Soaring house prices failed to deter first-time buyers in 2020

The overall number of first-time buyers fell in 2020, as the housing market was curtailed during the first national lockdown, according to the latest research by Halifax.

Main points:

- Average first-time buyer deposit amount leapt by more than £10,000 last year

- Number of first-time buyers fell by 13% but activity bounced back after first lockdown

- First-time buyers continued to make around half of all home purchases

Volume of first-time buyers

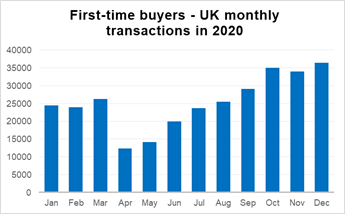

With sales activity largely grinding to a halt during Spring, the overall number of first-time buyers in 2020 was down by over 46,000 (13%) compared to 2019 (304,657 vs 351,260).

However, first-time buyer transactions bounced back strongly in the second half of the year (up 52% from 121,050 in H1 to 183,607 in H2) once the market reopened. Comparing the second half of 2020 to the same six-month period in 2019, first-time buyer transactions were down by just 2% (compared to -26% in H1).

In total, the number of first-time buyers as a proportion of all homes purchased with a mortgage remained stable last year at 50% (vs. 51% in 2019 and 50% in 2018).

Northern Ireland (-23%), Wales (-23%) and Scotland (-21%) experienced the biggest decreases in the number of first-time buyers last year. London’s first-time buyer figure fell by the smallest percentage of any region, down by just 6% year-on-year.

Russell Galley, Managing Director, Halifax, said:

“Whilst these figures confirm the almost inevitable fall in the overall number of first-time buyers in 2020 – with the entire housing market effectively shuttered during the first national lockdown – they also underline just how strong the bounce back was in the second half of the year.

“Despite the obvious challenges presented by soaring house prices, not least the need to raise an even bigger deposit, first-time buyers still accounted for half of all home purchases, a reassuring statistic given their overall importance to the market.

“However, with the economic impact of the pandemic likely to be felt most keenly by the young and those in lower-paid jobs, the need to prioritise improved housing availability and affordability for all those looking to make that first step onto the property ladder becomes ever greater.”

Average purchase price

The average price paid by a first-time buyer in the UK last year was £256,057, up by £22,939 (10%) from a year earlier (£233,118). London saw the biggest monetary increase in the average price paid by first-time buyers over the last 12 months, up by £33,486 (7%) from £455,611 to £489,098.

The greatest percentage growth came in the West Midlands, up by 11% (£19,565) from £185,682 to £205,246. The smallest increase came in Scotland, up by just over 1% (£2,133) from £153,278 to £155,411.

Average deposit paid

The average amount put down by a first-time buyer in 2020 was £57,278, compared to £46,449 the year before, a rise of over 23% (£10,829).

Average deposits for first-time buyers in London were up by £20,211 (18%), from £110,145 to £130,357. Other areas of the country also saw big increases, with the average first-time buyer deposit growing by 25% (£6,634) in Wales, from £26,029 to £32,663.

Affordability for first-time buyers

Burnley in the North West remains the most affordable area for local first-time buyers – calculated by comparing average earnings to average house prices – with a ratio of 3.1.

The vast majority of the top 20 most affordable areas are in Scotland (examples include both East and North Ayrshire at 3.2), with North Down and Ards in Northern Ireland (3.8), Middlesbrough and Doncaster (both 3.9) also making the list.

The list of the top 20 least affordable areas in the country continues to be dominated by Greater London, with Islington recording a house price to earnings ratio of 11.9, followed by Brent (also 11.9) and Hackney (11.8). Many of the other most expensive areas are in the South East, with Oxford (10.3) and Slough (10.0) also in the top 20. The average age of a first-time buyer in the UK is now 31, just one year older than it was a decade ago (30 in 2010).

Kindly shared by Halifax

Main article photo courtesy of Pixabay