Property market jitters: What will Brexit mean for the future of house prices?

Whether you’re a staunch remainer or avid Brexiteer, there’s no denying that the uncertainty around when the UK will leave the EU, and the terms under which it may happen, is causing property market jitters.

Less than a week after Boris Johnson replaced Theresa May as prime minister, Michael Gove has said that the government is assuming there will be a no-deal Brexit.

Boris Johnson has denied Mr Gove’s claim but made it clear that Brexit will take place on 31 October whether a deal has been agreed with the EU or not.

Meanwhile in the housing market, property sales have fallen by 16.5% year on year and rumours of a base rate cut before December could create further confusion for people weighing up whether to move house or remortgage.

What will a no-deal Brexit mean for house prices?

While MPs have repeatedly voted against the UK leaving the EU without a deal, the results are not legally binding. A no-deal Brexit remains the default position if an agreement cannot be reached between the UK and EU.

Many business leaders and financial experts have expressed concerns about the potential consequences of leaving without a deal.

Earlier this month the Office for Budget Responsibility predicted that a no-deal Brexit would lead to house prices falling by almost 10% by mid-2021.

Looking further back, in September 2018 Bank of England governor Mark Carney warned that leaving the EU without a deal could send property values tumbling by a third, and in February this year he added that UK growth would be ‘guaranteed’ to fall in the event of a no-deal Brexit.

So, what does all of this mean for the property market, and what impact has the vote to leave the EU already made on house prices and sales volumes?

We’ve analysed market activity before and since the Brexit referendum to bring you the insider’s guide to what experts from the estate agency, building, mortgage and buy-to-let sectors think will happen over the coming months.

What’s happened to house prices since the Brexit vote?

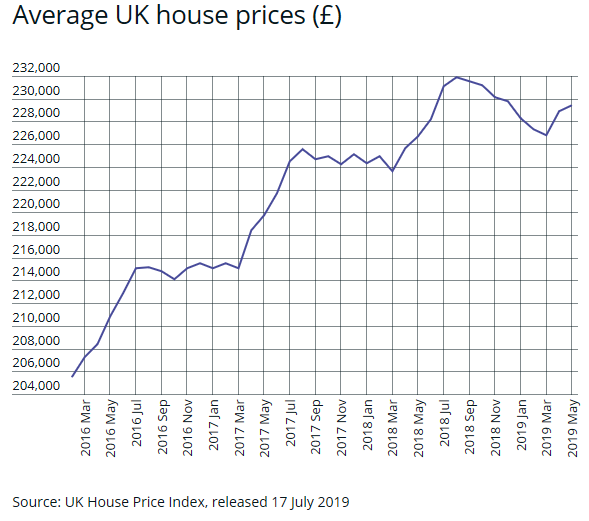

House prices did stagnate for a while following the referendum in June 2016, as you’ll see in the chart below. However, it was fairly normal for that time of year: prices generally grow in spring and plateau over the following few months, a pattern that was repeated in 2017.

But, with Brexit looming ever closer, house prices fell much more sharply than usual after last summer.

August 2018 saw the highest average house price on our chart (which begins in early 2016), at £231,936, but prices dropped every month after that until April 2019.

As you can see in the graph, it’s normal for prices to start improving in April, so this indicates a return to a more usual seasonal pattern.

Are UK house prices falling?

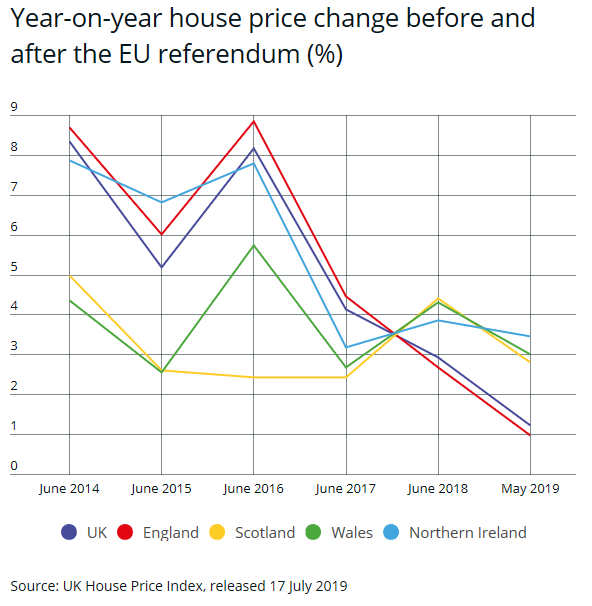

Looking at year-on-year house price change over the longer term can be another useful way of understanding what the market’s doing.

