Tracker mortgage rates drop below 1%: is now the time to gamble?

With the Bank of England cutting the base rate twice recently because of the coronavirus emergency, tracker mortgage rates have dropped under 1%, so Which? asks if now is the time to gamble.

After two emergency cuts to the Bank of England base rate in the space of eight days, home buyers and remortgagers can take advantage of some of the lowest mortgage rates on record.

With the base rate falling to a historic low of 0.1%, it’s now possible to take out a tracker mortgage with a rate of below 1%, but there are some drawbacks you’ll need to consider first.

Here, Which? offers advice on the pros and cons of tracker deals and explain what’s happened to the mortgage market since the first emergency base rate cut last week.

Tracker mortgage rates tumble

Tracker mortgages follow the Bank of England’s base rate plus a set percentage. This means that if the base rate goes up you’ll pay a higher rate, and if it goes down you’ll pay a lower rate.

Just before the first emergency base rate cut (from 0.75% to 0.25% on 11 March), the cheapest two-year tracker was priced at 1.24% (the base rate of 0.75% plus 0.49%). This was available to buyers and remortgagers with a 40% deposit.

10 days on, it’s possible to get an equivalent two-year tracker with a rate of just 0.74% from HSBC or 0.79% from Barclays.

But ultra-cheap tracker deals like these could be short-lived as lenders seek to protect their profits.

The HSBC deal is set to close to new applicants on Monday and Nationwide has already withdrawn its entire range of trackers.

Is now the time to take out a tracker?

A mortgage rate of below 1% might sound very attractive, but there are some drawbacks to tracker deals.

First of all, they’re quite niche products. Currently, there are only around 300 trackers on the market out of nearly 6,000 mortgage deals.

One of the biggest drawbacks is that trackers don’t offer any rate security, so you’ll be gambling on the base rate staying low, and that could be a dangerous move.

The current base rate of just 0.1% has much more room to go up rather than down during the two-year deal period, so your mortgage repayments could end up much higher than they started.

Another thing to be aware of is that some of the cheapest deals come with ‘collars’, which mean the rate you’ll pay can’t drop below the current level, even if the base rate falls.

With this in mind, trackers aren’t the right type of mortgage for everyone.

If you’re considering tracking the base rate, it can help to get expert advice from a mortgage broker on whether these deals will be suitable for your circumstances.

Are fixed-rate mortgages falling in cost?

The vast majority of home buyers and remortgagers take out a two or five-year fixed-rate mortgage, so let’s look at what’s happening with these deals.

Fixed-rate mortgages were already priced very cheaply before the base rate first fell last week, having dropped in cost steadily during 2019.

It’s perhaps no surprise, then, that the first base rate cut has had little effect on this market.

Data from Moneyfacts shows that the average rates on both two and five-year fixes fell by 0.02% in the week following the cut, to reach their current levels of 2.41% and 2.71% respectively.

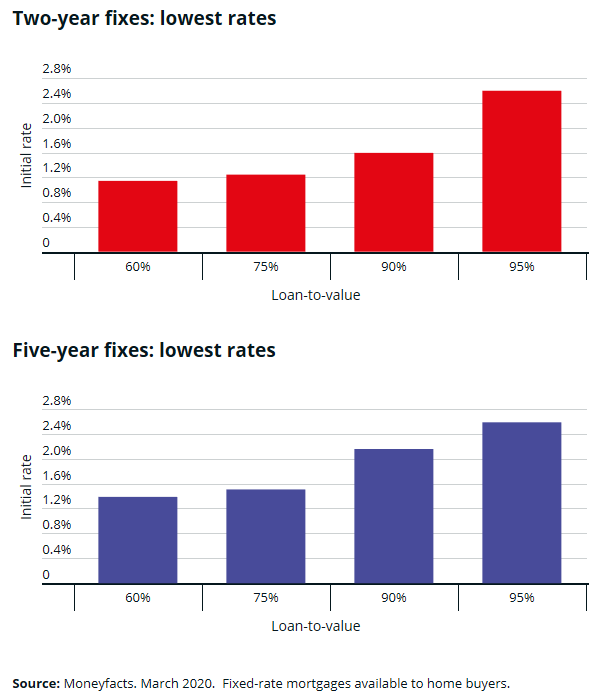

We’ve analysed the cheapest introductory rates at four different loan-to-value levels and found that only one table-topping deal has changed in cost, and that was only by 0.01%.

The chart below shows the cheapest rates currently on the market.

What’s happened to standard variable rates?

In the week following the first base rate cut, 14 major lenders passed on the saving to customers by lowering their standard variable rates (SVRs) by 0.5%.

Co-operative Bank, which has already passed on the 0.5% cut effective from April, has said it would apply a further reduction of 0.15% to its SVR to reflect the second base rate cut from 1 May 2020.

This generosity hasn’t been shared by everyone, however. Data from Moneyfacts shows that the overall average standard variable rate fell by just 0.06% from 4.9% to 4.84%.

It’s too early to say whether other lenders will pass on the second base rate cut to customers, but we’ll keep our story on what the coronavirus means for your mortgage updated as we hear more.

Coronavirus and your mortgage

Earlier this week, the government announced a package of reforms designed to help homeowners, buy-to-let landlords and tenants who face financial struggles due to the impact of the coronavirus.

These included allowing borrowers to benefit from a three-month payment holiday on their mortgages, and preventing private or social landlords from starting evictions against tenants for three months.

You can find out more about these measures in our full story on how to get a mortgage payment holiday.

Kindly shared by Which?