Surge in pay rings alarm bells for pensioners and employment climbs to pre-pandemic levels in some regions

Sarah Coles, personal finance analyst at Hargreaves Lansdown, comments on the ONS employment and pay figures for May, which show a surge in pay rings alarm bells for pensioners and employment climbs to pre-pandemic levels in some regions.

Surge in pay rings alarm bells for pensioners:

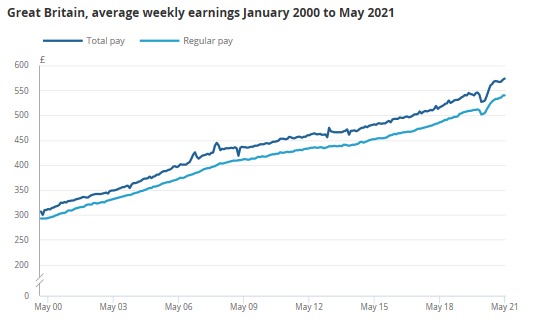

- In the three months to May, annual total pay growth hit 7.3% (and annual regular pay 6.6%).

- It’s even more striking when you consider May alone, because total pay is up 8.6% and regular pay is up 7.3% in a year.

- Even after accounting for inflation, total pay in the three months to May is up 5.6% and regular pay is up 4.9%.

Sarah Coles said:

“The figures lay bare the challenge that Rishi Sunak has to wrestle with. When you compare it to last year, pay inflation in the three months to May was a massive 7.3%, and in May the annual rise was 8.6%. If these kinds of wage hikes feed into the state pension triple lock, the government faces paying out billions of pounds more than planned.

“In May we started comparing wages against three months of the first lockdown, when hours fell away, millions were furloughed, and pay fell dramatically, so a big part of the rise is due to the fact we’re comparing wages to such a low level. It’s also affected by the fact that over the past 12 months, the number of people employed in lower-paid jobs has dropped, which automatically pushes average wages up too.

“However, if you take the pandemic out of the equation, pay has followed a gradual and steady upwards path over the long term, and recent rises have followed a similar pattern. The easiest way to see this is if you compare May this year with May in 2019, when pay is up 7.1% over the two years.

“The issue for the government is that if it sticks with the triple lock in its current form, a big rise in state pensions doesn’t just cost them more this year. This increase is locked in for good, so the extra cost stretches off into the far distance. The triple lock just can’t cope with sudden and spikey wage changes.

“Sunak has already suggested he may be rethinking the role of the triple lock in future, and these figures indicate that an element of smoothing applied to the wage figures could fit the bill. It would mean the spikes are evened out to a more gradual rise, so pensioners keep the incredible value of the triple lock, and the government doesn’t have to scrabble around to try to find billions of pounds in its budget.”

Employment climbs to pre-pandemic levels in some regions:

- Early payroll estimates for June show the number of employees has risen for the seventh consecutive month, up 356,000 to 28.9 million, but it’s still down 206,000 from before the pandemic.

- In the North East, North West, East Midlands and Northern Ireland, payroll numbers are above pre-pandemic levels.

- The employment rate for March-May was 74.8%, 1.8 percentage points down from before the pandemic, but 0.1 percentage points higher than the previous quarter.

- The unemployment rate was 4.8%, 0.9 percentage points up from the pre-pandemic level but 0.2 percentage points lower than the previous quarter.

- The redundancy rate fell by 3.8 per thousand over the three months, to 3.8 per thousand. This is similar to pre-pandemic levels.

- There were 862,000 job vacancies in April to June 2021 – 77,500 above its pre-pandemic level in January to March 2020.

Sarah commented:

“This spring saw us head back to work in our thousands, and in some parts of the UK, by June, the number of people on payrolls surged above their pre-pandemic levels.

“In the three months to May, unemployment is down, employment is up, the redundancy rate has fallen, and vacancies have risen well above pre-pandemic levels. Meanwhile, more than a million people came off furlough. And June followed a similarly positive path.

“The most recent ONS Business Insights Survey found that the number of businesses currently trading has hit 88% – the highest point since it was first measured in June last year (3.6% have gone out of business). The change has been most dramatic in the food and accommodation services sector, which went from 37% trading in January to 91% in June.

“The same survey also estimates that in early June between 1.3 million and 1.9 million people were on furlough, which is down from 2.4 million at the end of May. Of those on furlough, only 48% are still fully furloughed, and the rest have gone back to work for part of the week. And the Economic Activity and Social Change survey at the start of July showed that 80% of businesses don’t expect to make anyone redundant in the next three months.

“The Bank of England was expecting half a million people to still be on furlough when it was withdrawn in September, so unemployment would peak at 5.5% in the autumn. This doesn’t seem beyond the realms of possibility.

“But despite politicians urging us to get back into the workplace, our working lives look slightly different to before the pandemic. The Business Insights survey at the start of July revealed that in the previous two weeks, businesses reported that 11% of their workforce had moved from furlough or fully homeworking to a hybrid model, and another 9% were expected to do so in the following two weeks.”

Kindly shared by Hargreaves Lansdown

Main photo courtesy of Pixabay