House prices up 9.8% in 2021 – Halifax House Price Index

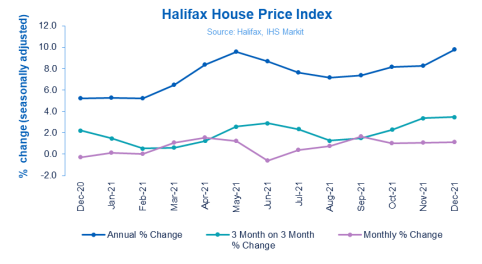

House prices up 9.8% in 2021, according to the latest Halifax House Price Index, which covers December 2021 and a review of the year.

Headlines:

- Average UK property price hits a new record high of £276,091

- House prices have increased by over £24,500 in 2021, the largest annual cash rise since March 2003

- House price growth in 2022 expected to slow

|

Average house price £276,091 |

Monthly change +1.1% |

Quarterly change +3.5% |

Annual change +9.8% |

Russell Galley, Managing Director, Halifax, said:

“UK house prices climbed again in December for the sixth consecutive month in a row, up 1.1%. The average price for a property now stands at £276,091, an increase of more than £24,500 compared to December 2020, marking the strongest year-on-year cash rise since March 2003.

“The housing market defied expectations in 2021, with quarterly growth reaching 3.5% in December, a level not seen since November 2006. In 2021 we saw the average house price reach new record highs on eight occasions, despite the UK being subject to a ‘lockdown’ for much of the first six months of the year.

“The lack of spending opportunities afforded to people while restrictions were in place helped boost household cash reserves. This factor, alongside the Stamp Duty holiday and the race for space as a result of homeworking, will have encouraged buyers to bring forward home purchases they’d maybe planned for this year. The extension of the Government’s job and income support schemes also supported the labour market and may have given some households the confidence to proceed with purchases.

“A lack of available homes for sale, and historically low mortgage rates, have also helped drive annual house price inflation to 9.8%, its highest level since July 2007.

“Looking ahead, the prospect that interest rates may rise further this year to tackle rising inflation and increasing pressures on household budgets suggest house price growth will slow considerably. Our expectation is that house prices will maintain their current strong levels, but that growth relative to the last two years will be at a slower pace. However, there are many variables which could push house prices either way, depending on how the pandemic continues to impact the economic environment.”

Regions and nations house prices:

Wales remains by far the strongest performing nation or region in the UK with annual house price inflation of 14.5%, taking the average house price to £205,579. However, the rate of increase is slightly down from the 14.8% rise recorded in November. Northern Ireland was also one of the strongest performing regions, again recording double-digit annual growth (10.6%, average house price of £170,946).

House prices also continue to rise in Scotland, with the average property now up 9.7% year-on-year, with the average price of £192,988, the most expensive on record.

In England, the North West was the strongest performing region (11.8%), followed by the South West.

Despite registering a strong quarterly rise in prices (2.9%), up from 1.1% in November, London remains by far the weakest performing for annual inflation (2.1%).

Housing activity:

- HMRC monthly property transactions data shows UK home sales increased in November 2021. UK seasonally adjusted residential transactions in November 2021 were 96,290 – up by 24.3% from October’s figure of 77,440 (up 22.7% on a non-seasonally adjusted basis). The quarterly transactions (September-November 2021) were approximately 9.8% lower than the preceding three months (June 2021- August 2021). Year-on-year, transactions were 16.4% lower than November2020 (13.4% lower on a non-seasonally adjusted basis). (Source: HMRC, seasonally-adjusted figures)

- The latest Bank of England figures show the number of mortgages approved to finance house purchases fell for a sixth consecutive month in November2021 by 0.2% to 66,964. Year-on-year, the Novemberfigure was 36% below November 2020. (Source: Bank of England, seasonally-adjusted figures)

- The latest results from the RICS Residential Market Survey report a rising in new buyer enquiries against a backdrop of declining new listings in November. New buyer enquiries increased by a net +13% in November, up marginally from +11% previously and the third month in positive territory. Agreed sales however remains modestly negative, with a net balance of -9% (compared to -7% previously). New instructions remain in negative territory for an eighth consecutive month, at -18% (-18% previously). (Source: Royal Institution of Chartered Surveyors’ (RICS) Residential Market Survey)

Kindly shared by Halifax

Main article photo courtesy of Pixabay