Freedom Finance comments on the Bank of England’s latest borrowing of mortgage debt figures

Freedom Finance comments on the Bank of England’s latest figures for borrowing of mortgage debt by individuals, showing that it has increased.

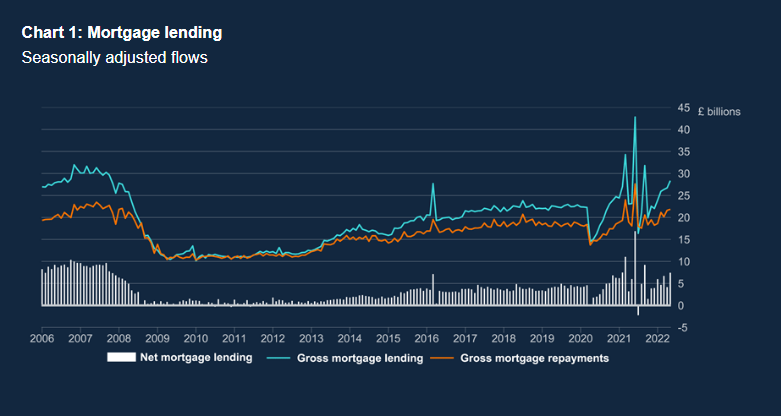

The Bank of England’s latest data shows that borrowing of mortgage debt by individuals increased to £7.4 billion in May 2022 from £4.2 billion in April. This is above the pre-pandemic average of £4.3 billion in the 12 months up to February 2020.

The Bank also reported that the ‘effective’ interest rate – the actual interest rate paid – on newly drawn mortgages increased by 13 basis points to 1.95% in May.

Commenting on the data, Andrew Fisher, Chief Commercial Officer at Freedom Finance, one of the UK’s leading digital lending marketplaces, said:

“The pandemic created enormous volatility in the mortgage lending market as pent up demand and stamp duty relief triggered a rush of activity in the housing market with lenders competing on rates to attract customers.

“We are seeing another surge in demand for lending as the increase in interest rates gathers pace as customers look to secure an offer before rates increase further.

“FCA data this week revealed that re-mortgaging has, once again, become a more popular source of lending than home moving and this week’s hawkish comments from the Governor of the Bank of England could see a further spike in demand as borrowers look to refinance debt before rates rise more sharply.”

Kindly shared by Freedom Finance

Main photo courtesy of Pixabay