Market Survey: Positivity leaks out of market as uncertainty sees residential sales fall

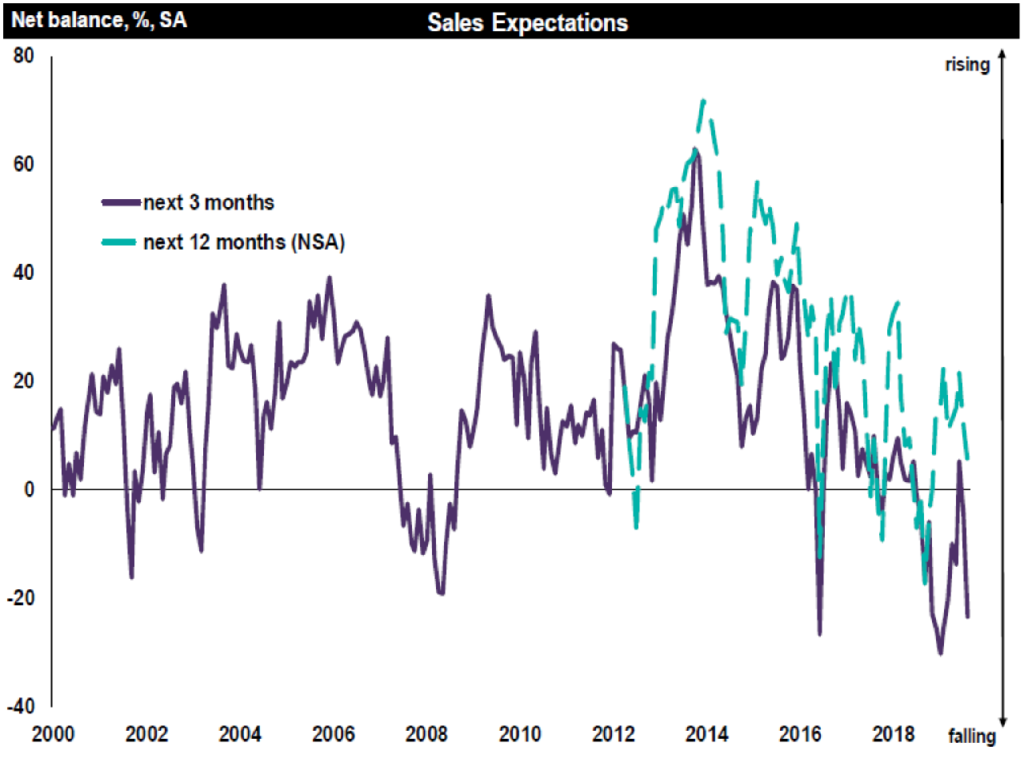

The August 2019 RICS Residential Market Survey results point to a renewed deterioration in sales expectations over the near term, with survey respondents predicting a further decline in activity over the three months to come.

Brexit uncertainty is unsurprisingly a significant factor causing the hesitation for both buyers and sellers.

Near term sales expectations fell from a net balance of -4% to -23%, representing the poorest return since February this year. Furthermore, sales expectations have weakened in almost all parts of the UK over the past two months. Things are expected to improve, albeit only very modestly, at the 12-month horizon.

Download this month’s survey (0.48MB) 12 Sep 2019

Headlines:

- Near term sales expectations also slip deeper into negative territory (next three months)

- New instructions and buyer enquiries broadly flat

- Demand for lettings continues to rise against a backdrop of falling supply leading to higher rents

As positivity has leaked out of the market, August also saw flat demand from new buyers, after a couple of months where enquiries from potential purchasers had increased somewhat.

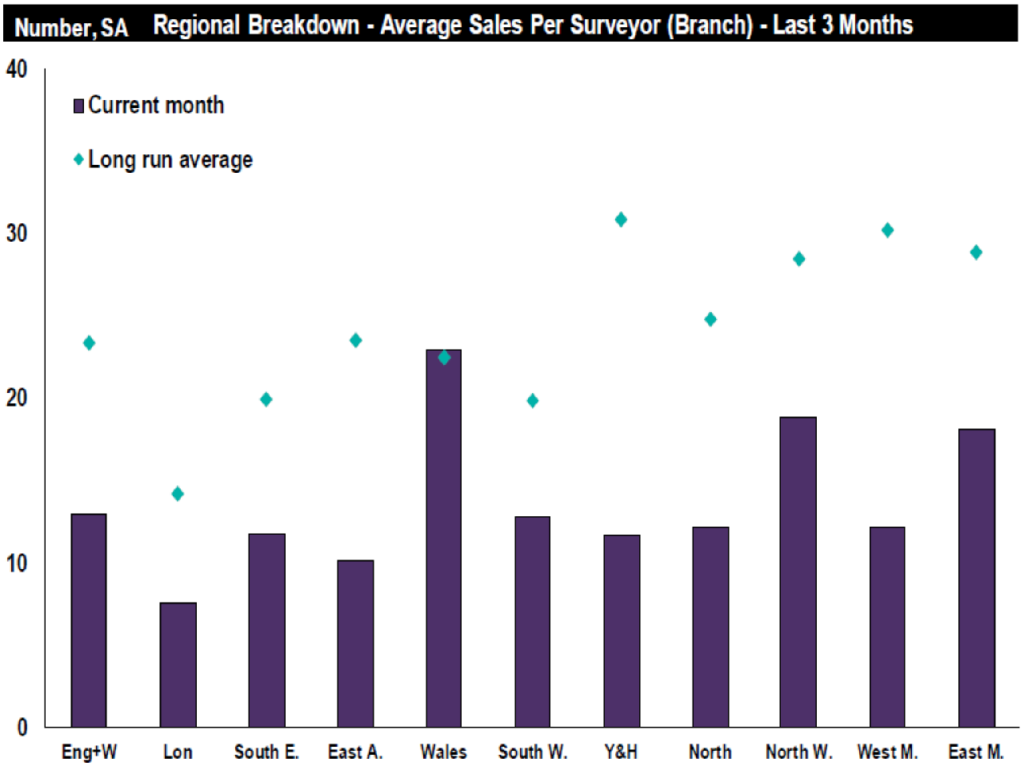

Predictably given the above results, the Newly Agreed Sales series inched slightly further into negative territory on a UK wide basis (net balance -8% compared to -6% previously). Within this, a slightly more upbeat picture was in Wales and the North East of England.

