UK homes’ value increases 3 times faster than their occupants’ salaries over past decade

New analysis from independent mortgage broker Private Finance shows the average UK homes’ value has increased in value almost three times faster than its owner’s wages over the past decade.

Headlines:

- The average UK property price has risen 43% since 2008, while wages have increased by just 15% over the same period

- If wages had increased at the same rate as house prices over the past 10 years, the average annual UK salary would now be £35,113

- London boroughs and Home Counties play host to the UK’s highest earning homes

- Homeowners have also benefitted from falling mortgage rates over this period, as despite property values rising by 43% monthly mortgage payments have increased by just 3%

New analysis from independent mortgage broker Private Finance shows the average UK home has increased in value almost three times faster than its owner’s wages over the past decade.

The average UK home experienced a 43% rise in value between 2008 and 2018, from £160,954 to £229,861.

In comparison, the average annual UK salary has increased by just 15% from £24,606 to £28,860 over the same period. Had wages experienced the same percentage increase as house prices, the average employee would now be earning £35,187 per year.

London boroughs and Home Counties home to highest earning properties

Homeowners in London boroughs and the Home Counties have witnessed their homes outperform them to the greatest extent.

The average property price in Kensington and Chelsea has soared by 85% over the ten-year period, while wages have increased by just 3%.

Had homeowners in Kensington and Chelsea seen their wages increase to the same extent as the value of their homes then the average salary in the borough would now be £112,124.

Table 1: Top 10 hardest working regions for house prices

| Local Authority | Growth in wages 2008-2018 (%) | Growth in house prices 2008-2018 (%) | 2018 annual wages | Average earnings if wage growth matched house price growth |

| Kensington and Chelsea | 3% | 85% | £62,088 | £112,124 |

| City of Westminster | -1% | 78% | £55,515 | £99,289 |

| Camden | 9% | 89% | £44,886

|

£77,424 |

| Hammersmith and Fulham | 11% | 69% | £46,306 | £70,057 |

| Islington | 12% | 83% | £43,820 | £70,191 |

| Richmond upon Thames | 15% | 84% | £48,235 | £75,703 |

| Hackney | 18% | 89% | £33,800 | £52,720 |

| Haringey | 12% | 96% | £33,597 | £58,044 |

| South Bucks | 7% | 65% | £42,812 | £65,623 |

| Elmbridge | -11% | 66% | £43,030 | £79,381 |

Property values rise as mortgage costs fall

Not only have homeowners benefitted from rising property values over this period but falling mortgage rates mean that the monthly cost of owning a home has become considerably more affordable – making their return on investment even more lucrative.

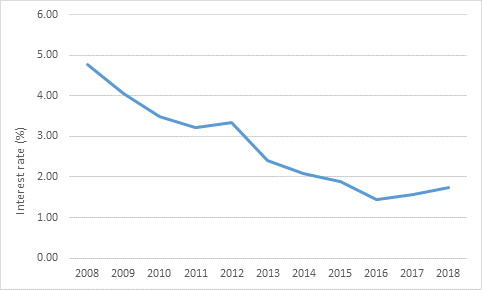

From 2008 to 2018, the average two-year fixed rate mortgage at 75% loan-to-value (LTV) has fallen from 4.77% to 1.73%. While house prices have increased, the average UK homeowner who purchased at the end of 2018 would only be paying £18 (3%) more per month on their monthly mortgage payments thanks to falling mortgage rates, this is despite the average loan size increasing by 43%.

Graph 1: Bank of England average 2 year (75% LTV) fixed rate mortgage rate

Table 2: Monthly repayments for average UK homeowner

| Year | Interest rate (2 year fixed 75% LTV) | Monthly mortgage payments |

| 2008 | 4.77% | £690 |

| 2018 | 1.73% | £708 |

| 10-year difference | 304 bps | +£18 |

Simon Checkley, Managing Director at Private Finance, comments:

“Property first and foremost provides a roof over your head and a place to call home; however, over the long term it can act as a lucrative investment. With falling mortgage rates making the cost of owning a home even more affordable, homeowners’ potential return on investment could be set to become even greater.

“Many homeowners will undoubtedly take comfort in the fact that over the past 10 years, as they’ve worked hard to earn an income, their home has essentially been doing the same – and arguably even more successfully. Though house price growth has slowed in recent years, it remains buoyant in many areas of the country, and has historically remained strong over the long-term.

“This money needn’t remain locked away in our homes. For homeowners looking to stay put, or move to a more manageable house, downsizing and remortgaging are both options that can enable individuals to release some of the money earnt by their home to help them with their wider financial goals.”

Kindly shared by Private Finance