Landlords with payment holidays could struggle to take out buy-to-let mortgages

Landlords who’ve taken out mortgage payment holidays could face problems when they come to remortgage or expand their portfolios.

Mortgage brokers are reporting that banks and building societies are asking investors if they’ve taken payment breaks when they assess their applications, resulting in some loans falling through.

Here, Which? explains the risks of taking a payment holiday and analyses what has happened to buy-to-let mortgages since the property market reopened.

What are mortgage payment holidays?

In March, the government announced that landlords could take a three-month mortgage payment holiday if their tenants faced financial difficulties due to the coronavirus outbreak.

Its guidance stated that landlords should pass these breaks to their tenants and agree on a repayment plan further down the line.

Earlier this month, it was confirmed that people who’ve taken a payment holiday can extend it by a further three months, and those who haven’t can apply up until 31 October.

Holidays allow you to defer your payments for a short period, but with the caveat that it will ultimately take you longer and cost you more to pay off your mortgage.

Are payment holidays a bad idea?

The Financial Conduct Authority says payment holidays won’t affect credit scores, but ultimately, lenders can still ask if you’ve taken a payment holiday and factor this in when you apply to remortgage or take out a new loan.

Mortgage Solutions says a number of brokers have reported that payment holidays have been ‘interfering’ with and potentially scuppering new finance applications from landlords.

Taking out a mortgage holiday carries the implication that you’re struggling to pay, but that won’t always be the case for landlords.

Brokers say some investors will have instead taken holidays as a precaution against their tenants being unable to pay rent, rather than due to a loss of earnings themselves.

But with payment breaks potentially affecting future borrowing, landlords considering applying for one should only do so if absolutely necessary – especially if they’re looking to remortgage or take on extra borrowing in the near future.

What’s happened to buy-to-let mortgages?

The mortgage market has gone through a period of flux amid the COVID-19 outbreak, but there are signs that things are slowly getting back to normal.

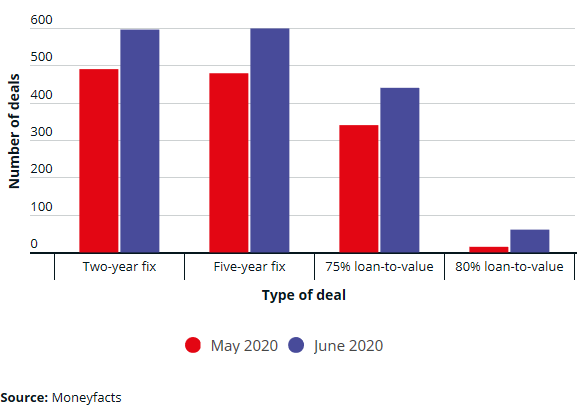

Data from Moneyfacts shows that the number of buy-to-let mortgages is now on the rise, after falling significantly during the lockdown.

The number of deals now available has risen by 280 compared with last month. Moneyfacts puts this down to the government easing its restrictions on mortgage valuations and the pressure on resources created by payment holiday applications having alleviated.

Some of the biggest increases have come at 75% and 80% loan-to-value (LTV), as shown in the chart below.

How have mortgage rates been affected?

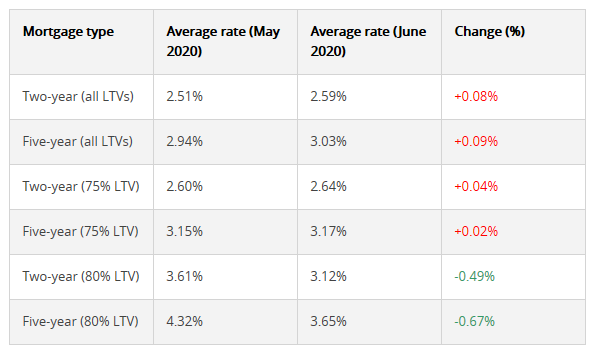

Overall, average rates have increased slightly in the last month, but the return of 80% deals has seen rates for landlords with smaller deposits plummet.

Is now a good time to invest in property?

It will be a while before we know the full effect of COVID-19 on the property market and house prices, but some of the biggest banks and agencies are expecting to see single-digit price falls this year.

Lloyds Bank has priced in a drop of around 5%, while the estate agencies Savills and Knight Frank have forecasted similar falls before a recovery in 2021.

Theoretically, this means that now could be a good time to grab a bargain, but it’s important to proceed with caution.

Eleanor Williams of Moneyfacts says:

“Those looking to invest their money in property now that the mortgage market has reopened may feel now is a good time to explore their options, particularly with rates becoming more competitive and product choice beginning to return.”

What are renters looking for?

It’s a sensitive market in terms of both house prices and mortgage rates, but investors also need to contend with the changing priorities of home movers.

A survey released earlier this week by the property portal Rightmove found that 49% of renters say the lockdown has had an impact on what they’ll look for in their next property.

The biggest shifts were around wanting access to a garden, a better space to work from home, and a good internet connection.

This tallies with earlier research which found city-dwellers are beginning to look further afield in search of a better quality of life.

All of this means it’s even more important than before to take your time, do your market research and take financial advice before investing.

Kindly shared by Which?