SPECIAL FEATURE: Why combining eSignature and ID validation technology with document workflow automation makes profitable sense for conveyancers – VirtualSignature-ID

SPECIAL FEATURE: David Kern, CEO of VirtualSignature-ID, writes on why combining eSignature and ID validation technology with document workflow automation makes profitable sense for conveyancers.

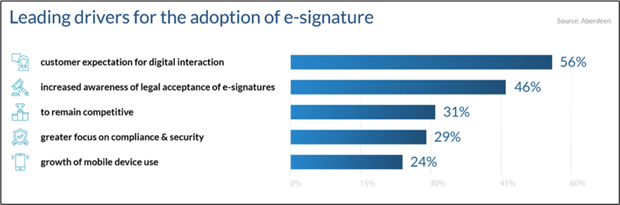

The drive towards digital in conveyancing has led to the adoption of an array of point solutions for key parts of the conveyancing process. This accelerated during the pandemic with firms rushing out and selecting digital solutions such as eSignatures to replace face-to-face interactions. It has been further driven by client demand for remote, mobile and secure solutions as they seek a better digital experience from their legal service providers.

Many law firms are now trying to figure out how to glue these point solutions together and deliver a better remote and digital experience for their clients. They are also trying to minimise dealing with multiple technologies with different ways of working and suppliers all with variable costs. They just want something that is easy and simple and that works seamlessly.

Converging need to combine eSignatures with higher ID Validation using the same standards and technology

The fact that there is a clear convergence in both the need and the technologies required to meet regulatory demand, especially around linking a person to a document or matter, means that the opportunity to switch to a better, longer-term solution is now real and practical.

