Which? asks what is happening to UK house prices

Which? asks what is happening to UK house prices, which are still high, up 11% year-on-year, although experts expect market to slow.

After a year of soaring prices and fierce competition between buyers, house price growth is likely to slow in the coming months as the market settles down.

The Land Registry says prices rose by nearly 11% year-on-year in February, but experts think we’re unlikely to see such rapid rises as 2022 progresses.

Here, Which? analyses what’s happening to house prices and explains whether now is a good time to get on to the property ladder.

What’s been happening in the property market?

The property market soared in 2021, as buyers rushed to take advantage of the government’s temporary cut to stamp duty.

The stamp duty holiday meant buyers in England and Northern Ireland could save up to £15,000 in tax if they bought a home before the end of June, or up to £2,500 if they bought before the end of September.

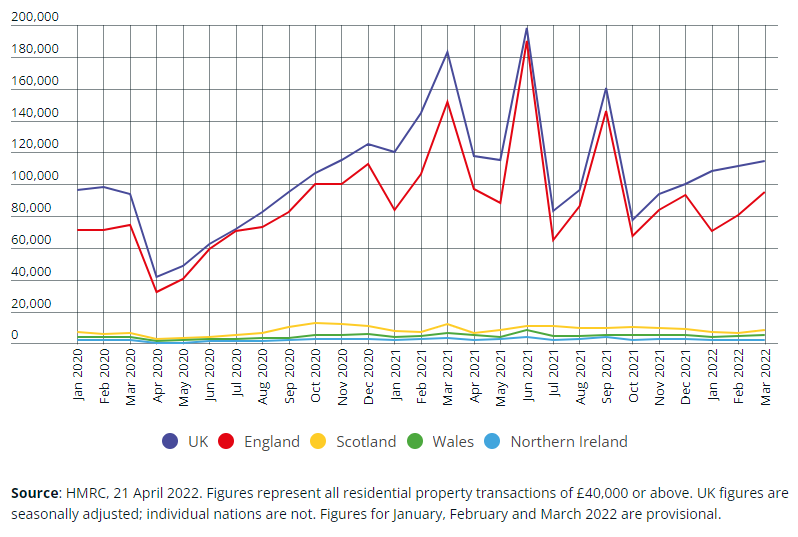

The number of property purchases peaked around these deadlines, but the number of sales each month is now much closer to pre-pandemic levels. Data from HMRC shows around 114,000 transactions went through in March.

The graph below shows the number of sales recorded across the UK since the start of 2020.

Number of residential sales across the UK:

How have house prices changed?

House prices have risen considerably in the last 12 months, with the pandemic and stamp duty holiday bringing about a more volatile market.

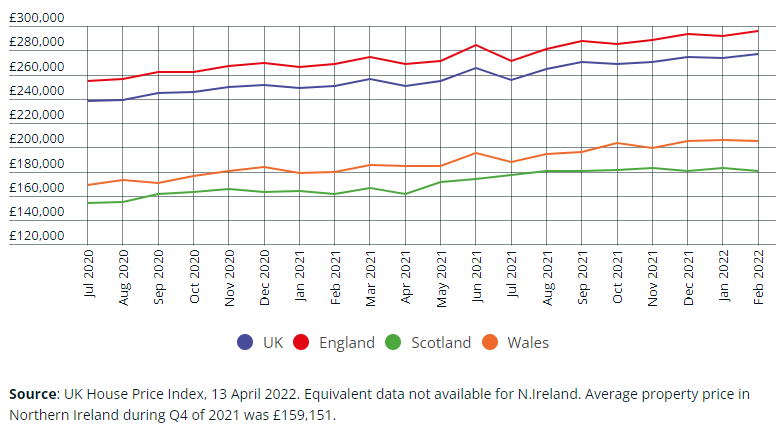

The Land Registry’s UK House Price Index is the most reliable barometer of what’s happening to house prices, as it’s based on actual property sales rather than asking prices. It works on a two-month lag, so the most recent figures are for February.

