Property Tracker report reveals a third of people think house prices will rise over the next 12 months

The Property Tracker report from Building Societies Association (BSA) reveals a third of people think house prices will rise over the next 12 months.

Key points from report:

-

- Affordability of mortgage payments remains the biggest barrier to buying a home

- Most homeowners remain confident they can afford their mortgage payments

- Less than one in five people think now is a good time to buy a home

The latest Property Tracker report from the BSA shows that a third of people (33%) think house prices will rise over the next 12 months, a significant change from three months ago when only 20% thought prices would rise. This is the most optimistic outlook since September 2022 and is likely to be influenced by the halt in Bank Rate rises and lower mortgage interest rates which are now becoming available, and the fact that house prices have risen for the last three months.

Source: BSA

There is a corresponding shift in those who think house prices will fall in the next year, with one in four (24%) believing this to be the case, compared to 39% in September.

Barriers to Home Buying

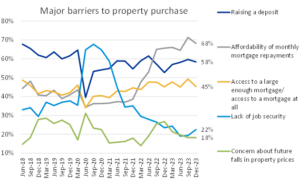

The report also shows that while the biggest obstacle to homeownership continues to be mortgage affordability, the proportion of people who said this is a barrier has fallen to 68% in December, from 71% in September.

Source: BSA

Raising a deposit continues to be a significant barrier to buying a residential property, but this is also showing signs of reducing. This month 58% of people cited this, down from 60% in September.

Lack of job security is however starting to creep up, with 22% saying this was a barrier, an increase from 19% in September.

Affordability concerns

When homeowners were asked about the affordability of their monthly mortgage payments over the next six months, the majority did not express any concern about keeping up with their housing costs. 85% of mortgage borrowers are confident about keeping up with their monthly mortgage payments.

These figures have remained relatively unchanged over the last year, however the proportion who said they are not at all confident increased to 5% in December. Whilst this remains a small proportion of the total, it does demonstrate that the number of people experiencing financial difficulties is rising and building societies and other lenders are continuing to offer practical, tailored support to borrowers who may be struggling.

Those who rent their home are a little less assured, with around three-quarters (73%) feeling confident about meeting their housing costs.

Market sentiment

Sentiment in the housing market remains subdued, but stable. The proportion of people who think now is a good time to buy a property is just 16%, around the same as it has been throughout 2023.

Those who specifically think now is not a good time to buy a new home is considerably higher at 41%, rising to 46% for first-time homebuyers.

Kindly shared by Building Societies Association (BSA)