Reallymoving January 2020 House Price Forecast

The Reallymoving January 2020 House Price Forecast suggests there is a strong annual growth forecast for first quarter of the year.

Headlines:

- Average house prices in England and Wales to dip by 1.7% over first quarter of 2020

- Positive annual growth expected over next three months, reaching 3.7% in February 2020

- Increased certainty following General Election has yet to translate to growth in sale prices agreed

| Month | Average price agreed | Monthly change % | Annual change % |

| November 2019 (actual) | £296,459 | -0.7% | 2.5% |

| December 2019 (actual) | £292,991 | -1.2% | 1.6% |

| January 2020 (forecast) | £293,231 | 0.1% | 1.4% |

| February 2020 (forecast) | £290,139 | -1.1% | 3.7% |

| March 2020 (forecast) | £288,070 | -0.7% | 3.1% |

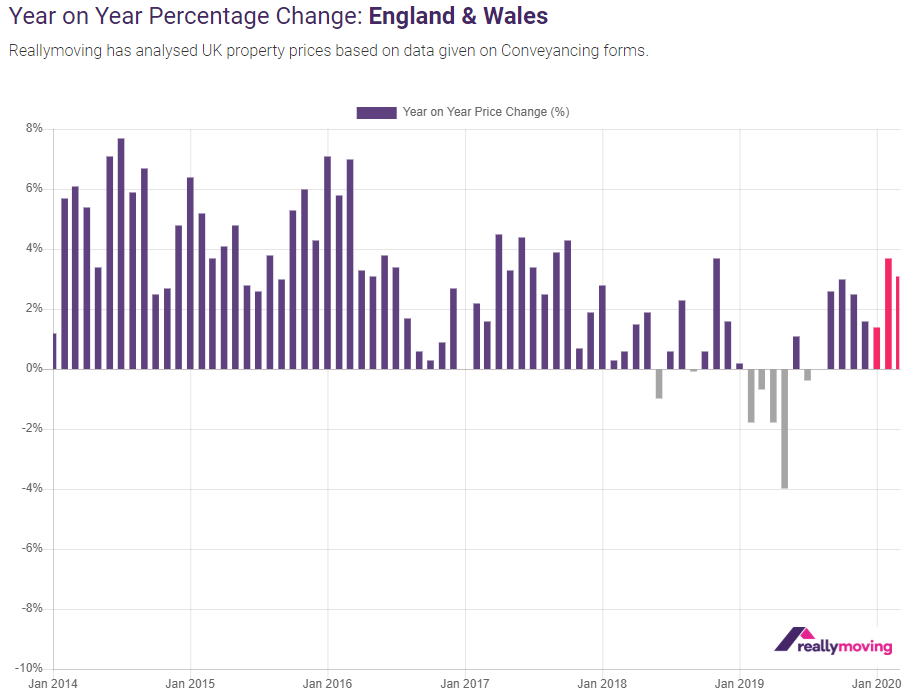

Annual growth in average house prices in England and Wales will remain in positive territory throughout the first quarter of the year, according to reallymoving’s House Price Forecast January 2020, released today. This trend of positive year on year growth, which began in July 2019 and is on track to continue through to at least March, highlights the underlying stability of the housing market during a tumultuous period politically and economically.

Month on month, however, house prices are on course to fall by 1.7% over the first quarter of 2020 (January to March), with any anticipated ‘Boris bounce’ in housing market activity failing to materialise in the value of deals agreed prior to Christmas, following the decisive Conservative win in December’s General Election.

As homebuyers register for quotes for home move services on the site typically twelve weeks before their purchase completes, reallymoving is able to provide an accurate three-month property price forecast based on the purchase price agreed. Historically, reallymoving’s data has closely tracked the Land Registry’s Price Paid data, published retrospectively (see Graph 1). This forecast is based on mix-adjusted data from sales agreed in October, November and December 2019, which are on course to complete over the next three months.

Monthly price changes

Average house prices in England and Wales will increase by 0.1% in January 2020 followed by a decline of -1.1% in February and -0.7% in March. The path to Brexit at the end of January is now clear, which could result in a surge in activity and price growth in the spring, but the election taking place so close to Christmas prohibited an immediate bounce which would have been evident in the March data.

It’s likely that a significant proportion of buyers will remain reluctant to commit until there is greater certainty around the UK’s future relationship with the EU and the possible implications for jobs, the housing market and the wider economy.

Minor price falls are typical at the start of the year and despite the wider political turmoil of the past few months, the housing market is continuing to follow its usual seasonal patterns with prices remaining largely stable.

Annual price changes

Annual growth has been in positive territory since July 2019 and is set to remain so throughout the first three months of the year, with 1.4% annual growth forecast for January, followed by 3.7% in February and 3.1% in March when the average price will be £288,070 compared to £279,452 in March 2018.

The market performed poorly in the early part of 2019, providing a low base for annual growth in 2020, yet such a sustained period of positive year on year growth is encouraging and highlights the underlying strength of the market despite uncertainty over Brexit and fragile consumer confidence. A shortage of homes, low unemployment and cheap borrowing costs have helped support buyer activity and people who need to move home have continued to get deals done.

Analysis and commentary

Rob Houghton, CEO of reallymoving, comments:

“A forecast of continued positive annual growth confirms that the market is performing consistently more strongly than twelve months ago and consumer confidence in the housing sector is growing. But despite the UK’s imminent departure from the EU later this month there are still many questions about our future relationship which will deter buyers who don’t need to move urgently, curbing the potential for strong price growth during 2020.

“Those who are hoping for a ‘Boris bounce’ in house prices in March as a result of sales agreed straight after the Conservatives’ decisive election victory in December will have to wait a little longer. It’s likely that Christmas put a dampener on any immediate post-election flurry of activity from buyers, but we may see the delayed impact of this activity in January reflected in house price growth later in the spring.”

Kindly shared by Reallymoving.com