The Land Registry says that the average price of a property in the UK rose by 10.9% year-on-year in February to reach £276,755, as shown in the graph below.

Average house prices over time:

How do other house price indices compare?

There are several other property price indices. The property portal Rightmove provides the most up-to-date figures, but they’re based on asking prices set by sellers rather than confirmed sales. Nationwide and Halifax also publish their own monthly data, based on mortgage lending.

All three providers are currently reporting around 10% growth, as shown in the table below:

| House price index | Month-on-month change | Year-on-year change |

| Rightmove (April 2022) | 1.6% | 9.9% |

| Nationwide (April 2022) | 0.3% | 12.1% |

| Halifax (April 2022 | 1.1% | 10.8% |

Is the property market set to slow down?

After the home-moving frenzy of 2021, there’s now a mismatch between supply and demand. A recent survey by the estate agency Savills found that nine-in-10 current house hunters have had their search affected by a lack of available properties.

The estate agency trade body Propertymark reported an average of 84 prospective buyers registering with each estate agent in March. It says 84% of properties sold for the asking price or above, compared to 80% in February.

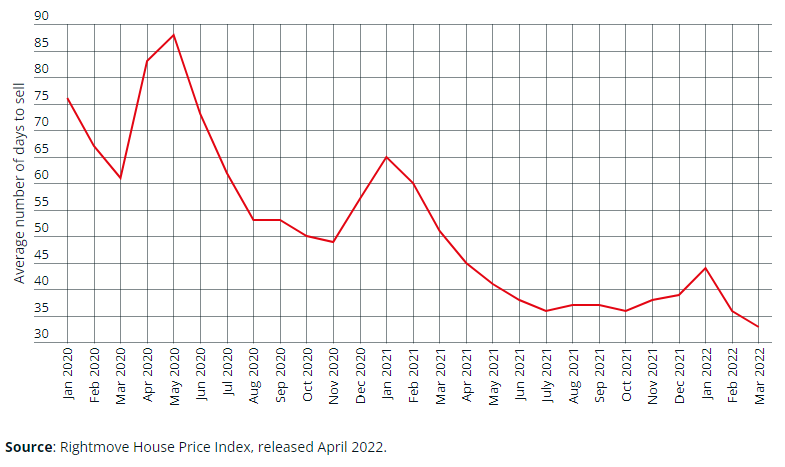

The imbalance between supply and demand is reflected in Rightmove’s ‘time to sell’ data. The property portal estimates that homes took an average of 33 days to sell in March, down from 36 days in February.

How long does it take to sell a property?:

What will happen to house prices in the remainder of 2022?

Experts predict that house price growth will slow down as the year progresses.

Savills forecasts overall price rises of 3.5% this year and 3% in 2023.

The property portal Zoopla has similar projections, forecasting a 3% rise this year. Halifax envisages a slower property market, with prices changing by 0%-2%.

Is it possible to get a good mortgage deal?

Mortgage rates fell consistently in 2021, as lenders battled to offer the cheapest deals to buyers with big deposits – but that’s now changing.

Rates have been rising off the back of four increases to the Bank of England base rate, but the good news is that there are still some attractive deals still available.

Check out Which?’s stories on the best mortgage rates and 90% and 95% mortgage deals for the lowdown on the latest mortgage deals.

Is now a good time to buy your first home?

If you’re thinking of getting onto the property ladder this year, there’s good and bad news.

The good news is that low-deposit mortgages are readily available, so you might find it a little easier to get a home loan than before.

The bad news is that it’s unlikely that house prices will become more affordable. Experts expect slower growth, but none are forecasting that prices will actually fall.

If you are thinking of taking the plunge, we’re here to help. As a starting point, check out Which?’s story on the five things all first-time buyers should consider. And you can explore all Which?’s free house-buying and mortgage advice in its mortgages and property section.

Kindly shared by Which?

Main article photo courtesy of Pixabay