Housing demand and supply of rental stock at record high throughout 2020

As we near the end of 2020, Propertymark (NAEA and Arla) has analysed its sales and lettings data and housing demand to reveal trends from the year.

NAEA Propertymark’s overview of the housing market:

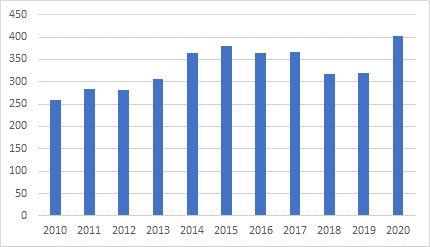

- Over the course of 2020, the number of prospective buyers was the highest it has been over the past decade with an average of 403 house buyers registered per branch, compared to 320 on average throughout 2019 and the previous decade high of 379 in 2015. Looking back over the last decade, demand for housing is up by 55 per cent, from 260 per branch in 2010.

Figure 1: demand for housing over the last 10 years

- The number of properties available to buy hasn’t changed year-on-year, with an average of 39 available per branch consistently since 2018. The month of July saw the highest number of properties available this year, with an average of 43 available to buy per branch. Supply has dropped considerably over the last decade, from 63 on average per branch in 2010.

- The number of sales agreed per branch throughout the year hit a decade high of 10 sales on average per month in 2020. Historically this figure has stayed consistent, only moving between seven and nine between 2010 and 2019.

- The average proportion of total sales made to first-time buyers (FTBs) decreased by two percentage points in 2020, from 27 per cent in 2019 to 25 per cent. This figure is consistent with both 2018’s average figure of 25 per cent and the past decade’s average of 25 per cent of total sales being made to FTBs.

ARLA Propertymark’s overview of the private rented sector:

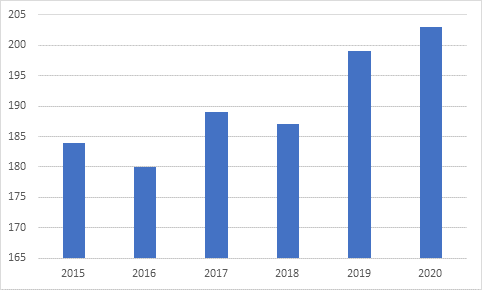

- The supply of rental accommodation was the highest on record in 2020, with 203 properties managed on average per branch throughout the year, compared to 2019’s figure of 199. This is the highest figure on record, with an annual high of 213 in October.

Figure 2: Supply of rental stock since records began in 2015

- As landlords continued to feel the pinch, the number of buy-to-let (BTL) investors selling their properties remained high, at an average of four per month in 2020. In both February and September, the figure spiked to five per branch.

- The number of tenants experiencing rent hikes has fallen this year to 36 per cent, from an average of 44 per cent in 2019. This is due to COVID-19 rent struggles preventing further tenant fees ban related rent increases.

- Agents reported the highest number of prospective tenants searching for homes on record in August, when 101 were recorded per branch, compared to 86 on average across the year. This yearly average is the highest on record, topping 2019’s previous figure of 69 prospective tenants searching for homes.

Mark Hayward, Chief Policy Advisor at Propertymark, comments on the findings:

“Both the sales and rental markets have remained remarkably resilient throughout this trying year, despite market closure between March and May. The prioritisation by the government of a functioning property market and subsequent implementation of the stamp duty holiday as well as measures taken to keep the rent flowing within the private rental sector, have allowed for record breaking levels of house sales and rental accommodation.

“We are confident this boom will continue through the new year but grow increasingly concerned about the impact of the stamp duty cliff edge on 31st March 2021. This cliff edge has already increased pressure on service providers within the industry, causing delays for buyers and sellers, and could cause thousands of sales to fall through at the final hurdle as buyers realise their sale will not be completed ahead of the deadline.”

Kindly shared by Propertymark

Main article photo courtesy of Pixabay