Exclusive: first-time buyers offered cheaper mortgages despite base rate hikes

Buyers with small deposits are the biggest beneficiaries of two base rate increases in a year, as lenders flock to offer more deals and better rates on 90% and 95% mortgages, Which? analysis has found.

It’s now a year since the Bank of England’s base rate rose from an historic low of 0.25%. It then increased again in August this year, to reach its current level of 0.75%.

We’ve investigated how the mortgage market has changed in the past 12 months, and found that while mortgages have broadly got more expensive, first-time buyers with small deposits are in a much better position than before.

Mortgage rates rise in 2018

On 2 November last year, the Bank of England’s Monetary Policy Committee (MPC) voted to shift the base rate up to 0.5%, after 14 months at the historically low rate of 0.25%.

Since then, both fixed-rate and tracker mortgages have become more expensive.

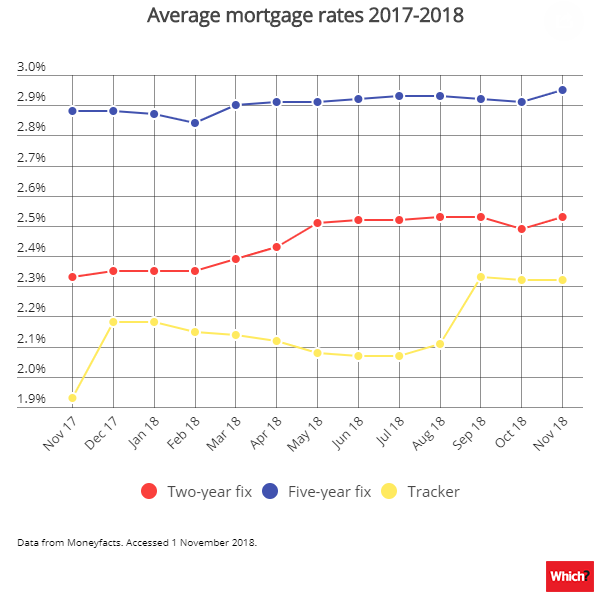

On 1 November last year – the day before the base rate went up – two-year fixed-rate deals cost an average of 2.33%, according to analysis of Moneyfacts data. A year later, the average has risen by 0.2% to reach 2.53%.

The price of five-year fixed-rate deals also increased, but at a much slower rate, from 2.88% to 2.95%.

Tracker mortgages, which rise and fall in line with the Bank of England base rate, grew in cost by 0.39% in the same period, the Moneyfacts data shows.

On paper, this might sound like bad news. When you look a little more closely at the data, however, it becomes clear that some types of buyers are actually better off.

Can first-time buyers get cheaper rates?

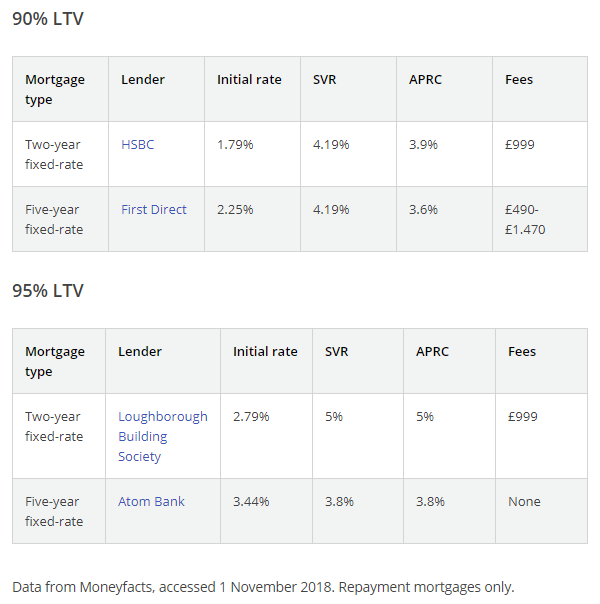

To take a closer look, we broke these figures down to different loan-to-value (LTV) levels, indicating how large of a loan the buyer is taking out compared with their deposit.

