Over 1,000 conveyancing firms go missing in action over last decade

The number of active conveyancing firms in England and Wales has fallen by over one thousand since 2011 [1], according to the latest Conveyancing Market Tracker from Search Acumen, the legal property data and technology provider.

Key points:

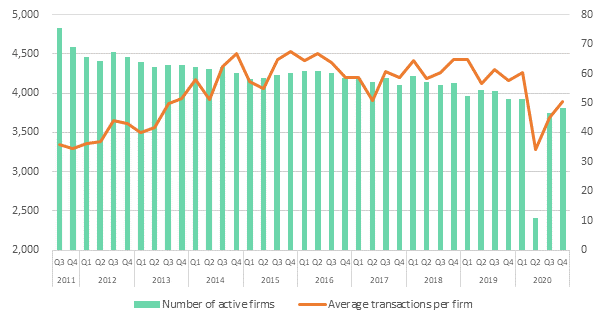

- Competitive pressures drive industry consolidation as active firms fall from 4,836 to 3,808

- Average number of transactions per firm plummets 43% during first lockdown

- However, average firm sees caseload grow by 63% over the last ten years

The analysis, which provides a quarterly assessment of transaction activity and competitive pressures in the conveyancing market, reveals the number of firms registering transactions reached 3,808 in Q4 2020. This is down from 4,836 in Q3 2011 – amounting to a net loss of 1,028 businesses.

Number of active conveyancing firms and average quarterly caseload, Q3 2011 to Q4 2020

The reduction has been partly driven by challenging trading conditions in the conveyancing market over the last decade possibly leading to increased M&A activity. Firms may have sought to capitalise on greater economies of scale by merging in an effort to reduce costs and boost profits.

Between the EU Referendum in June 2016 and Q2 2019, 245 firms exited the conveyancing market. This sharp fall may be partly attributed to a drop in housing market activity as a result of greater economic volatility and Brexit uncertainty impacting consumer confidence.

Search Acumen’s analysis follows a period of intense disruption in the property market caused by the coronavirus pandemic, which has impacted conveyancing firms’ operations over the last year. The average number of transactions each firm undertook in Q2 2020 reached 34, down 43% from 60 in Q1 2020, while the total number of transactions across the whole market fell 65% to 82,385 from 236,641 over the same period.

The number of active firms who registered completed transactions plummeted to an all-time low of 2,411 before rebounding in the second half of the year as lockdown measures were eased. However, the total of 3,808 firms who were active in Q4 2020 remains lower than at any other point in the pre-pandemic period.

The average firm has seen its transaction volumes grow by 64% over the last ten years. From Q3 2011 to Q2 2012, the average firm completed 36 transactions per quarter. During the 12 months from Q2 2019 to Q1 2020, before the pandemic took hold, the average firm was responsible for delivering 59 completed transactions per quarter.

Andy Sommerville, Director at Search Acumen, says:

“These figures demonstrate the scale of consolidation and competitive pressures in the conveyancing market over the last decade, as some conveyancers have exited and larger firms have joined forces.

“Greater consolidation in the market means fewer firms are generally handling larger transaction volumes, with the obvious exception of the pandemic period. Employers have an important part to play in ensuring they are set up to meet the challenge of completing more cases while handling the pressures of maintaining client service and meeting client expectations.

“The current rush of activity prompted by the stamp duty holiday shows the pressures that can be placed on businesses by a surge in activity that can leave systems and processes under severe pressure. It is vital firms make the most of digital tools and investing in upskilling to strengthen their capacity to cope, as well as ensuring employee wellbeing remains front-of-mind.

“The property industry must break free from traditional ways of working that belong to a bygone era. Greater digitisation and investment in training to use new technology productively will help to manage competitive pressures and provide clients with the kind of responsive services they expect in a world where on-demand services are common in other sectors.”

Sources:

[1] Search Acumen: The Conveyancing Market Tracker examines competition in conveyancing by analysing business activity among those firms holding HM Land Registry client accounts, as well as assessing commercial pressures and the outlook among conveyancers.

Kindly shared by Search Acumen

Main photo courtesy of Pixabay