Homelet Rental Index: Average UK rent hits third record high in as many months

HomeLet has released the HomeLet Rental Index figures for August 2021, with London seeing the largest monthly price rise out of every region in the country.

The headlines from this month’s report are:

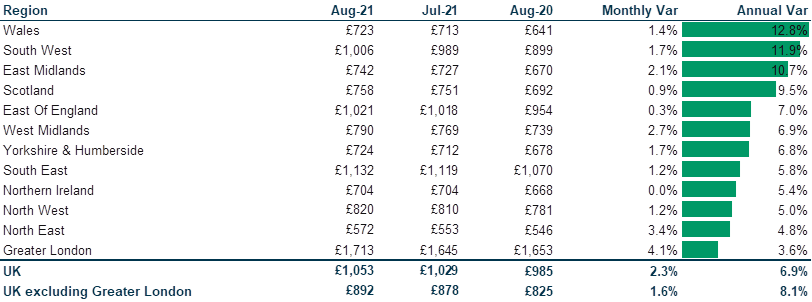

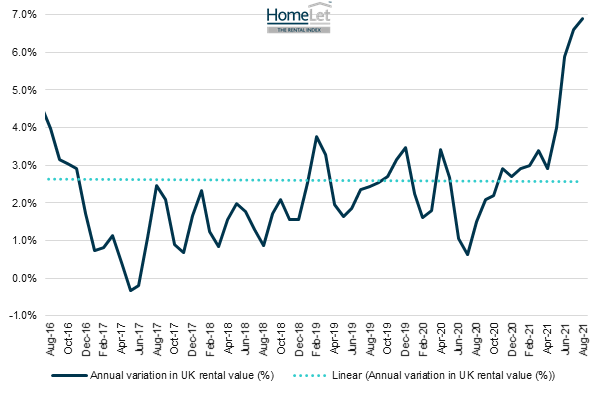

- The average rent in the UK has hit another record high of £1,053, up 9% on the same time last year, and up 2.3% from the previous month’s figures.

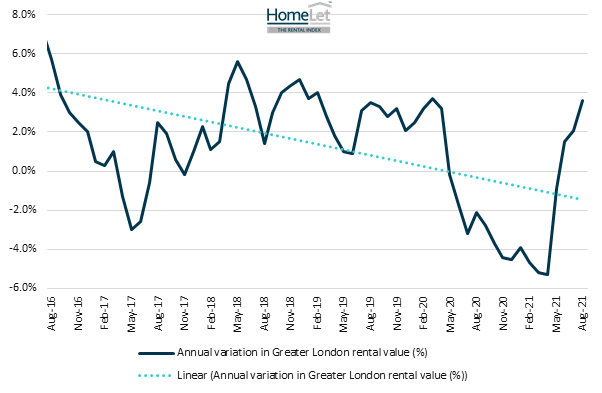

- There are signs of recovery in London, which sees another price rise after a year of decline, with an annual variance increase of 6% to £1,713 PCM. The monthly rise of 4.1% is steeper than any other area of the country.

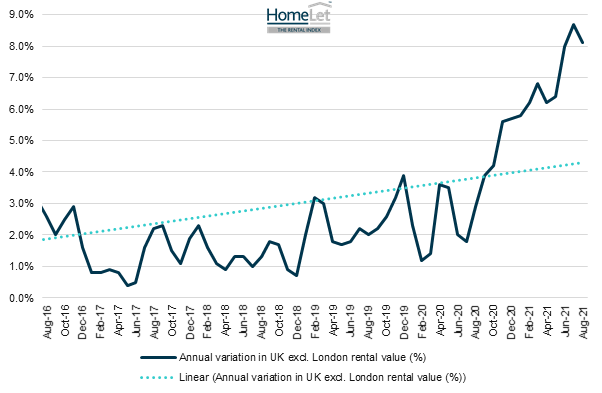

- Excluding London, the average UK rent price is up to £892 PCM, up 8.1% YOY.

- Wales has seen the highest YOY rise. The average rent is now 12.8% higher than this time last year, up to £723 PCM.

- Elsewhere, every single region saw a YOY price rise, with Northern Ireland the only area not to see a monthly rise, staying at an average of £704 PCM.

The HomeLet Rental Index provides the most comprehensive and up-to-date data on rental values in the UK.

The trends reported within the HomeLet Rental Index are from data on actual achieved rental values for just-agreed tenancies arranged in the most recent period – providing an in-depth insight into the lettings market and what’s happening right now across the UK.

Commenting on the latest data, Rob Wishart, HomeLet & Let Alliance Head of Business Intelligence, said:

“Typically, rents for new tenancies will rise in line with the rate of inflation, but that’s not been the case in the past few months. The demand for housing and certain property types is outstripping supply in many areas, causing upward pressure on rental prices. We can expect the increase in rents to continue for the foreseeable future, with many regions now seeing unprecedented demand for housing stock and landlords.

“In the capital, we have seen yet another price rise, and we may see London accelerate at a faster rate than the rest of the country in the coming months, as international travel ramps up and rates of working from home move in the opposite direction.”

“We’ve seen record levels of new customers this year. As our group expands, so does the level of insight that we can provide for our customers, processing over 1m tenant references a year; we’ll continue to monitor the market closely.”

“On the whole, the private rented market has been exceptionally resilient throughout the pandemic, so it’s no surprise that the level of investment is increasing through sectors like build to rent. Consistent yields over the long term coupled with capital appreciation have only bolstered confidence in the industry even in the face of the disruption we’ve had over the past 18 months.”

“There’s no doubt that further challenges are ahead in the short term; with the end of the furlough scheme, which still supports around 2m people, we expect claims on rent protection products to increase further. Whilst the pandemic has accelerated the demand for rent protection products, it’s become integral to many letting agents management propositions and has supported the confidence we’re seeing in the sector.”

Table: Final Rental figures from the August 2021 HomeLet Rental Index

Chart 1: Annual Variance in UK Rent

Chart 2: Annual Variance in UK Rent (Excluding Greater London)

Chart 3: Annual Variance in Greater London Rent

Head to https://homelet.co.uk/homelet-rental-index/ for more information.

Kindly shared by HomeLet

Main photo courtesy of Pixabay