Unblock the market by scrapping stamp duty for downsizers

Scrapping stamp duty for downsizers would help free up larger family homes for families who need them and boost transaction levels throughout the property market, at relatively little financial cost to the Treasury, according to new research by reallymoving.

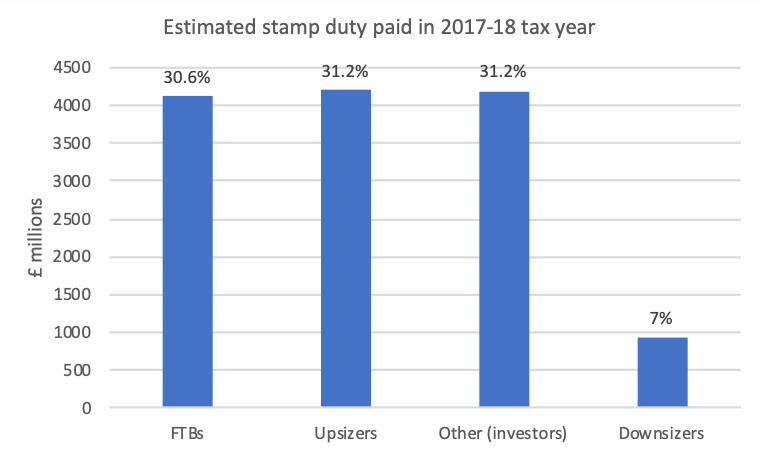

- Downsizers account for only 7% of stamp duty receipts, amounting to £938m

- Tax break for downsizers would encourage them to move, freeing up larger family homes

- Increased fluidity in the market benefits all buyers, including first time buyers and families

- Increased transactions across market would compensate for lost income to Treasury

Reallymoving, which launched a new stamp duty calculator this week, has analysed its own data from 240,000 homebuyers since the beginning of 2017 along with HMRC data on SDLT receipts for 2017/18 to reveal that downsizers[1] are on average responsible for just 7% of stamp duty paid to the Treasury, totalling £938 million. This is just a fraction of the £4,201 million (31.2%) paid by upsizers, £4,120 million paid by first time buyers (30.6%) and £4,193 million (31.2%) paid by others such as investors (see Graph 1).

Graph 1: Estimated SDLT paid by different buyer groups (£ million), source reallymoving / HMRC

New Prime Minister Boris Johnson stated last month that he is keen to shake up stamp duty, with proposals being considered including a reduction in tax for all homes under £500,000 and slashing the current rate paid for homes worth over £1.5m from 12% to 7%. There has since been speculation that he may go further and radically overhaul the tax by switching responsibility from buyer to the seller. This would reduce immediate upfront costs for all homebuyers except for downsizers and therefore while it would encourage people to move, it would not help free up the family homes required at the top of the chain.

Government policy over the last few years has focused solely on helping first time buyers onto the ladder, through Help to Buy and First Time Buyer Relief, but nothing has been done to tackle the blockage at the other end, where an estimated 1.1 million homes with two or more spare bedrooms are lived in by a single person over 65, according to think tank Policy Exchange. A tax break for downsizers would not only help that specific group but would benefit the entire market, including first time buyers, through greater fluidity and less competition for property, reducing pressure on prices.

Rob Houghton, CEO of reallymoving, said:

“Scrapping stamp duty for downsizers is the simplest and most cost-effective way of freeing up the housing market, allowing older people to move into more suitable homes if they so wish and reducing competition among families for larger homes.

“Since downsizers account for just 7% of stamp duty contributions, this proposal wouldn’t be disastrous for the Treasury. When a larger house gets sold it enables a chain of transactions and I believe the lost stamp duty revenue would be more than recovered by boosted transaction levels across the market, not to mention the release of vast equity by over-65s which has been locked into property for decades with no benefit to the wider economy.”

To check current stamp duty liability on any transaction in the UK please visit reallymoving’s brand new Stamp Duty Calculator at https://stampdutycalculator.co.uk

Kindly shared by reallymoving