UK build-to-rent sector grows by 20% year-on-year to 148,000 homes

22 October 2019, London: Research published today by the British Property Federation (BPF) shows that there are now 148,046 build-to-rent homes complete, under construction or in planning across the UK, a jump of some 20 per cent against the same period last year.

The number of completed units rose by 31 per cent over the same period, to 34,840.

About the Data

To aid transparency on the sector and its growth, the research has been produced by Savills, commissioned by the BPF, and is published quarterly as an interactive map on the BPF’s website.

Findings

Today’s findings reveal that between Q3 2018 and Q3 2019, the number of build-to-rent homes completed, under construction or in planning across the UK jumped by 20 per cent. There are now 148,046 build-to-rent units at varying stages of development across the country, up by 24,509 units last year.

The sector continues to go from strength to strength, with the build-to-rent pipeline growing considerably in the year to Q3 2019. This is highlighted by the number of units in planning, which has soared by 23 per cent to 77,446.

| Status | Q3 2019 Totals | Q3 2018 Totals | Increase |

| Complete | 34,840 | 26,633 | 31% |

| Under Construction | 35,760 | 33,965 | 5% |

| In Planning | 77,446 | 62,939 | 23% |

| Totals | 148,046 | 123,537 | 20% |

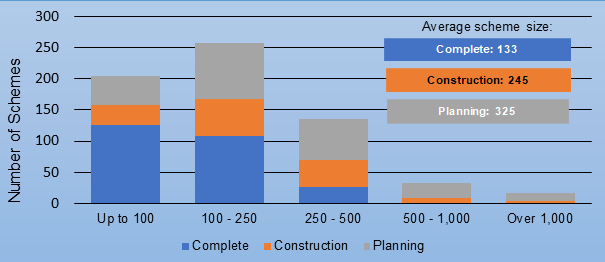

The average size of build-to-rent developments is also growing, indicating the confidence that investors have in the sector. In Q3 2019, the average size of each completed build-to-rent scheme was 133 units, this increases to 245 units for the schemes under construction, while the average size of schemes in the planning system is higher still at 325 units.

The larger size of build-to-rent schemes underlines the growing importance of build-to-rent in increasing UK residential supply and meeting government house building targets.

Geographically, growth of the sector is spread evenly between London and the regions, with both areas seeing total growth of 20 per cent. The number of build-to-rent units inside the capital and in the regions is also similar at 63,200 and 60,337 respectively. However, in terms of units completed the regions saw the biggest increase, with a significant rise of 41 per cent over the year to Q3 2019.

| Status | Complete | Under Construction | Planning | Totals | % of total |

| London | 17,937 | 17,797 | 40,013 | 75,747 | 51% |

| Regions | 16,903 | 17,963 | 37,433 | 72,299 | 49% |

| Total | 34,840 | 35,760 | 77,446 | 148,046 | – |

Ian Fletcher, Director of Real Estate Policy at the British Property Federation, said:

“The build-to-rent sector continues to attract investment and deliver much needed homes. Not only do we have an impressive 31 per cent growth in completions between Q3 2018 and Q3 2019, but the pipeline of new projects is also strengthening.

“Right across the country we are seeing growth in the sector, allowing people to access high quality, institutionally-managed rental properties.

“With both Labour and the Conservatives prioritising house building during their recent party conferences, our data shows build-to-rent is making an important contribution to housing delivery and often on difficult to develop and large urban sites.”

Jacqui Daly, Director, Savills Residential Research, adds:

“As individual households increasingly cannot afford to access the housing market, particularly once help to buy is withdrawn, so demand for the quality rented homes the sector provides will rise. Built-to-rent already makes a significant contribution to housing delivery, and we project this will increase to one in five new homes as more and more people rely on renting.

“This will change the housebuilder model, with bulk sales to investors growing their share of housing delivery. In our opinion, in 10 years, the customer lists of housebuilders will see pension funds and life insurers alongside first-time buyers and second steppers.

“Rather than shouldering the full burden of risk, housebuilders will act as master contractors, forging long-term partnerships with landowners and investors.”

Kindly shared by British Property Federation (BPF)