UK house prices increase sharply again but growth still expected to slow – Halifax House Price Index

UK house prices increase sharply again but growth still expected to slow, according to the latest Halifax House Price Index, covering April.

Key points from the publication:

- House prices increased by 1.1% in April

- Tenth consecutive monthly rise, the longest run since 2016

- House prices are up £47,568 over the last two years

- Average property price reaches another new record high of £286,079

- Northern Ireland now the UK area with strongest house price inflation

- Rate of house price growth still expected to slow as incomes squeezed

|

Average house price £286,079 |

Monthly change +1.1% |

Quarterly change +2.7% |

Annual change +10.8% |

Russell Galley, Managing Director, Halifax, said:

“The average UK house price rose again in April, up by 1.1%, or £3,078, in the month . This was the 10th consecutive month that property values have increased, the longest run of continuous gains since the end of 2016.

“Housing transactions and mortgage approvals remain above pre-pandemic levels and the continued growth in new buyer enquiries suggests activity will remain heightened in the short-term. The imbalance between supply and demand persists, with an insufficient number of new properties coming onto the market to meet the needs of prospective buyers and strong competition to secure properties driving up prices.

“There remains evidence that this demand is centred on larger, family homes, rather than smaller properties such as flats. Over the past year, prices for detached and semi-detached properties have risen by over 12%, compared to just 7.1% for flats. The net cash increase for detached properties, at just under £50,000 over the past year, is nearly five times more than for flats.

“For now, at least, despite the current economic uncertainty, the strong increases we’ve seen in house prices show little sign of abating. Demand in the housing market remains firm and mortgage servicing costs are relatively stable with fixed-rate deals making up around 80% of mortgages on homes across the industry, protecting many households from the effects of rate rises so far.

“However, the headwinds facing the wider economy cannot be ignored. The house price to income ratio is already at its highest ever level, and with interest rates on the rise and inflation further squeezing household budgets, it remains likely that the rate of house price growth will slow by the end of this year.”

Examining the rate of house price growth:

The property market has continued to defy expectations in recent times, with the rate of house price growth accelerating since the end of the Stamp Duty holiday last year.

Average house prices are now up by £47,568 over the last two years. To put this in context, it took the previous five and half years to make an equivalent leap (+£47,689 between October 2014 and April 2020).

Indeed, average house prices have fallen in just four months since the start of the pandemic. The average monthly gain of 0.9% during the past year is more than double the typical monthly increase seen over the previous decade.

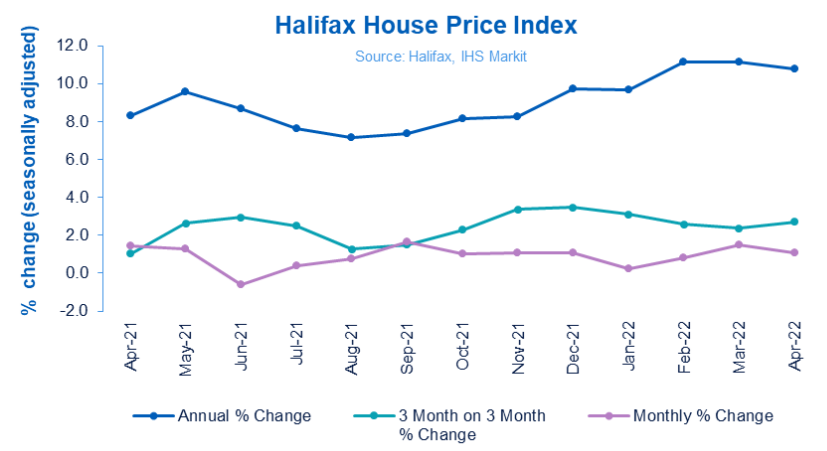

The rate of annual growth fell slightly to 10.8% (from 11.1%), though this partly reflects the strength of the market 12 months ago.

At the current rate of growth, it raises the prospect of a typical home hitting £300,000 by the end of this year. However, as outlined above, such a prospect remains unlikely given the forecast economic conditions.

Regions and nations house prices:

Northern Ireland has overtaken the South West of England as the UK’s strongest performer in terms of annual price house inflation, now at 14.9%, its highest rate of annual growth since December 2007. The average house price is now £182,565 though this is still some way short of the country’s record high of £230,931, set prior to the financial crisis in the summer of 2007.

Wales, so often the area with the UK’s highest rate of growth in recent months, continues to record strong annual house price inflation of 14.2%. The average house price is £214,396 which is yet another all-time high for the country.

House prices also edged up once more in Scotland – reaching a new record of £196,471 – with the rate of annual growth now at 8.3%.

Elsewhere, six out of nine English regions recorded double-digit annual house price inflation during April. The South West of England continues to record the biggest increase, with year-on-year house price growth at 14.8% and the average house price now breaking through the £300,000 barrier for the first time (£301,632).

The rate of annual house price inflation in London continues to lag the rest of the UK, with prices now up by 6.2% year-on-year. However, average property values in the capital remain much higher than the rest of the country, with the latest average house price figure of £537,896 a new record for the city.

Housing activity:

- HMRC monthly property transactions data shows UK home sales increased in March 2022. UK seasonally adjusted (SA) residential transactions in March 2022 were 114,650 – up by 2.6% from February’s figure of 111,700 (up 18.2% on a non-SA basis). Quarterly SA transactions (January-March 2022) were approximately 21.8% higher than the preceding three months (October 2021-December 2021). Year-on-year SA transactions were 35.7% lower than March 2021 (36.2% lower on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases fell in March 2022, by 0.4% to 70,691. Year-on-year the March figure was 14.5% below March 2021. (Source: Bank of England, seasonally-adjusted figures)

- In the latest RICS Residential Market Survey, a net balance of +9% respondents cited an increase in new buyer demand during March – a seventh consecutive month in positive territory (previously +16%). Agreed sales net balance remained at +9%, with new instructions moving into positive territory for the first time in 12 months at +8% (-1% previously). (Source: Royal Institution of Chartered Surveyors’ (RICS) monthly report)

UK house prices Historical data National: All Houses, All Buyers (Seasonally Adjusted):

| Period | Index

Jan 1992=100 |

Standardised average price

£ |

Monthly change

% |

Quarterly change

% |

Annual change

% |

| April 2021 | 445.4 | 258,295 | 1.4 | 1.0 | 8.3 |

| May | 451.2 | 261,642 | 1.3 | 2.6 | 9.6 |

| June | 448.5 | 260,099 | -0.6 | 2.9 | 8.7 |

| July | 450.4 | 261,165 | 0.4 | 2.5 | 7.6 |

| August | 453.8 | 263,162 | 0.8 | 1.3 | 7.2 |

| September | 461.3 | 267,516 | 1.7 | 1.5 | 7.4 |

| October | 465.9 | 270,184 | 1.0 | 2.3 | 8.2 |

| November | 470.8 | 273,028 | 1.1 | 3.4 | 8.2 |

| December | 475.9 | 275,996 | 1.1 | 3.5 | 9.7 |

| January 2022 | 477.0 | 276,645 | 0.2 | 3.1 | 9.7 |

| February | 480.9 | 278,894 | 0.8 | 2.6 | 11.2 |

| March | 488.0 | 283,001 | 1.5 | 2.4 | 11.1 |

| April | 493.3 | 286,079 | 1.1 | 2.7 | 10.8 |

Kindly shared by Halifax

Main article photo courtesy of Pixabay