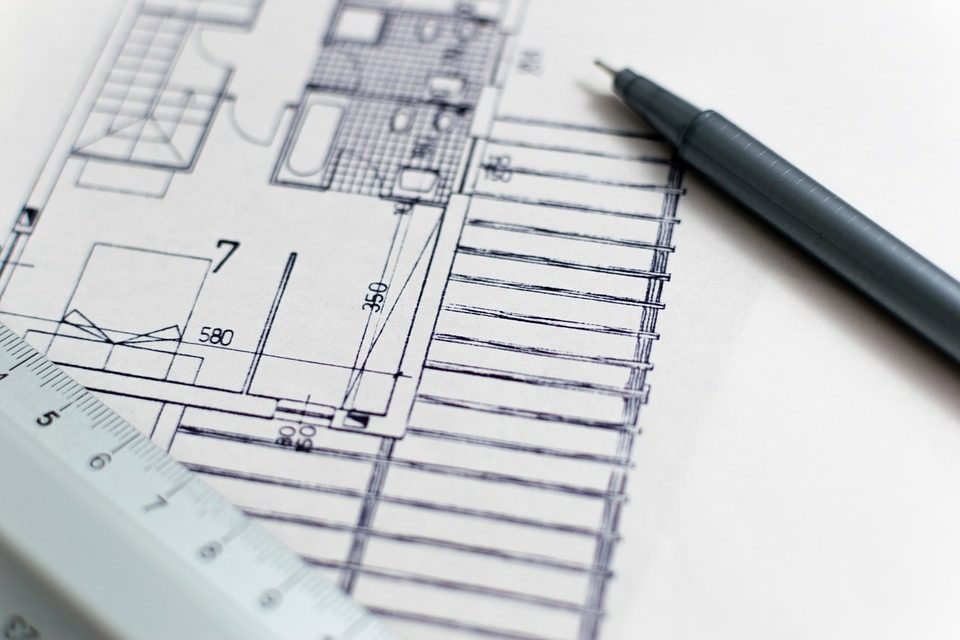

Homeowners choosing to remortgage and extend

UK homeowners are choosing to stay put and improve their current property rather than move home.

New research from TSB shows that two in five (41 percent) homeowners would prefer to build an extension rather than sell up and find a new place to live.

More than a third (35 percent) say they’d consider remortgaging to afford to extend their current living space.

Are you ready to get a conveyancing quote?

There is no obligation, and you will see your quote online rather than having to wait for an email or call. We offer a “no completion, no fee” guarantee should you instruct through Homeward Legal.

Planning rules relaxed

But almost 80 percent of those quizzed for the study said the relaxation of planning laws in England are more likely to cause neighbourhood disputes.

And four in five (79 percent) worried that people would have their views spoiled by new extensions.

Earlier this year the Government announced new regulations that mean many extensions, in particular those at the rear of a property, would no longer require planning permission from the local council.

Emotional attachment

The TSB quizzed current homeowners on their future plans for their home with one in five (19 percent) saying they’re now more likely to build a rear extension in the next three years.

Among the reasons given for adding to their current homes were the emotional attachment felt to that property (50 percent); the cost of moving (49 percent); and preferring the locale (25 percent).

Remortgaging was the most popular option for homeowners on how to pay for any extension.

Cost a barrier to moving

Nick Smith, head of mortgages at TSB, said: “It’s no surprise that homeowners cite the cost of moving as one of the biggest barriers to affording a new home or moving up the property ladder.

“Building an extension is a great way to add extra space without having to undertake the additional costs such as stamp duty and legal fees.

“That is why TSB offers a range of different mortgage and lending options aimed at a wide variety of homeowners.

“Planning ahead is vital so make sure you get the best rate possible for your individual circumstances and consider how much it will cost you in the long term.”

Affordable conveyancing services

Homeowners looking to remortgage to finance an extension can get the most affordable conveyancing deal through Homeward Legal.

We work with an expert panel of property law firms across England and Wales with vast experience in providing the essential legal services for remortgaging, and all are on the lenders’ approved list of solicitors.

Call 0800 038 6699 – we’re open seven days – or get an instant, no-obligation quote for remortgaging conveyancing here.

Kindly Shared by Homeward Legal