Reallymoving House Price Forecast: House prices fell in February prior to stamp duty extension news

Homebuyers who had their offers accepted by sellers in February agreed to pay less than the previous month, resulting in the fifth consecutive month of average house price falls, according to the Reallymoving House Price Forecast February 2021.

Key points:

- Buyers doing deals in February 2021 agreed to pay 2.4% less than the previous month

- Positive benefit of stamp duty extension is likely to be reflected in deals agreed in March

- Underlying value of property market remains strong, but Government intervention is distorting prices

Early reports from property portals and estate agents suggest that the stamp duty holiday extension announced in the March 3rd Budget, along with news of a new the mortgage guarantee scheme, has boosted buyer demand. But Reallymoving’s data indicates that in February prices were continuing to head downhill as the window for buyers to benefit from the original stamp duty holiday closed. This will be reflected in Land Registry Price Paid data in May 2021 – though the downward trend is likely to be reversed as the stamp duty holiday extension once again boosts demand.

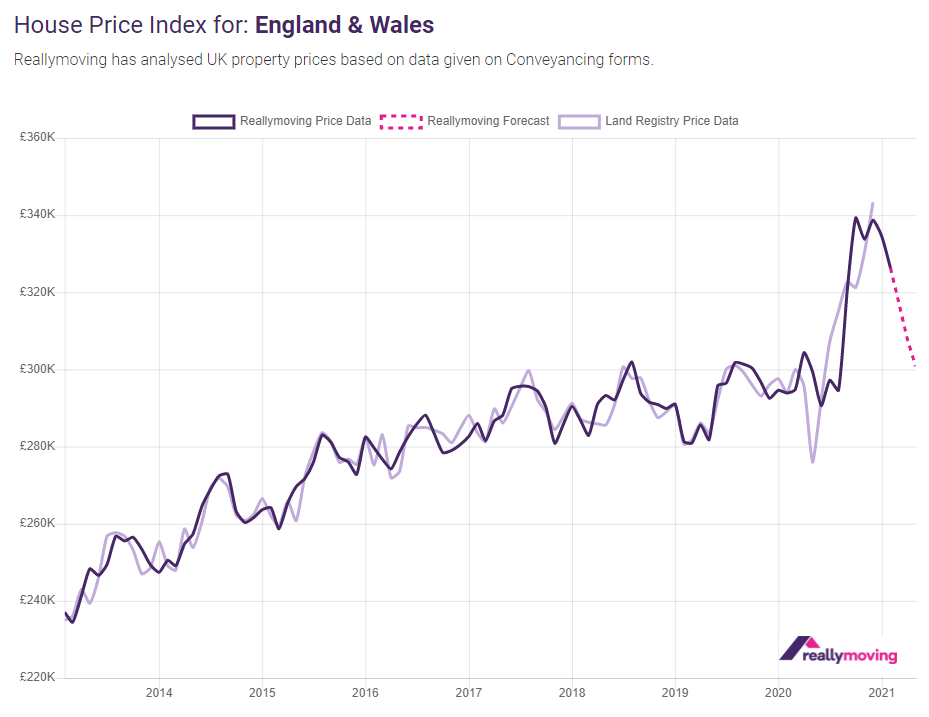

Reallymoving captures the purchase price buyers have agreed to pay when they search for conveyancing quotes through the comparison site, typically 12 weeks before they complete. This enables reallymoving to provide a three- month house price forecast that historically has closely tracked the Land Registry’s Price Paid data, published retrospectively (see Graph 1).

Following a Christmas peak, completed sale prices will decline through the early spring, falling by 2.6% in March, 3% in April and 2.4% in May 2021. The impact of the original stamp duty holiday deadline of 31st March is clearly evident in the value of deals being agreed last month, as buyers factored in the additional cost and sellers were forced to accept lower prices.

This Chancellor’s announcement of an extension of the stamp duty holiday in the 3rd March Budget and a tapering of the saving into the autumn, is likely to halt this downward trend in the value of deals being agreed as buyers are once more set to benefit from substantial cash savings, boosting confidence and affordability.

Annually, prices in May 2021 will be just 0.5% higher than May 2020, suggesting that the decline in house prices seen since the start of the year is simply a reversal of house price inflation seen in the second half of last year, when the market boomed post-lockdown.

The proportion of First-Time Buyers in the property market is showing signs of a strong recovery, following a 12% drop in the second half of 2020, when they faced greater competition for homes, rising prices and a restricted mortgage market. First-Time Buyer share is now back up to 58% of all transactions from a low of 46% last September. Use of Help to Buy and Shared Ownership is already at an all-time high and with loans expected to become available imminently through the mortgage guarantee scheme, there’s a significant opportunity for First-Time Buyers to access the housing market in the coming months with a relatively small initial cash outlay.

Rob Houghton, CEO of reallymoving, comments:

“Average prices agreed between buyers and sellers fell for the fifth consecutive month in February, continuing the readjustment in house prices we’ve seen so far in 2021. We believe this to be a reversal of remarkable levels of growth last year, although further Government intervention in the Budget is likely to positively impact prices and transaction volumes heading into the summer – particularly if housebuilding volumes fail to recover quickly.

“First-Time Buyers are crucial to the health of the wider market and their share is recovering strongly, with record numbers using Government schemes to get onto the housing ladder. The mortgage guarantee scheme could really open the floodgates by giving First-Time Buyers with a 5% deposit access to the wider market, rather than being limited to new build. This is likely to have a significant effect on activity levels by enabling transactions all the way the up the chain, particularly in London and the South East where deposit levels are the most prohibitive.”

Kindly shared by reallymoving.com

Main photo courtesy of Pixabay