Is it cheaper to own or rent a home? Halifax study reveals the gap

The gap in cost between buying and renting rises to more than £800 a year, according to research published in a Halifax study.

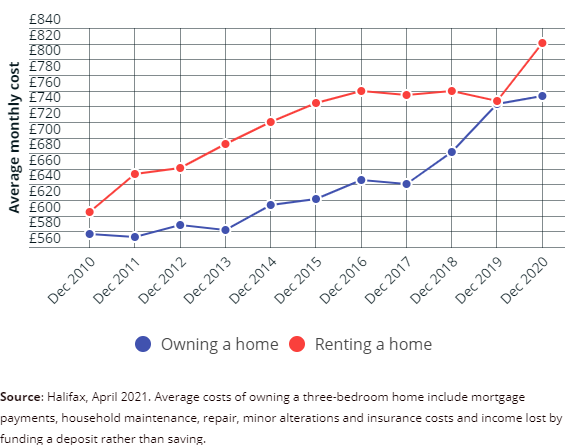

Research by Halifax found that the gap in cost between owning and renting a home has grown by 8% during the pandemic, led by low mortgage rates and rising rental costs.

Here, Which? explains how much better off homeowners are in your region and offers advice on how to get on to the property ladder.

Renters pay £68 a month more than homeowners

Halifax’s Buying vs Renting Review analysed the costs of owning a property compared with renting one.

It found that the cost of renting has increased by 10% in the past year. In the same period, the cost of owning a property (taking into account mortgage repayments, maintenance and insurance costs) increased by just 1%.

The bank says the gap in costs between buying and renting was just £4 a month (£48 a year) in December 2019, but rose to £68 a month (£816 a year) by December 2020.

How costs vary around the UK

£800 a year might sound like a lot, but the gap in cost is much bigger in some parts of the UK.

Expensive rents in London and the South East mean homeowners are thousands of pounds a year better off than renters, as shown in the table below.

At the opposite end of the scale are the East Midlands, Yorkshire & The Humber and Northern Ireland, where the gap is less than £1,000.

Average deposit rises 11% during the pandemic

Halifax’s report shows how owning a property can be considerably cheaper, but for many prospective buyers, the prospect of home ownership remains a distant dream.

Rising house prices and the absence of low-deposit mortgages since the start of the pandemic mean many would-be buyers have been unable to save a big enough deposit.

Halifax says the average deposit put down by a first-time buyer in the UK is now £58,986, a rise of nearly 11% in the space of a year.

Buyers in Northern Ireland put down the smallest deposits (£30,150) while those in London pay the biggest (£132,685).

Will the return of low-deposit mortgages help first-time buyers?

Halifax says first-time buyers put down a deposit averaging 23% of a property’s purchase price, but it’s possible to get on to the ladder with a much smaller sum.

Historically, buyers could get a mortgage with a 5% deposit, but the Covid-19 outbreak saw the vast majority of low-deposit mortgages withdrawn, meaning most first-time buyers needed a 15% down payment.

The good news is that this is now changing. 90% mortgages have made a comeback in the past few months, and the government’s new mortgage guarantee scheme (which launches on 19 April) could be a game-changer for first-time buyers.

The new scheme will encourage lenders to offer thousands of new 95% mortgages, and some of the UK’s biggest banks have already signed up.

How much deposit will I need to buy a house?

We’ve analysed data from the Land Registry to find how much you might need to put down to buy a home in your region.

The table below shows the amount you’ll need for a 5%, 10% and 15% deposit in each region, based on the average price paid by first-time buyers in January 2021.

Is it better to save a bigger deposit?

The mortgage guarantee scheme should make it easier to get a 95% deal, but in the short term, rates are likely to be high.

Let’s take 90% mortgages as an example. The best rates on two and five-year fixed term deals are around 3% and 3.3% respectively, that’s about 1.2% more than before the pandemic.

When the new scheme begins, we should see a flurry of new 95% deals appear, but it’s unlikely this will immediately result in much lower rates.

These mortgages could make all the difference for first-time buyers with small deposits, but if you can put down more than 5%, you’ll be able to get a much lower rate, cutting the cost of your monthly repayments and the amount of interest you’ll pay.

Additional costs of buying a home

Halifax’s research analysed the comparative cost of owning a home and renting, but it didn’t factor in the one-off costs of buying a property.

The current stamp duty break means you could save thousands when buying in England, Wales and Northern Ireland, but you’ll need to pay some other fees, too.

These can include mortgage arrangement fees, house survey and conveyancing fees, as well as the cost of removals.

You can find out more in Which’s full guide on the cost of buying a house.

Kindly shared by Which?

Main photo courtesy of Pixabay