Should you use an online estate agent to sell your home?

The online estate agent is becoming increasingly popular at the lower end of the property market, with cash-strapped sellers likely to be enticed by their low fees.

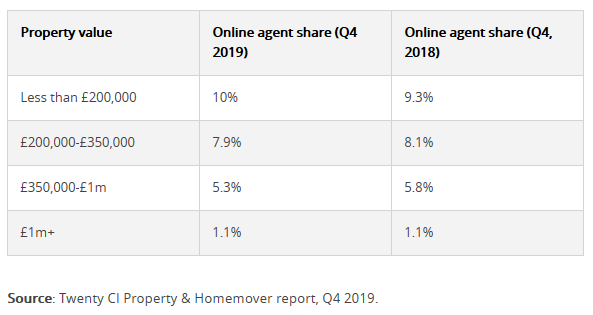

A new report by the data consultancy TwentyCi found 10% of people selling homes for less than £200,000 used an online agent in the last quarter of 2019.

But should you seek out a cut-price online deal or go for a high street agent?

Online agents increase market share

Online agents are now securing 10% of instructions on properties valued below £200,000 – that’s the highest level on record.

Breaking the 10% barrier is a major boost for online agents, but they still face challenges in getting instructions to sell more expensive properties.

The overall online market share is 7.9% (the same as 2018), and for properties valued between £200,000 and £1 million the share has actually decreased, as shown in the table above.

Why are online agents securing cheaper properties?

The growing popularity of the online sector at the lower end of the market could reflect the challenges faced by sellers in a year dominated by Brexit uncertainty.

Slow price growth and fewer properties selling may have resulted in cash-strapped sellers looking to try out a cheaper service to keep their costs down.

Where are sellers using online agents?

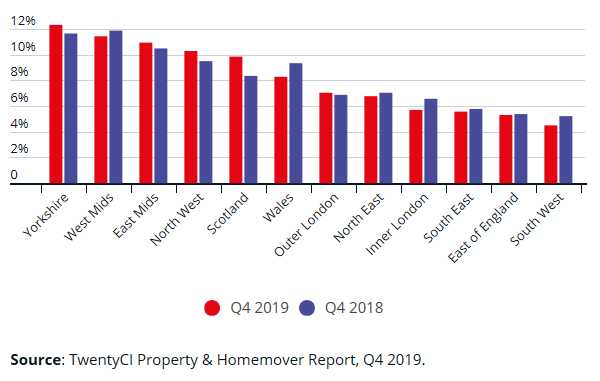

Online agents have had their greatest successes in the Midlands and North of England.

Yorkshire and the Humber led the way in the final quarter of 2019, with 12.3% of instructions going online. The West Midlands (11.4%) and East Midlands (11%) followed close behind.

These figures mask losses elsewhere, however. Online market share fell in seven of the 12 regions assessed by TwentyCi.

What is an online estate agent?

Online estate agents are an alternative to traditional high street estate agencies that typically operate on your local high street.

They are instead run through websites and call centres, and generally offer a lower-cost and more basic service.

Online agents come in all shapes and sizes, but they broadly fit into two categories:

- Online-only agents provide a basic service which can be as simple as getting the property listed on portals like Rightmove and Zoopla. Some agencies require sellers to take their own photos, conduct viewings and negotiate offers themselves.

- Some of the biggest online agents classify themselves as hybrid agencies. In addition to the above services, they employ ‘local property experts’ to handle adverts, viewings and buyer enquiries, although some of these services come with an additional cost.

How do online agents charge fees?

Rather than charging their fee as a percentage of the property price like a high street agent, most online players charge a flat fee instead.

Some agents require this to be paid up front, while others allow it to be paid in instalments. You’ll usually need to pay the fee whether the property sells or not.

Fees are often tiered depending on the level of service you choose, which can suit more hands-on sellers.

For example, Purplebricks charges a £999 fee (£1,499 in London) for its standard service, which includes valuations, listings on property portals and arranging viewings.

If you want one of its agents to conduct the viewings for you, however, you’ll have to pay a further £300 (£399 in London).

One of its largest competitors, Yopa, has a similar structure – with ‘premium’ portal lists, energy performance certificates and accompanied viewings coming at an additional cost.

Are online agents cheaper?

Yes, but they’re also riskier.

If you’re selling a £200,000 home with a traditional estate agent, you might pay commission of around 1.4% if the property sells – that’s just under £2,800.

With an online agent, you might only pay £999, but you’ll usually need to pay even if the property doesn’t sell, and you will receive a less comprehensive service.

Pros and cons of choosing an online agent

Reasons to use an online agent:

- Fees: these are usually cheaper than a high street agent, and the more expensive your house, the more you could save.

- Convenience: online agents tend to have longer opening hours than high street agents.

- Flexibility: some online agents offer packages you can tailor to your specific requirements, which can be a boost for sellers who want to take control of the process.

- Freedom: online agents won’t usually lock you into an exclusive contract.

Reasons to avoid online agents:

- Upfront fees: you’ll probably need to pay an upfront fee even if the property doesn’t sell. Having already secured your custom, the agent may have less incentive to get the best possible sale price.

- Local knowledge: even if an online agent has a ‘local property expert’, they’re unlikely to possess the hyper-local knowledge of a high street agent in your neighbourhood.

- Negotiation: an online agent is less likely to negotiate offers or act as a go-between to progress your sale towards completion.

- Viewings: you might need to conduct viewings yourself rather than have an expert who can ‘sell’ the property to buyers on your behalf.

How are online agents regulated?

Online estate agents are subject to the same regulations as high street agents.

They must be a member of an approved redress scheme such as The Property Ombudsman or Property Redress Scheme.

The agent should clearly state which redress scheme it belongs to on its website.

If you end up in a dispute with the agent, you’ll need to contact and provide evidence to the relevant redress provider.

Kindly shared by Which?