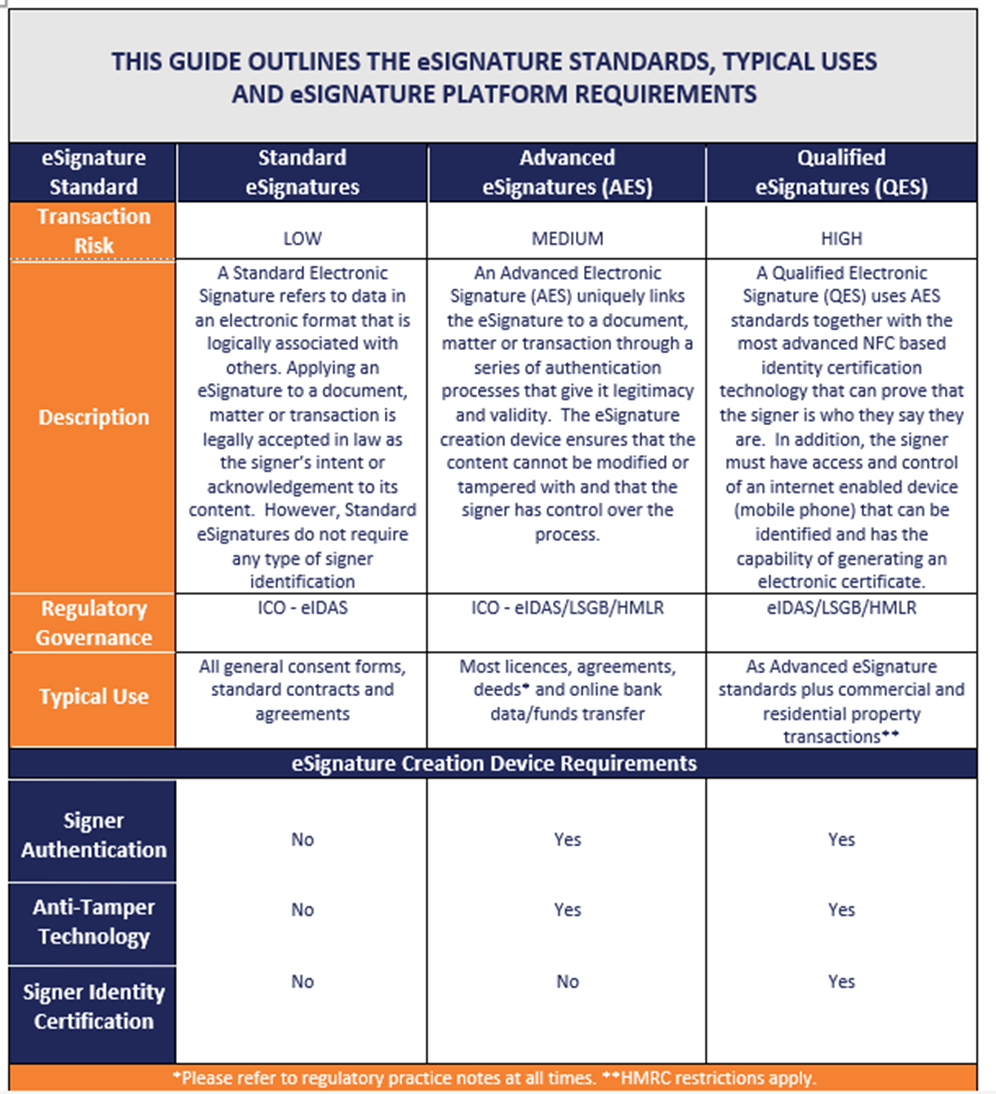

When using eSignatures, for many types of transactions, especially property related matters, it is critical to know that the person signing the document is who they say they are to reduce the risk of identity fraud and, therefore, real-time ID verification technology is increasingly being used with eSignatures to deal with this issue. UK eIDAS regulations categorise electronic signatures into three standards, Simple (SES), Advanced (AES) and Qualified (QES). Both Advanced eSignatures and Qualified eSignatures require the eSignature to be uniquely linked to the signer and their ID verified. Qualified electronic signatures have the same features as Advanced eSignatures but require the use of more sophisticated technology and need to meet a higher standard of security, meet stricter validation criteria, and be supported by a more detailed certificate from a trusted provider. They have the same legal effect as a handwritten signature.

Although all three types are legal, the choice as to which one a firm uses depends on the nature of the transaction, risk level and the personal situation of the parties involved. However, firms, especially in conveyancing, are increasingly adopting Advanced and Qualified eSignatures as standard practice so that ID Verification is combined with eSignatures.

It is therefore no surprise that the HM Land Registry, as outlined in its Practice Guide 81 on encouraging the use of digital technology in identity verification, has adopted UK eIDAS regulations for the higher standard of identity check – one that uses biometric and cryptographic technology. The standard when followed, constitutes what is regarded by HM Land Registry as a discharge of the duty to verify the identity of a party to a registrable transaction. A conveyancer who adopts this approach will have fulfilled their obligation to take reasonable steps in relation to the requirement to verify their client’s identity and will reach “Safe Harbour” status.

But the requirement to combine these technologies is not limited to just conveyancing. The reality is that engagement with clients and most document transactions require some form of eSignature and ID verification to add deeper assurance in the signing process. As an example, the client on-boarding process requires sending a client a form to complete or an engagement letter to sign; ID verification checks as well as other checks such as AML, Bank checks and Proof of Funds also need to be completed.

Combining a number of these together as part of a seamless process makes common sense. It not only delivers a great experience to end-clients but also reduces errors, effort and costs for the firm. The onboarding process can be done with the documents signed and verified electronically and ID Verification and all other checks completed at the same time in minutes and on the same platform, giving clients a great digital experience comparable with other industries. The technology to do this seamlessly on one integrated platform exists today.

Benefits of a seamless integrated approach

For clients, it is easy, it can be done remotely at their convenience and is secure.

For the firm, it saves time and reduces from weeks to days the start of legal work. It also reduces errors, additional effort and cost. From a compliance perspective, it reduces risk of fraud and enables firms to be compliant and adopt the higher-level Qualified ID verification checks to achieve Safe Harbour status.

Furthermore, by combining these technologies on a single, integrated, seamless platform, firms can reduce the headache of dealing with different technologies and different suppliers and unlock the power and benefits of a simple ‘one solution, one supplier, one price’ for their eSignatures and their ID verification and compliance checks such as AML and Source of Funds.

David Kern

Written by David Kern, CEO of VirtualSignature-ID.

VirtualSignature is a leading UK provider of Regulatory Technology. Its Smart Onboarding platform which incorporates SmartSign, SmartForms and SmartCheck applications, helps businesses reduce risk of fraud by identifying and validating their clients with 100% accuracy and enabling them to sign and verify complex documents easily, remotely and quickly. To find out more contact us here.

Kindly shared by VirtualSignature-ID

Main article photo courtesy of Pixabay