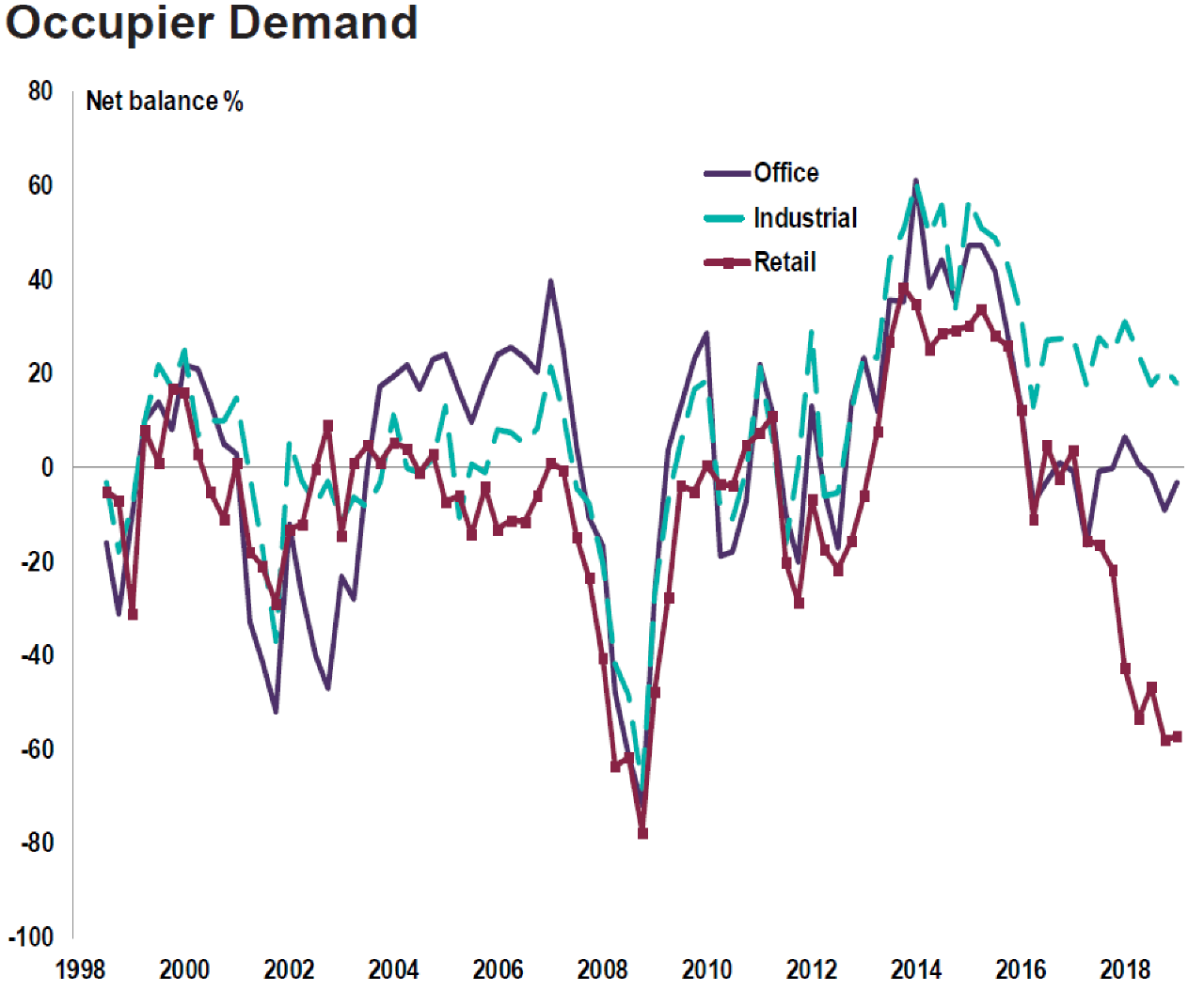

Demand from occupiers for UK commercial property saw an overall decline over Q1 2019. However, this decline stemmed from the retail sector, where 57% of respondents reported a fall in demand. Occupier demand for office space was broadly stable, having weakened slightly in Q4 2018. Meanwhile, the industrial sector (including warehouses) continued to see a steady rise in tenant demand.

As demand for industrial space rose, the number of vacant units continued to decrease. In contrast, the number of vacant retail units has been increasing over the past 18 months. Respondents also cited a slight rise in office availability for the second consecutive quarter. Consequently, 48% of respondents saw a rise in retail inducements, 26% saw a rise in incentives to take office space.

