reallymoving House Price Forecast September 2020: Further house price growth to come but first signs of slowdown emerge

reallymoving House Price Forecast September 2020: Further house price growth to come but first signs of slowdown are starting to emerge.

Headlines:

- House prices are on course to rise by 8.8% in the final quarter of 2020

- Monthly rate of growth to hit 6.1% in October but slow to more normal levels in November and December

- Annual growth to average 14.3% over final quarter of 2020, based on deals already agreed

- London is one of the weakest-performing regions with price growth of 2.4% over next quarter

| Month | Average price agreed | Monthly change % | Annual change % |

| August 2020 (actual) | £296,485 | -6.4% | -1.4% |

| September 2020 (actual) | £314,235 | 6.0% | 4.7% |

| October 2020 (forecast) | £333,331 | 6.1% | 11.4% |

| November 2020 (forecast) | £336,946 | 1.1% | 14.0% |

| December 2020 (forecast) | £341,999 | 1.5% | 17.5% |

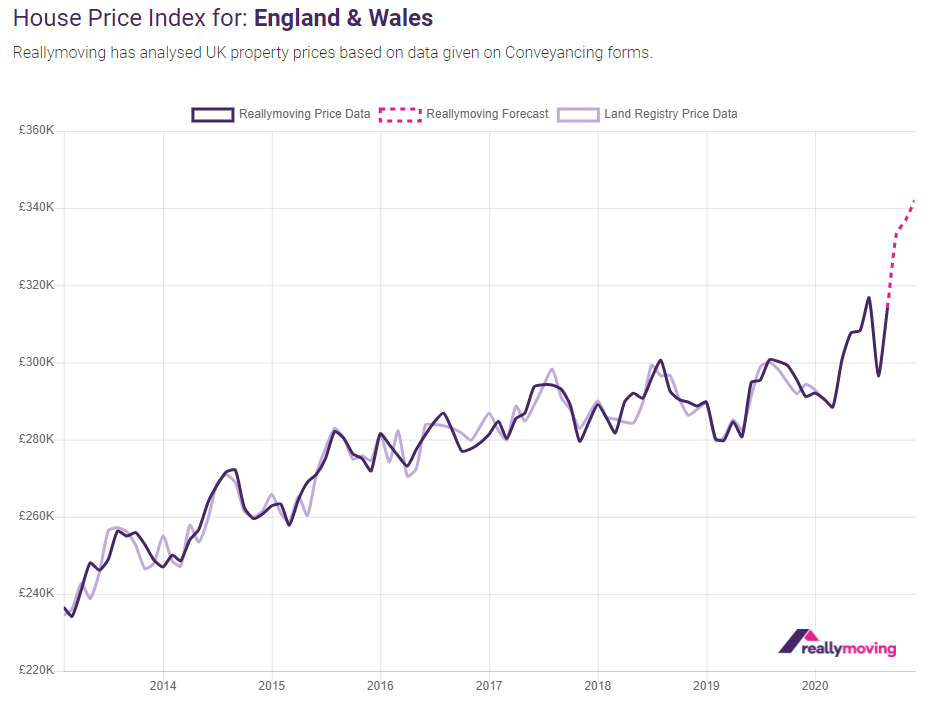

House prices in England and Wales are on track to see further strong gains of 8.8% over the next three months, according to the reallymoving House Price Forecast September 2020 released today, but the first signs are emerging of a slow-down in the rate of growth.

Significant pent-up demand and an urgency to ensure sales are completed before the stamp duty holiday ends next spring have driven a spike in activity and pushed up prices as buyers compete for homes, but the market could be approaching a tipping point as concerns over rising unemployment and further regional lockdowns take their toll on consumer confidence.

As homebuyers register for quotes for home move services on the site typically twelve weeks before their purchase completes, reallymoving is able to provide an accurate three-month property price forecast based on the purchase price agreed. Historically, reallymoving’s data has closely tracked the Land Registry’s Price Paid data, published retrospectively.

Monthly price changes

Based on deals already agreed between buyers and sellers, average house prices in England and Wales are set to increase from £314,235 in September to £341,999 in December, largely driven by a very strong performance in July which will deliver price rises of 6.1% in October when those deals complete.

Month on month house price increases will continue into the final two months of the year, but the rate of growth is forecast to reduce to 1.1% in November and 1.5% in December. This could be the first sign that demand from buyers is tailing off to more normal levels following this summer’s extraordinary surge in activity.

Annual price changes

House prices are significantly higher than this time last year, with annual price growth expected to hit 11.4% in October, 14% in November and 17.5% in December. However, this is almost certainly a spike in demand driven by the stamp duty holiday which has prompted equity-rich homebuyers to secure additional space, especially in light of further lockdowns this autumn and winter. Year on year growth is expected to return to more normal levels in early 2021, when the window of opportunity to complete a sale before the stamp duty holiday deadline begins to close.

Analysis and commentary: Rob Houghton, CEO of reallymoving, comments:

“Our data indicates continued strong price increases in the run up to Christmas but the slowdown in the rate of growth in November and December could be an early sign that the post-lockdown spike in activity is beginning to run out of steam.

“For the remainder of the year the stamp duty holiday will continue to support demand but the real test will be the start of 2021, when the window for offering on a property and completing before the March 31st deadline begins to close. This is likely to be in the context of rising unemployment and continued lockdowns, impeding economic activity and denting consumer confidence.

“Increasing numbers of First Time Buyers have been locked out of the market in recent months due to competition for homes and the withdrawal of high Loan to Value mortgages. But if the Government presses ahead with the launch of its proposed 95% loans in spring 2021, that would help overcome the biggest barrier to home ownership for thousands of First Time Buyers, boosting demand at the lower end of the market at a crucial time.”

Kindly shared by reallymoving.com

Main article photo courtesy of Pixabay