The UK’s Top 20 Property Hotspots: Buy in these areas for the biggest property value increases

Research by Share to Buy shows the UK’s Top 20 Property Hotspots: Buy in these areas for the biggest property value increases.

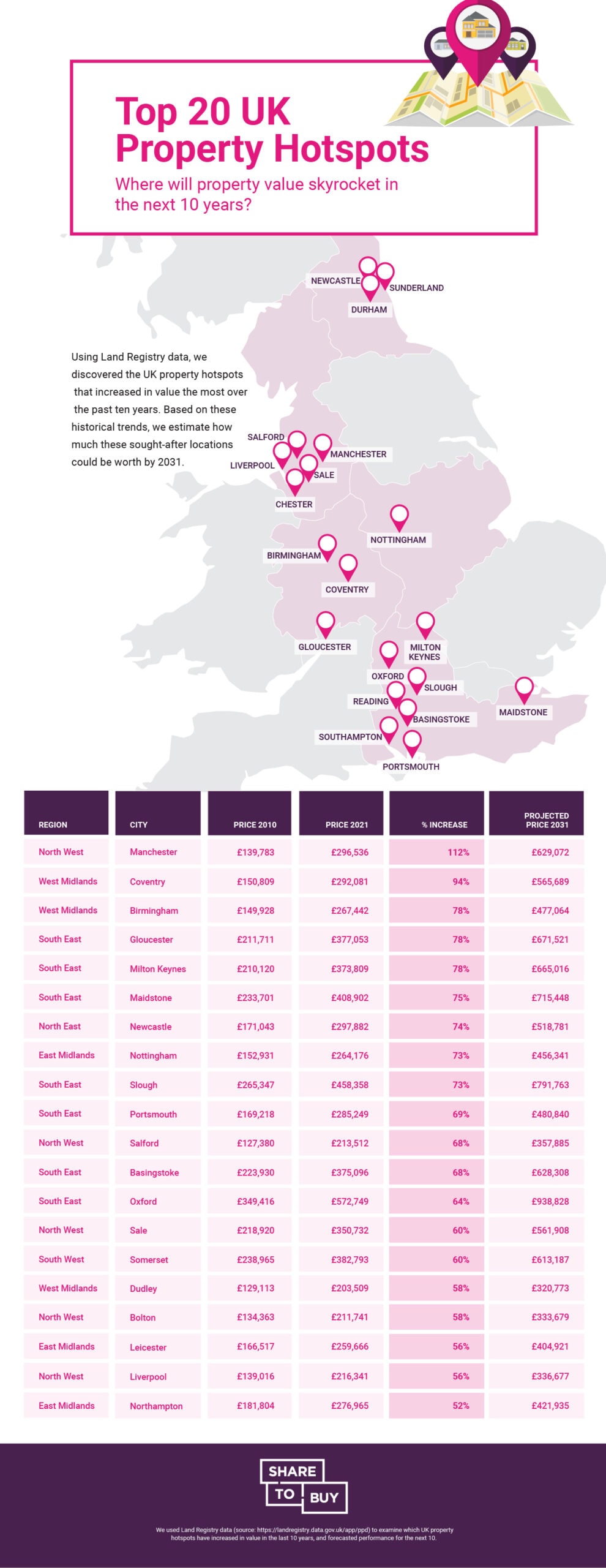

It’s revealed that the North East is overall be the best region for increasing property value, with an increase in 186% in the last 10 years. As well as this key property hotspots include Manchester (112%), Coventry (94%) and Birmingham (78%) who have all seen significant property value increases.

The average UK property value has increased 10% this year alone — and some locations have increased in value more than others. Using UK government Land Registry data, we examine the UK locations where property values have increased the most and speculate what these property hotspots could be worth in 10 years’ time if growth continues at the current rate.

Properties in North-East England rise in value fastest

Property prices in the North East have nearly tripled in the last 10 years with an average property value increase of 186%. This is followed by South East (82%) and West midlands (61%).

The top 10 UK property hotspots: the UK cities where property values are skyrocketing

Here are our top 10 property hotspots in the UK outside of London:

| Rank | City | Percentage Increase |

| 1 | Manchester | 112% |

| 2 | Coventry | 94% |

| 3 | Birmingham | 78% |

| 4 | Gloucester | 78% |

| 5 | Milton Keynes | 78% |

| 6 | Maidstone | 75% |

| 7 | Newcastle | 74% |

| 8 | Nottingham | 73% |

| 9 | Slough | 73% |

| 10 | Portsmouth | 69% |

What is it that makes these cities so desirable? We take a look at the UK’s top five property hotspots to see why house values are skyrocketing:

1: Manchester — 112.1% property value increase over 10 years

At the top of our list, the average property value in Manchester has increased from £139,783 to £296,536 over the past ten years. At this rate, the average property price in Manchester in 2031 would be around £629,000!

2: Coventry — 93.7% property value increase over 10 years

The average property price in Coventry has increased from £150,809 in 2010 to £292,081 in 2021. At this rate, the average Coventry property value in 2031 could be around £565,869!

3: Birmingham — 78.4% property value increase over 10 years

Our research shows the average property in Birmingham has increased in value from £149,928 in 2010 to £267,442 in 2021. The average property value could reach around £477,000 in ten years!

4: Gloucester — 78.1% property value increase over 10 years

Ten years ago, the average Gloucester property was worth around £211,711. Nowadays, it’s worth over £377,053. At this rate, we project the average property in Gloucester could be valued at over £670,000 in ten years!

5: Milton Keynes — 77.9% property value increase over 10 years

The average property in Milton Keynes was £210,120 ten years ago; now, it’s £373,809. This suggests the average Milton Keynes home in ten years will be roughly £665,000.

Nick Lieb, Head of Operations, Share to Buy, said:

“First-time buyers looking to get on the property ladder may wish to do so for a combination of reasons: it’s common to not just want a comfortable home to live in, but the chance to buy in an area you love, as well as making a solid investment to ensure financial wellbeing over the long term. Locations where property values steeply increase are a great option for buyers looking for not only a home but an investment; however, the initial costs in these locations are often out of reach for first time buyers.

“While these projections are of course based on the current rate rather than our own forecasts, many potential purchasers are already feeling priced out of the property market in popular areas – that’s why schemes like Shared Ownership and Help to Buy exist.

“These government-backed products assist buyers in climbing the property ladder by lessening the upfront deposit costs. Shared Ownership allows buyers to purchase a share of a property, while Help to Buy can help first time buyers with the assistance of an equity loan. As a result, eligible buyers who would otherwise struggle to buy can purchase properties in sought-after locations which offer a rich lifestyle and a solid return of their initial investment when the time to sell eventually comes.”

Kindly shared by Share to Buy

Main photo courtesy of Pixabay