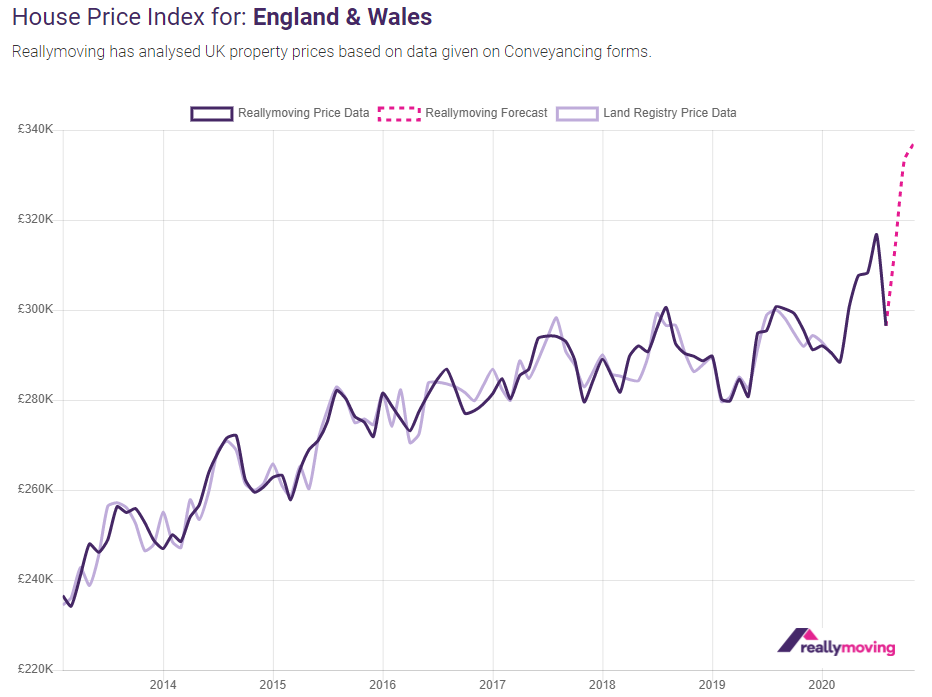

reallymoving House Price Forecast August 2020: Housing market boom continues with 14% price growth over next quarter

reallymoving House Price Forecast August 2020: Housing market boom continues with 14% price growth over next quarter to November.

Headlines:

- House prices are on course to rise by 14% between August and November 2020

- Annual growth forecast to hit 11.4% in October and 14% in November based on deals already agreed

- Strong demand evident in 55% annual increase in conveyancing quote volumes this summer

- Spike expected to be short-lived, with prices returning to more normal levels in Q2 2021

| Month | Average price agreed | Monthly change % | Annual change % |

| July 2020 | £316,753 | 2.7% | 7.2% |

| August 2020 | £296,485 | -6.4% | -1.4% |

| September 2020 (forecast) | £314,235 | 6.0% | 4.7% |

| October 2020 (forecast) | £333,331 | 6.1% | 11.4% |

| November 2020 (forecast) | £336,946 | 1.1% | 14.0% |

There’s no correction on the horizon yet for the property market in England and Wales which is on track to see average prices increase by 14% over the next quarter based on deals already agreed, reports the reallymoving House Price Forecast August 2020, released today.

Significant pent-up demand and an urgency to benefit from the temporary stamp duty holiday is driving activity in the market, with conveyancing quote volumes on reallymoving 55% higher during the three months from June and August than over the same period last year.

As homebuyers register for quotes for home move services on the site typically twelve weeks before their purchase completes, reallymoving is able to provide an accurate three-month property price forecast based on the purchase price agreed. Historically, reallymoving’s data has closely tracked the Land Registry’s Price Paid data, published retrospectively.

Monthly price changes

Average house prices in England and Wales are on course to increase by 14% in the three months between August and November 2020, from £296,485 to £336,946. High levels of activity in the housing market and rising asking prices have been widely reported, but the Forecast provides the first real glimpse of the impact on prices before they show in Land Registry data later in the autumn. A significant surge in the value of deals agreed between buyers and sellers through the summer will result in 6% growth in house prices in September, 6.1% in October and 1.1% in November.

Annual price changes

Following a 1.4% dip in August as a result of the spring lockdown property market freeze, annual growth is now rocketing. Compared to twelve months previously, the average property price is set to be 4.7% higher in September 11.4% higher in October and a remarkable 14% higher in November 2020. However, economic forecasts remain unfavourable and with a second national lockdown now being mooted, this is extremely likely to be only a short-term hike driven by strong demand from equity-rich homebuyers seeking extra space.

Analysis and commentary

Rob Houghton, CEO of reallymoving, comments:

“Buyers are determined to make their move now, despite the fact that the current spike in prices will in many cases wipe out the stamp duty savings. For those higher up the ladder with secure finances, a healthy level of equity in their property and little other debt, gloomy economic forecasts are only encouraging them to press ahead with the move rather than sit tight and wait out what could be a long and painful recession.

“More than ever people’s homes are their castles and their offices – and with borrowing costs likely to be rock bottom for the foreseeable future, paying over the odds on a purchase isn’t too painful if you’re also getting over the odds on your sale and making a stamp duty saving. It’s a different story for First Time Buyers though, who aren’t benefitting from stamp duty savings in most areas and who have seen low deposit mortgages all but wiped out. This explains why the proportion of First Time Buyers in the market has dropped by 19% since May.

“We anticipate that this boom will be relatively short-lived. With the end of the furlough scheme around the corner and the prospect of further lockdowns on the horizon, not to mention the growing likelihood of a No Deal Brexit, demand is likely to drop off through the late autumn and winter, reversing the current spike in house prices.”

Kindly shared by reallymoving.com

Main article photo courtesy of Pixabay