Meanwhile, new instructions to sell were flat once again in August, marking the third consecutive report in which the volume of fresh listings coming onto the market has seen little change.

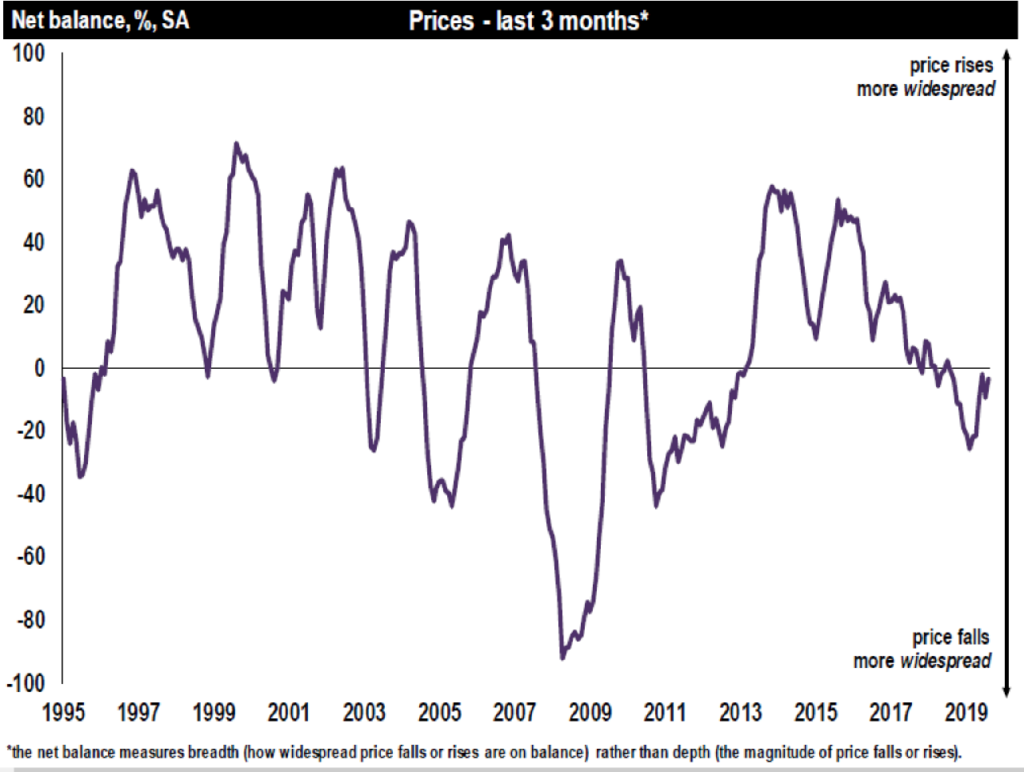

The downcast trends over the past month have ensured price pressures remain unchanged across the country as a whole. The headline RICS Price net balance came in at -4% in August, suggesting house prices were largely unchanged.

In the near term, prices are expected to fall at the national level, with a net balance of -24% of survey participants anticipating a decline over the coming three months (down from -13% last time out). Nevertheless, at the 12-month time horizon, a net balance of +12% of respondents project prices will increase.

In the lettings market, the August results show tenant demand increased for an eighth month in succession, as a net balance of +23% of contributors cited a pick-up (non-seasonally adjusted figures). Set against this, landlord instructions remain in decline, an ongoing trend stretching all the way back to 2016. Given the consistent imbalance between rising demand and falling supply, rents are seen being squeezed higher over the next three months.

Simon Rubinsohn, RICS Chief Economist, said:

“It is hard to get away from the shadow being cast over the housing market by the seemingly never-ending Brexit saga. Indeed, uncertainty is a theme that respondents continue to highlight as a negative influence on sentiment in survey after survey. That said, the key RICS activity indicators have actually remained relatively resilient until now pointing to only a modest dip in transactions across the country rather than anything more severe.

“More ominously, the August RICS results again draw attention to the challenge in the lettings market, with feedback continuing to indicate that demand is outstripping supply. As a result, the pressure is for rents to continue moving higher and indeed outstripping any price gains both in the near and medium term.”

Hew Edgar, RICS Head of UK Government Relations and City added:

“The ever-changing policy landscape is damaging confidence in the lettings market. But the Private Rented Sector (PRS) has the enormous potential to deliver more homes that are urgently needed, and to contribute to the alleviation of the affordability issues which are being exacerbated by the ongoing dearth of supply across all tenures.

“The need for the regulation of property agents – including those operating in the PRS – is critical in order to make the sector more attractive to landlords, and of equal importance, enhance the landlord-tenant relationship. To assist this recommended regulation, we are working with industry to develop an approved PRS Code of Practice. We have also worked with Lord Best as part of his Regulation of Property Agents (ROPA) working group, to help bring positive change and increase public confidence in the sector; parts of which have been likened to the ‘wild west.'”

Kindly shared by Royal Institution of Chartered Surveyors (RICS)