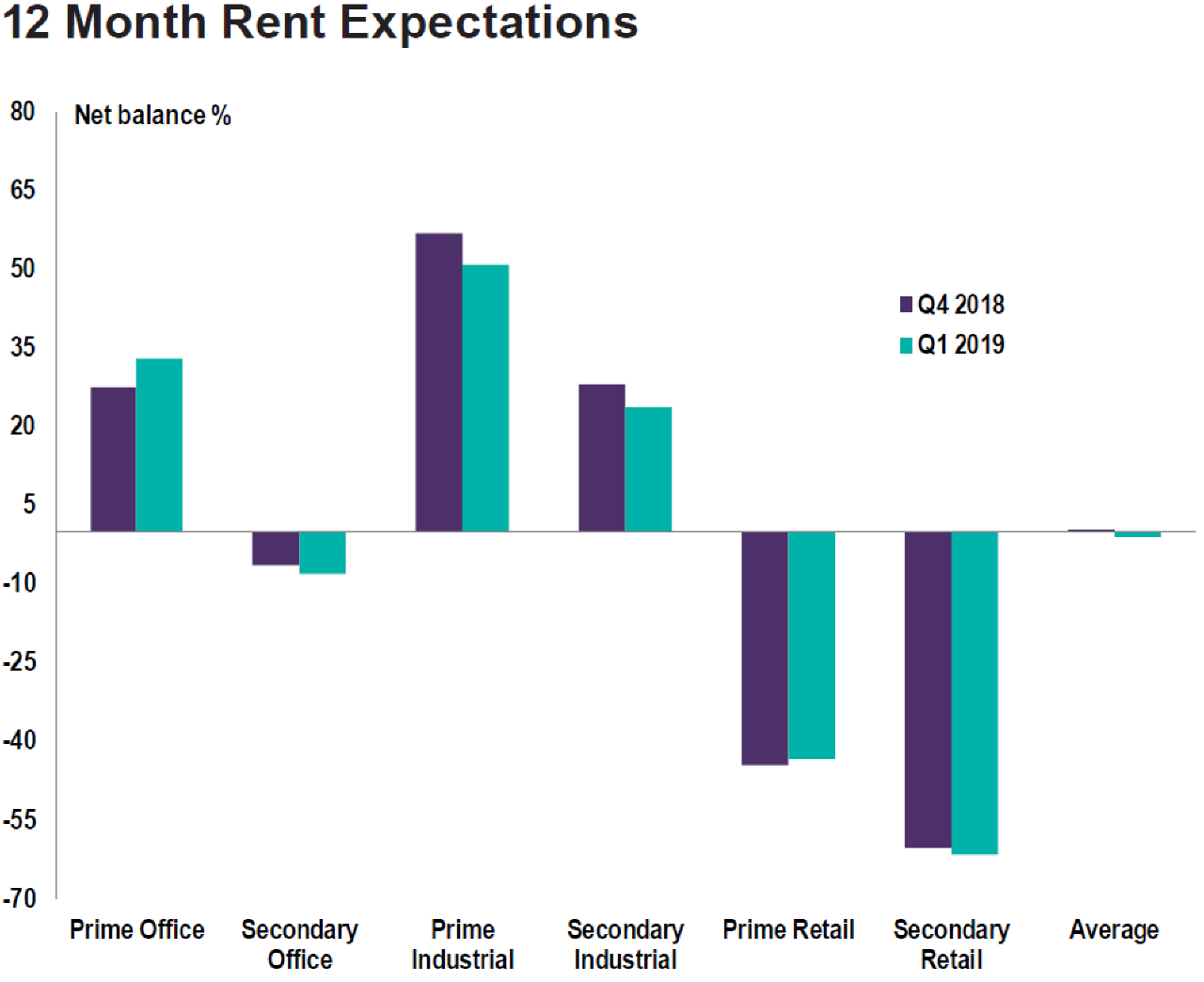

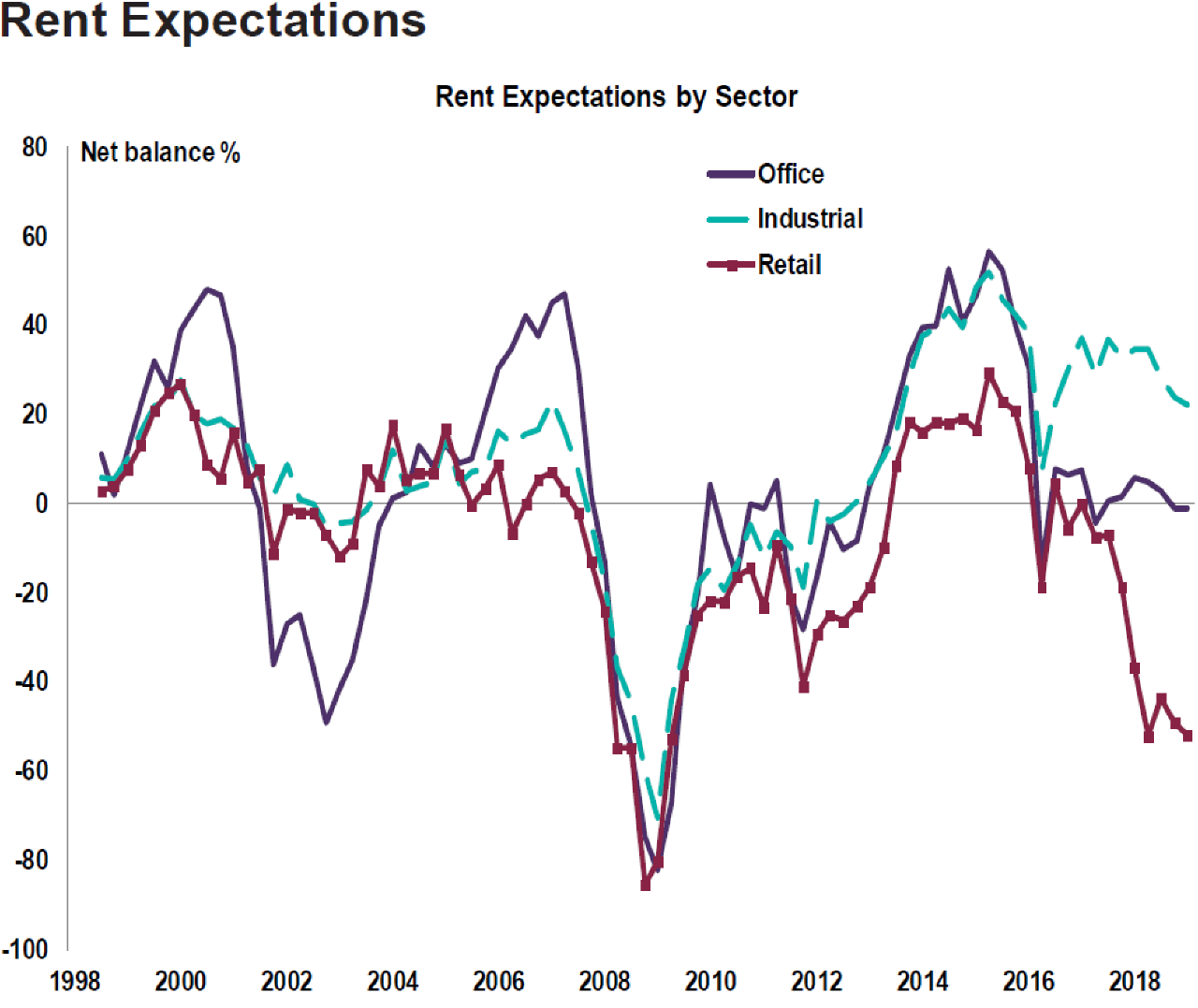

Contributors are still anticipating further growth in rents across prime and secondary industrial market over the next twelve months. Meanwhile, for offices, there remains a clear split between prime and secondary, with the former expected to deliver steady rental growth whereas for secondary office space rental growth projections are marginally negative.

When viewed across the UK regions, the pattern of positive rental growth expectations for industrials and negative views for retail is replicated. The office sector is more nuanced, although prime office rents are seen rising across most regions.

UK Commercial Property Market Survey: in numbers

As the Brexit debate rumbles on, domestic investment enquiries for commercial property have declined for two successive quarters. Retail was responsible for most of this decline, however, investment enquiries also fell modestly for offices. Buyers remain keen for industrial units and investment demand for this sector remained positive. Prime industrial assets are predicted to post the strongest capital value gains on a sectoral comparison over the coming year.

Overseas investment demand has declined. 52% of respondents nationally continue to sense conditions are consistent with the early to middle stages of a downturn, virtually unchanged from Q4.

In each quarter since the Brexit vote took place, survey participants have been asked if they have seen any evidence of firms looking to relocate at least some part of their business as a result. In each of the two previous quarters, the proportion reporting they had seen signs of this type of activity came in at around 24%. Interestingly, however, this picked up to 33% in the latest results. Going forward, a slim majority (53%) of respondents nationally do now expect relocations to occur. Of course, whether firms do decide to relocate will still depend on how the negotiations unfold.

Tarrant Parsons, RICS Economist, comments:

“Trends across the UK commercial property market in the early part of 2019 have continued in a similar vein to those reported last year. The industrial sector remains a clear area of strength while the retail sector continues to be challenged by the growth in e-commerce. Brexit uncertainty is again cited to be a negative influence on market activity, causing some occupiers and investors to hesitate as they await further clarity on the future direction of policy.”

Kindly shared by RICS