The biggest April for property sales since the financial crisis: sales double in a year

Sarah Coles, personal finance analyst at Hargreaves Lansdown, comments on the HMRC’s publication of monthly property sales for April, which shows biggest April for sales since the financial crisis.

Key points from the publication:

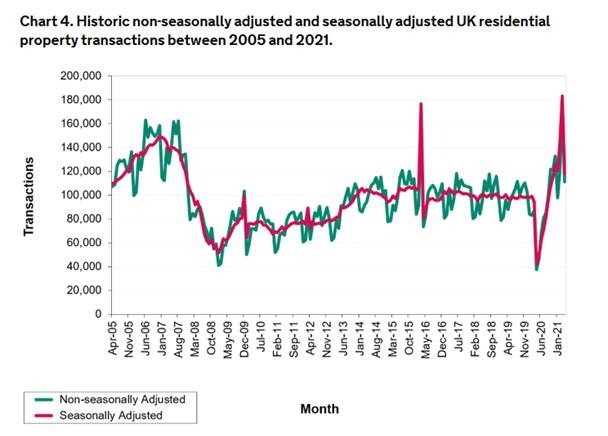

- 117,860 homes sold in April (seasonally adjusted), almost double the number we saw a year earlier (179.5%) but down more than a third from March (35.7%).

- This is the most transactions in any April since 2007 (non-seasonally adjusted).

- By the end of the 2020/21 financial year, sales overtook the previous financial year. It’s the fourth busiest year of the past decade.

Sarah Coles comments:

“We’ve dropped from the vertiginous peak of property sales in March, but rolled onto more gentle slopes rather than falling off a cliff. This is still the biggest April for property sales since the financial crisis.

“We were always expecting a stamp-duty-related March spike: we had one that was almost as high as this in March 2016, just before the rules on stamp duty on second properties changed. However, the last-minute extension this time round meant sales didn’t drop so far in April. We’re now back at the kind of sales levels we saw in November last year, just before sales ramped up to fever pitch as the stamp duty deadline approached.

“We need to take the massive annual rise with a pinch of salt, because back in April, we were in the depths of the first lockdown, and we saw the lowest level of sales of any April since records began. However, overall sales are ahead of those in the previous financial year.

“This may well come as good news for the Treasury, which is trying to keep the property market moving. However, the number of sales isn’t the only important measure, and there are other more disquieting figures dominating the market at the moment. The stamp duty extension certainly kept buyers interested, but it failed to energise sellers to the same extent, so we’re seeing a real imbalance in the market, which is pushing prices up. This may be good news for anyone hoping to remortgage and free up cash from their home, but it’s terrible news for those trying to get onto the property ladder.

“The Bank of England figures show that 75% of those who are priced out of the property market are struggling to raise a deposit big enough to buy (the others have issues with the loan-to-income ratio). The faster that property prices rise, the more those buyers will have to save, so as they struggle to hit their goals, every day they’re moving further away.”

Kindly shared by Hargreaves Lansdown

Main photo courtesy of Pixabay