HALIFAX House Price Index: February 2025

Average UK house price holds steady in February

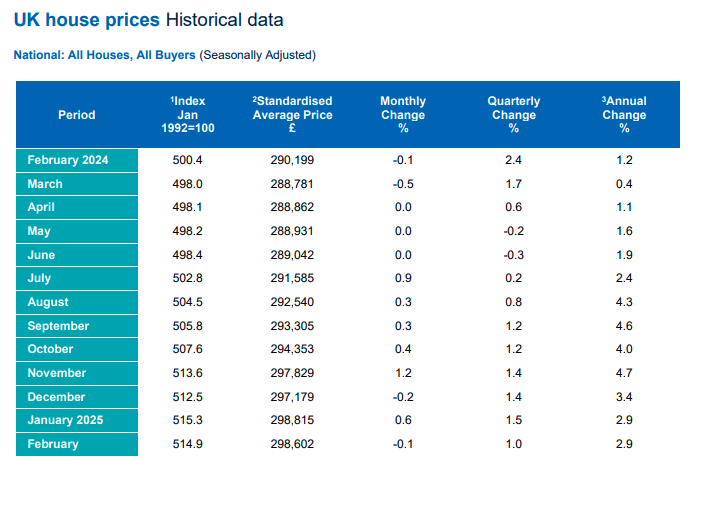

- House prices dipped by -0.1% in February (vs +0.6% in January)

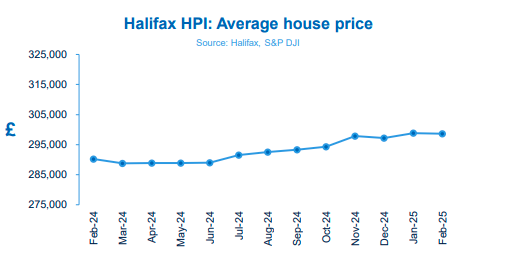

- Average property price now £298,602 (compared to £298,815 in previous month)

- Annual growth remains at +2.9%, unchanged from January

- Scotland sees house prices rise at fastest pace in 13 months (+3.8%)

Amanda Bryden, Head of Mortgages, Halifax, said:

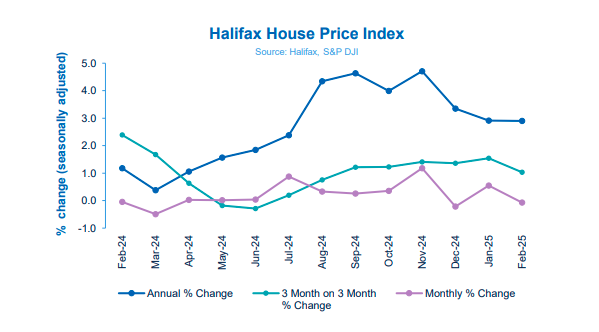

“The typical UK house price remained stable in February, with a slight monthly dip of -0.1%. Annual growth also held steady at +2.9%, with the average house price edging down by just £213 to £298,602.

“February’s figures highlight the delicate balance within the UK housing market. While there’s been talk of a last minute rush on new mortgages ahead of the changes to stamp duty, inevitably we’ve seen some of the demand that was brought forward start to fade as the April deadline ticks closer, given the time needed to complete a purchase.

“That may help to explain why growth in first-time buyer property prices eased in February, falling to +2.4%, in contrast to homemover price inflation which accelerated, reaching +3.7% “While house price growth has slowed overall, market activity remains strong and comparable to prepandemic levels, demonstrating a resilience amongst buyers that’s been evident in the face of higher borrowing costs.

“While those affordability challenges persist, the ongoing shortage of housing supply coupled with sustained demand suggests property prices will continue to rise this year, albeit at a more measured pace compared to last year.”

Nations and regions house prices

Most areas of the UK saw a slowdown in house price inflation in February.

Bucking the trend most notably was Scotland, which saw annual growth increase to +3.8% compared to +2.5% in January, with an average house price of £213,014.

Northern Ireland continues to have the strongest annual property annual price growth in the UK, largely unchanged at +5.9% in February. Properties in Northern Ireland now cost an average of £205,784.

House prices in Wales were up +2.8% compared to the previous year, with properties valued at an average of £226,811.

In England, Yorkshire and Humberside recorded the strongest annual property price growth for the first time since July 2021, up +4.1% compared to the previous year, with properties now costing an average £216,130.

London saw annual house price growth ease considerably from +2.6% in January to +1.6% in February. The capital still has by far the most expensive average property price in the UK, at £545,183.

Housing activity

- HMRC monthly property transaction data shows UK home sales decreased in January 2025. UK seasonally adjusted (SA) residential transactions in January 2025 totalled 95,110 – down by -1.0% from December’s figure of 96,050 (down -17.1% on a non-SA basis). Quarterly SA transactions (November 2024 – January 2025) were approximately +0.1% higher than the preceding three months (August 2024 – October 2024). Year-on-year SA transactions were +14.4% higher than January 2024 (+20.7% higher on a non-SA basis). (Source: HMRC)

- Latest Bank of England figures show the number of mortgages approved to finance house purchases decreased in January 2025, by -0.5% to 66,189. Year-on-year the figure was +18.3% above January 2024. (Source: Bank of England, seasonally-adjusted figures)

- The RICS Residential Market Survey results for January 2025 show buyer demand and sales easing slightly. New buyer enquiries returned a net balance of zero compared to +4% in December 2024, with agreed sales at +3%, down from +7%. New instructions returned a net balance of +25% from 14%, representing the seventh successive positive report. (Source: Royal Institution of Chartered Surveyors (RICS) monthly report)

Kindly shared by Halifax Picture courtesy of Adobe