Halifax HPI: House prices in March 2024 were 0.3% higher than the same month a year earlier

The Halifax HPI for March 2024 published, showing house prices were 0.3% higher than the same month a year earlier.

Key points from publication:

-

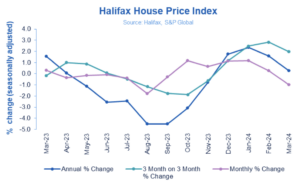

- Property prices grew by +0.3% annually (vs +1.6% last month)

- House prices up +2.0% on previous quarter

- Average house prices fell by -1.0% in March on a monthly basis, following a rise of +0.3% in February

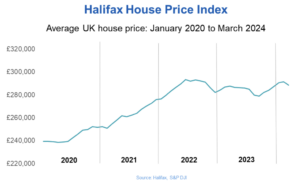

- Typical UK home now costs £288,430, around £2,900 less than last month

- Northern Ireland remains strongest performing nation or region in the UK

Key indicators:

|

Average house price |

Monthly change |

Quarterly change |

Annual change |

|

£288,430 |

-1.0% |

+2.0% |

+0.3% |

Kim Kinnaird, Director, Halifax Mortgages, said:

“UK house prices grew in March on a quarterly basis, by +2.0%, with annual growth slowing to +0.3%, from 1.6% in February.

“Compared to last month, the price of a UK property fell -1.0% or £2,908 in cash terms, with the average property now costing £288,430.

“That a monthly fall should occur following five consecutive months of growth is not entirely unexpected particularly in view of the reset the market has been going through since interest rates began to rise sharply in 2022.

“Despite this house prices have shown surprising resilience in the face of significantly higher borrowing costs.

“Affordability constraints continue to be a challenge for prospective buyers, while existing homeowners on cheaper fixed-term deals are yet to feel the full effect of higher interest rates.

“This means the housing market is still to fully adjust, with sellers likely to be pricing their properties accordingly.

“Financial markets have also become less optimistic about the degree and timing of Base Rate cuts, as core inflation proves stickier than generally expected.

“This has stalled the decline in mortgage rates that had helped to drive market activity around the turn of the year.

“The broader picture is that house prices are up year-on-year, reflecting the opposing forces of an easing cost of living squeeze – now that pay growth is outpacing general inflation – and relatively high interest rates.

“Taking a slightly longer-term view, prices haven’t changed much over the past couple of years, moving in a narrow range since the spring of 2022, and are still almost £50,000 above pre-pandemic levels.

“Looking ahead, that trend is likely to continue.

“Underlying demand is positive, as greater numbers of people buy homes, demonstrated by recent rises in mortgage approvals across the industry and underpinned by a strong labour market.

“And with rental costs rising at record rates, home ownership continues to be an attractive option for those who can make the sums work.

“However, the housing market remains sensitive to the scale and pace of interest rate changes, and with only a modest improvement in affordability on the horizon, this will likely limit the scope for significant house price increases this year.”

Nations and regions house prices:

Northern Ireland remains strongest performing nation or region in the UK – with house prices up by +4.3% on an annual basis. Properties in Northern Ireland now cost an average of £194,743, which is £7,972 more than a year ago.

In Wales annual property price growth slowed to +1.9% in March, from +3.9% in February, with the average home now costing £219,213. Meanwhile Scottish house prices rose +2.1% year-on-year to stand at £204,835.

Something of north/south divide exists in England, where the North-West saw the strongest growth, up by +3.7% on an annual basis to £232,315.

Properties in Eastern England recorded the biggest decline of -0.9%, with homes selling for an average of £330,627, a drop of £2,878 over the last year.

London continues to have the highest average house price in the UK, at £539,917. Prices in the capital have increased by +0.4% over the last year.

Housing activity:

-

- HMRC monthly property transaction data shows UK home sales increased in February 2024. UK seasonally adjusted (SA) residential transactions in February 2024 totalled 82,940 – up by 1.2% from January’s figure of 81,930 (up 9.0% on a non-SA basis). Quarterly SA transactions (December 2023 – February 2024) were approximately 1.4% lower than the preceding three months (September 2023 – November 2023). Year-on-year SA transactions were 5.6% lower than February 2023 (2.6% lower on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases increased in February 2024, by 7.7% to 60,383. Year-on-year the February figure was 39.8% above February 2023. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for February 2024 show a positive trend in buyer demand and new listings. New buyer enquiries posted a second consecutive net balance positive reading of +6% (identical to last month), with agreed sales softening to a net balance of -3% (from +4%). A solid rise in new instructions net balance to +21% (from +12%) was the strongest since October 2020. (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)

UK house prices Historical data National: All Houses, All Buyers (Seasonally Adjusted):

|

Period |

Index Jan 1992=100 |

Standardised average price £ |

Monthly change % |

Quarterly change % |

Annual change % |

|

March 2023 |

496.1 |

287,696 |

0.3 |

-0.2 |

1.6 |

|

April |

494.3 |

286,662 |

-0.4 |

1.0 |

0.1 |

|

May |

493.6 |

286,234 |

-0.2 |

0.9 |

-1.1 |

|

June |

493.2 |

286,011 |

-0.1 |

0.1 |

-2.6 |

|

July |

491.2 |

284,852 |

-0.4 |

-0.5 |

-2.5 |

|

August |

482.5 |

279,793 |

-1.8 |

-1.2 |

-4.5 |

|

September |

481.1 |

278,985 |

-0.3 |

-1.8 |

-4.5 |

|

October |

486.7 |

282,221 |

1.2 |

-1.9 |

-3.1 |

|

November |

489.8 |

284,039 |

0.6 |

-0.6 |

-0.8 |

|

December |

495.3 |

287,244 |

1.1 |

1.2 |

1.8 |

|

January 2024 |

501.1 |

290,608 |

1.2 |

2.5 |

2.3 |

|

February |

502.4 |

291,338 |

0.3 |

2.8 |

1.6 |

|

March |

497.4 |

288,430 |

-1.0 |

2.0 |

0.3 |

Next publication:

The next Halifax House Price Index for April 2024 will be published at 07:00 on Tuesday, 7 May 2024.

Kindly shared by Halifax