The housing market is on course for New Year correction

The New Year will herald a turning point for the housing market, with a Christmas peak in prices followed by negative growth of -1.2% in January and -2.5% in February 2021, according to the Reallymoving House Price Forecast

Headlines:

- House prices set to fall in January and February as post-lockdown boom ends

- Prices will fall by 1.2% in January and 2.5% in February following December peak

- Average house price will reach new high of £352,239 in December before correction begins

- Proportion of FTBs fell by 12% in last six months versus same period in 2019

The New Year will herald a turning point for the housing market, with a Christmas peak in prices followed by negative growth of -1.2% in January and -2.5% in February 2021, according to the Reallymoving House Price Forecast.

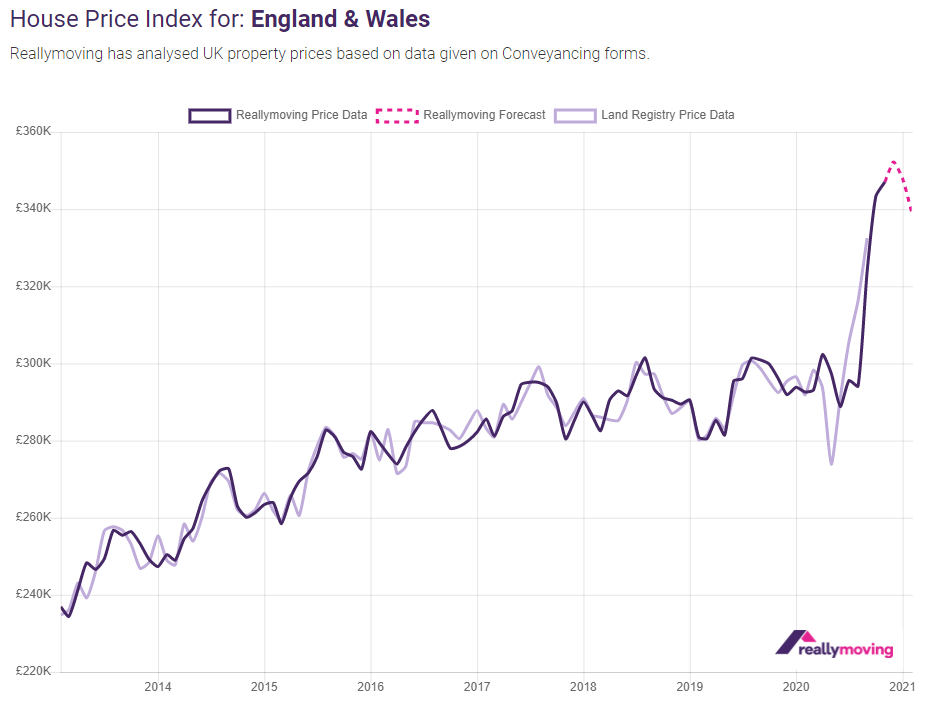

Collected at the beginning of the homebuying process, when buyers agree a deal and seek conveyancing quotes, the data provides one of the earliest snapshots of the short-term property market outlook and confirms that the post-lockdown boom will come to an end at Christmas, with prices beginning to decline heading into the New Year. Based on analysis of purchase price data from 30,000 conveyancing quotes on the price comparison site for home movers between September and November, the average property price in England and Wales will peak at £352,239 in December, before falling to £343,312 by February 2021.

Reallymoving’s forecasts have historically closely tracked the Land Registry’s Price Paid data, published retrospectively (see Graph below).

Between July and December 2020, the proportion of First Time Buyers in the market fell by 12% compared to the same period last year, as the post-lockdown boom was driven by equity-rich homeowners higher up the ladder who benefited the most from the stamp duty holiday. Comparatively, few First Time Buyers benefited from the tax saving, while facing additional challenges securing mortgages and competing with Buy to Let investors for starter homes. This trend helped push up average prices in the second half of 2020, with a correction likely when the stamp duty holiday ends and First Time Buyer activity rebounds.

Rob Houghton, CEO of reallymoving, comments:

“Our prediction of a New Year change in fortunes for the housing market has been further strengthened by the latest data which clearly shows price growth entering a downward trend in January and accelerating in February.

“The mask is beginning to slip on the two-tier housing market of recent months, which has seen activity from equity-rich homeowners who are less affected by the pandemic, concealing problems at the lower end of the market where First Time Buyers have benefited little from the stamp duty holiday and faced considerable challenges securing higher loan to value mortgages.

“The kind of growth we’ve seen over the last few months was never sustainable. Despite positive vaccine news, which will certainly boost confidence that the end of the pandemic is now in sight, there are significant challenges for the housing market to overcome in the short term, including the end of both the stamp duty holiday and the furlough scheme on 31st March, which is likely to result in further downward movement in prices over the first half of next year.”

Kindly shared by reallymoving.com

Main article photo courtesy of Pixabay