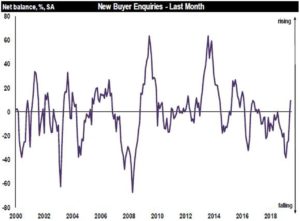

New buyer interest rises for the first time since November 2016

A more stable trend is now emerging in the UK housing market as new buyer interest rises, according to the latest results for the RICS UK Residential Market Survey.

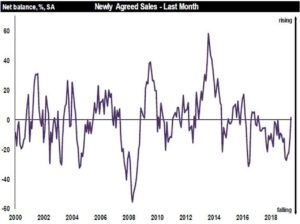

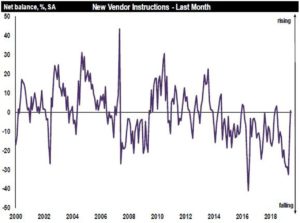

Although anecdotal commentary from respondents remains generally a little downbeat, contributors reported a rise in buyer demand, that new instructions have held steady, and that newly agreed sales also edged into positive territory for the first time in twenty-eight months.

Headlines

- Majority of survey respondents say new build premium is still between 5% and 10%

- Buyer enquiries rise modestly over the month after significant declines early in the year

- Number of sales expected to pick up over the next 12 months

In June, 10% more respondents saw a rise in interest from new buyers, which is the first time since November 2016 that the survey has reported a rise in new buyer enquiries at the national level.

As buyer interest picks up, there also seem to be signs of a more stable trend in numbers of those putting property up for sale. The new instructions indicator has now edged into positive territory for the first time in a year. However, with stock levels on estate agents’ books still around record lows, and appraisals lower now than at this time last year, it remains to be seen if this change will have a material impact on the supply issue.

The newly agreed sales net balance was +2% in June marking the first time in ten months where survey participants did not report a decline, and sales expectations for the coming three months suggest that the stable trend is likely to continue. Further ahead twelve-month sales expectations are also more positive.

As the market appears to settle down in terms of activity, house price movement appears to be flatlining at the national level. At the regional level, with the exception of London, the South East and East of England, all parts of the country are showing house price growth.

Contributors see this stable trend in national house price inflation continuing over the coming three months but a balance of 25% more respondents are anticipating price rises at the twelve-month horizon.

In an extra question to the survey, we enquired regarding the magnitude of the new build premium. The majority of contributors (52%), stated that this was around 5-10% on a UK wide basis, and a little higher in London. When asked whether the premium has changed over the past year the majority of contributors reported no change overall at a national level. In London, a significant share (one-third) of contributors took the view that the premium had narrowed. This is unsurprising, given the more challenging market conditions in the capital compared to the rest of the country.

Moving to lettings, the ongoing theme of a fall in landlord instructions on the back of changes in the tax treatment continues, pointing to a drop in supply of rental properties coming on the market for the twentieth month in a row. On the back of the deteriorating imbalance between tenant demand (which remains solid) and supply, rent expectations are pointing to a further pick-up in the coming year. Average five-year projections imply rental values are expected to rise by 3.6% per annum surpassing house prices, which are seen rising by 2.7% on the same basis.

The view from RICS

Simon Rubinsohn, Chief Economist, RICS, said:

“The latest data provides further evidence of the sales market settling down but I don’t get the impression from the insight provided by contributors that this is fuelling hope of a significantly more active market going forward. Many of the factors that have provided a challenge during the first half of the year remain unresolved.

“Meanwhile feedback on the lettings market continues to highlight the impact of the policy changes announced in recent years. Build to Rent should in time help take up some of the slack in parts of the country but the RICS indicators capturing rent expectations suggests there is no expectation this will be the case anytime soon.”

Kindly shared by RICS