The chart below shows what the annual rate of change has been each June since 2014, and we’ve added figures for May 2019 (the latest month available from the ONS) so you can see the most up-to-date info too.

As you can see, the rate of house price growth plummeted in the year after the referendum everywhere in the UK except Scotland.

Two years on, in June 2018, year-on-year price growth had improved in every UK nation except England. But now, with Brexit fast approaching, the rate of growth has slowed across the board.

House prices in England have put in the weakest performance, increasing by just 0.97% year on year. Northern Ireland is currently faring best, with property values up 3.47% on the same month last year.

It’s impossible to say the extent to which Brexit has influenced these figures. Many argue that the house-price slowdown is simply a long-overdue market correction, which could help the thousands of potential first-time buyers who’ve been priced out in recent years.

Transaction volumes since the referendum

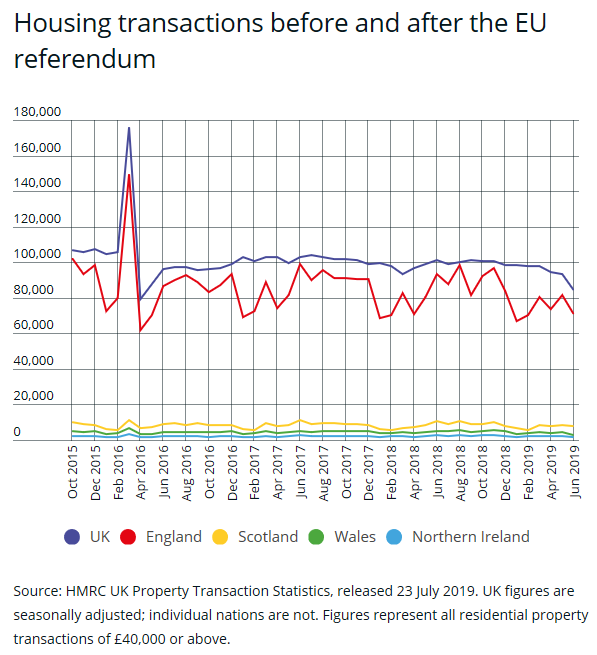

Another way of judging the health of the housing market is to look at transaction volumes, meaning the number of property sales in any given month. A lower number of sales can indicate market uncertainty, which is often triggered by events such as an election or referendum.

This is borne out by the latest data from HMRC, which shows a dramatic year-on-year drop of 16.5% in the number of residential transactions in June 2019 (84,490).

This represents the lowest number of property sales since April 2016, when the 3% buy-to-let stamp duty surcharge was introduced. (The spike you can see in the graph below was caused by investors rushing to complete their purchases before the new tax rule came into force.)

Interestingly, the referendum itself didn’t seem to have much impact on transaction figures.

What’s the pre-Brexit market like for sellers?

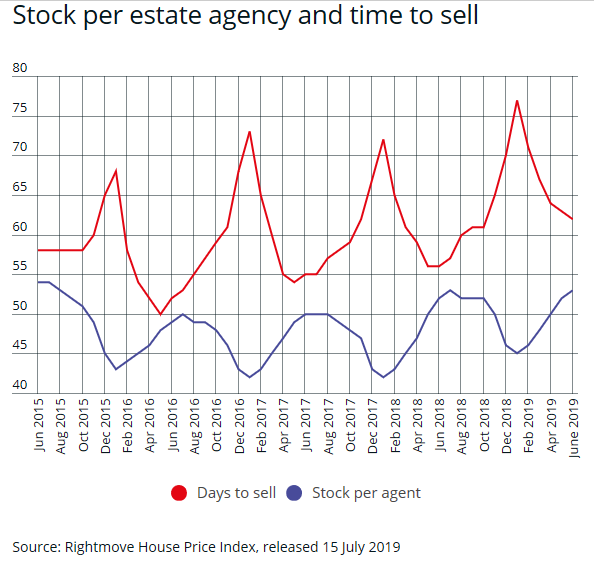

Two commonly used measures of how the market is performing for sellers are stock per branch – which is the average number of properties on each estate agency’s books – and time to sell.

The chart below shows that it’s taken people longer to sell their homes recently than in previous years. In January, the average time for a property to go under offer shot up to 77 days, the highest on record.

It has since fallen each month, dropping to 62 days in June, but that’s still much slower than in previous years – and many commentators believe this is due to nervousness around buying a home in the run-up to Brexit.

Stock per branch is only slightly up year-on-year, from 52 in June 2018 to 53 in June 2019.

This could be indicative of seller frustration, with data agency TwentyCi pointing to 895,000 homes having been withdrawn from the market over the past year.

Brexit house price predictions: what do the experts think?

