Reallymoving House Price Forecast October 2019: House prices continue to defy expectations

Reallymoving House Price Forecast October 2019: House prices continue to defy expectations as Brexit deadline looms large.

Headlines:

- House prices to dip marginally by just 0.3% over the next three months (October to December 2019)

- Overall the housing market in England and Wales continues to show resilience and stability

- Annual growth will remain in positive territory through to the end of the year according to the Forecast

House prices in England and Wales are set to dip by a modest 0.3% over the next three months, as the market continues to show resilience and stability in the face of continued uncertainty over Brexit, according to the reallymoving October 2019 House Price Forecast, released today.

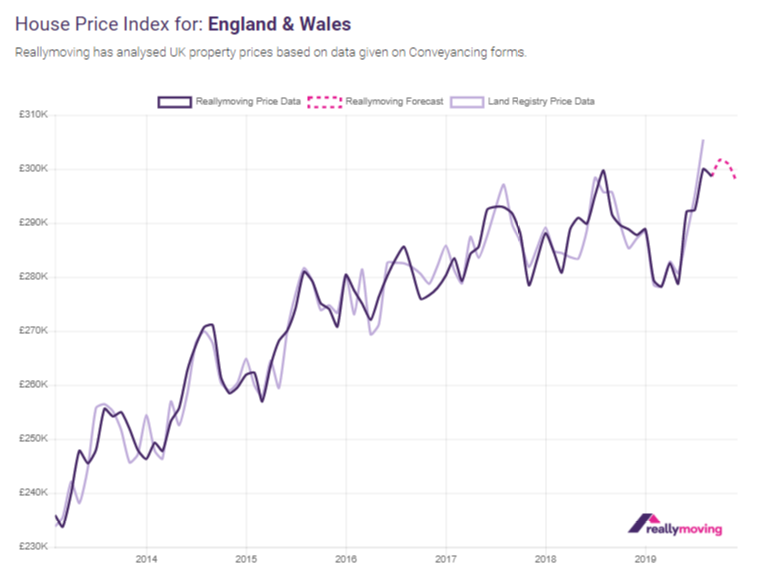

As homebuyers register for quotes for home move services on the site typically twelve weeks before their purchase completes, reallymoving is able to provide an accurate three-month property price forecast based on the purchase price agreed. Historically, reallymoving’s data has closely tracked the Land Registry’s Price Paid data, published retrospectively (see Graph 1). This forecast is based on mix adjusted data from sales agreed in July, August and September which will complete over the next three months.

Graph 1: reallymoving House Price Index (England and Wales) including 3-month price forecast

Monthly price changes

The housing market continues to defy expectations with price growth remaining stable in the short term. Average house prices are on course to increase by 1% in October before falling by 0.3% in November and 1.1% in December. The impact of a UK departure from the EU on 31 October, with or without a deal, will not be evident until sales agreed in October and November complete in January and February 2020.

Annual price changes

Year on year, house prices have been consistently higher than the previous year since August 2019. Looking ahead, annual growth is on course to remain positive through to the end of 2019, with an increase of 4.2% forecast in October and November – the highest level seen since October 2017 – followed by 3.4% in December.

Transaction levels are down by 7% for the year to date, according to Land Registry, but the housing market has adjusted to the ongoing political instability of the past three years and prices continue to be supported by a shortage of stock for sale, pent up demand from buyers who need to move and historically low borrowing costs.

Regional 3-month price forecasts

Two thirds of the regions of the UK are expected to see average house prices rise during the three months to December 2019, with the strongest gains in Yorkshire & Humber (3.1%), the East Midlands (3% – see Graph 3) and the North East (2.6%). This data suggests that in most parts of the UK, buyers and sellers are continuing to agree deals undeterred by the wider political context.

London is forecast to experience the heaviest price falls between now and Christmas, with values set to fall by 4% from £573,243 in September to £550,430 in December 2019. The South East will follow a similar trend with prices expected to fall by 2% over the next three months.

Analysis and commentary

Rob Houghton, CEO of reallymoving, comments:

“The fact that house prices are on course to remain broadly stable over the next three months, alongside positive annual growth, suggests that buyers and sellers have adjusted to a ‘new normal’ and become resigned to doing deals against a backdrop of political instability. While our Forecast looks beyond the current Brexit deadline of 31st October, the impact of a departure from the EU at the end of this month will not be evident in the data until January and February 2020, when the deals agreed in October and November complete.

“If a deal with the EU is approved by 31st October, or indeed if Article 50 is revoked, we would be likely to see an injection of optimism in the housing market that could prompt prices to rise by up to 5% from the new year as uncertainty melts away. Transaction volumes are restrained currently and if those buyers who are currently holding back were motivated to return to the market this would quickly result in more sales being agreed and potentially higher prices.

“If we have a No Deal Brexit, we could expect a fairly significant economic hit which would possibly tip us back into recession. A lack of consumer confidence is the biggest risk to the housing market and if buyers are nervous about committing, particularly if we see unemployment starting to rise, this would really hold the market back for at least two or three years.”

Kindly shared by reallymoving.com