The charts above show us what’s already happened, but what lies ahead? We spoke to a range of industry experts to find out what they believe the future holds for the UK property market, both before Brexit and beyond. Here’s what they said.

The mortgage broker: ‘Don’t just jump into a fixed rate’

David Blake, Which? mortgage expert, says:

‘The political situation may be in turmoil but it’s important that buyers and homeowners don’t panic or make any rash decisions.

‘I’m sure many people are waiting until we know more about whether the UK will leave with a deal, but it’s tough putting your life on hold for an unknown.

‘Recent price drops in some regions mean that it’s becoming more of a buyers’ market, so you might be able to get a good deal. Besides, buying a property should generally be regarded as a long-term investment and, even if there is a short-term price drop, house prices will probably stabilise in the future.

‘Mortgage rates are incredibly low right now and many will want to fix into a low rate to give themselves security as we move into a period of uncertainty. But don’t just jump into a fixed rate without considering the alternatives – there are plenty of flexible products that would leave your options to remortgage open if rates did start to change.

‘Brexit is still a complete unknown, and while a professional mortgage adviser won’t have all the answers, they will be able to explain your mortgage options to help you navigate this period of uncertainty.’

The property pundit: ‘If you want to live there long term, buy now’

Kate Faulkner, housing expert and founder of propertychecklists.co.uk, says:

‘We’ve definitely seen a stagnation in the market over the last year in areas such as London, the South and East (which had all overheated), and this slowdown has spread to other areas over the last few months.

‘Buyers are holding back in the hope that prices will fall. But it’s not only demand that’s dropping – supply is, too, with many people battening down the hatches until we have a clearer picture of what’s going to happen.

‘This can limit the likelihood of decreasing house prices, but also mean that few move, as there’s little choice on the market for would-be sellers.

‘I don’t think buyers should be put off by fears of a house price crash as long as they mitigate the risks. If you bought a property now, even if it did drop in value in the short term, the market would probably have corrected itself by the time you wanted to move (assuming you stayed there for at least five years).

‘However, if you’re considering buying somewhere for the short term it’s more complicated. Transactions are likely to drop over the next few months and it’s possible that interest rates could jump back to their pre-credit crunch levels of 6-7% if a no-deal Brexit causes issues.

‘In terms of the buy-to-let sector, demand from landlords has already reduced so it’s unlikely we’ll see further falls this year.

‘And, while tenant fees were banned in June, rents are likely to rise further due to lack of stock, meaning now isn’t a particularly bad time to be a landlord as long as you really understand your objectives and whether the deal stacks up both now and in the long run.’

The estate agent: ‘Buyers and sellers are putting their plans on hold’

Mark Hayward, chief executive, NAEA Propertymark says:

‘Brexit is undoubtedly causing uncertainty in the housing market, which in turn affects sentiment and decision-making.

‘With details of the final deal still unknown, we’re seeing both buyers and sellers putting their plans on hold. Once the details are clearer, we’ll have a degree of certainty which may trigger a flurry of activity.’

The buy-to-let expert: ‘Portfolio landlords will fare well’

Chris Norris, director of policy and practice at the National Landlords Association (NLA), says:

‘The issues troubling most landlords are the status of non-UK, and in particular EU, citizens, given their responsibilities to police the Government’s Right to Rent policy, as well as the overall impact that divergence [Brexit] will have on the stability of the housing market.

‘It is still too early to predict what impact Brexit will have on property values. A weakening of the appeal of UK investment could drive prices down or a lack of certainty could drive up interest in the relative stability of bricks and mortar.

‘Likewise, changes to immigration policy could reduce demand from those coming to the UK, or drive up interest from those taking advantage of new arrangements with states outside the EU.

‘It is likely that landlords with established, well-capitalised portfolios will fare reasonably well. However, those heavily reliant on finance may find uncertain conditions more troubling.’

The housebuilder: ‘We need skilled labour from abroad’

Stewart Baseley, executive chairman of the Home Builders Federation, says:

‘Unlike the wider housing market, where transactions have dropped considerably from the historical norm, the new-build market has remained strong in recent months – a trend we expect to continue.

‘The confirmation in the Budget of an extension to the Help to Buy scheme was welcome. The scheme is ensuring demand for new-build homes remains strong [and]… the certainty of demand is enabling builders to plan ahead to increase output in the coming years, as is demonstrated by the record high number of planning permissions being granted.

‘To enable increases to be delivered the industry needs certainty about future labour supply. It is essential that, post-Brexit, the industry continues to be able to access skilled labour from abroad if housing targets are to be met.’

This article was first published on 1 November 2018. Copy, charts and quotes have been regularly updated since then to reflect newly released data and the current situation at Westminster.

Kindly shared by Which?