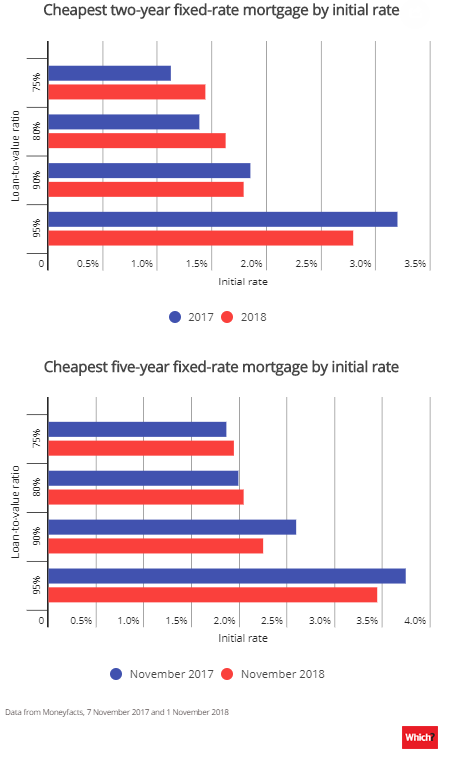

We compared the cheapest initial rate on two-year and five-year fixed-rate deals at four different LTV levels in November 2017 and November 2018.

Our analysis showed that at 75% and 80% LTV, prices have increased. But that at 90% and 95% LTV, prices have dropped.

The difference is most pronounced when we look at 95% mortgages, where the cheapest deal is now 0.41% (two-year) and 0.3% (five-year) cheaper than a year ago.

This means buyers with smaller deposits – typically first-time home buyers – can now take advantage of lower interest than before the base rate rise.

More deals for buyers with small deposits

It stands to reason that greater competition results in cheaper rates, and that may explain the trends in relation to first-time buyers.

A little over a year ago, mortgage rates for buyers with larger deposits of 20-25% hit all-time lows, as lenders fought to offer chart-topping deals.

Now though, there are signs that lenders are instead focusing on buyers with small deposits.

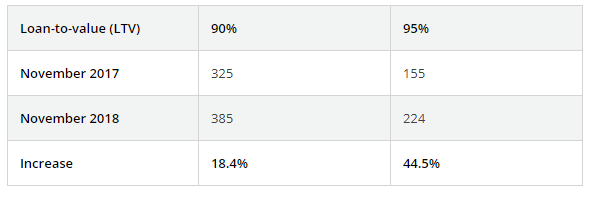

Our analysis of data from Moneyfacts found that the number of products for buyers with a 5% deposit increased by a whopping 45% in the space of a year, from 155 to 224.

Two and five-year mortgage gap closes

With the prospect of further base rate increases and wider economic uncertainty, an increasing number of buyers are considering fixing for five years rather than two.

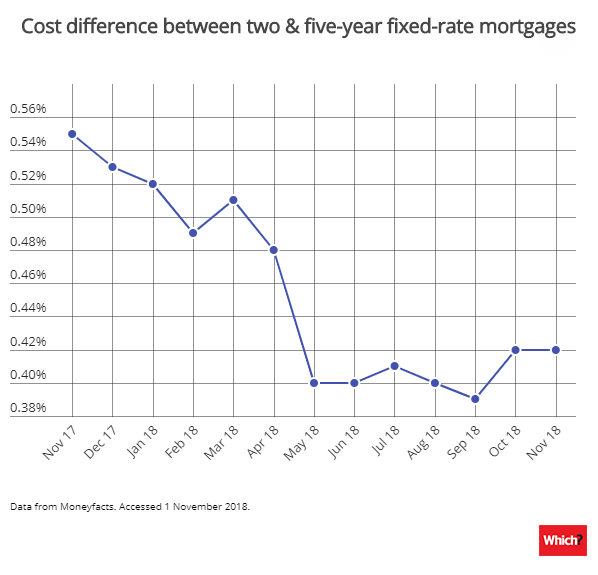

Previously, opting for a longer-term deal would have cost you more, but the price difference is decreasing.

While both types of mortgage hit historic low prices over a year ago, two-year mortgages have risen in price more quickly than five-year mortgages.

As the graph below shows, the gap in cost between the average two and five-year deal has dropped from 0.55% to 0.42% in the space of a year – and hit a low of just 0.39% in September.

SVRs up by 0.3% in a year

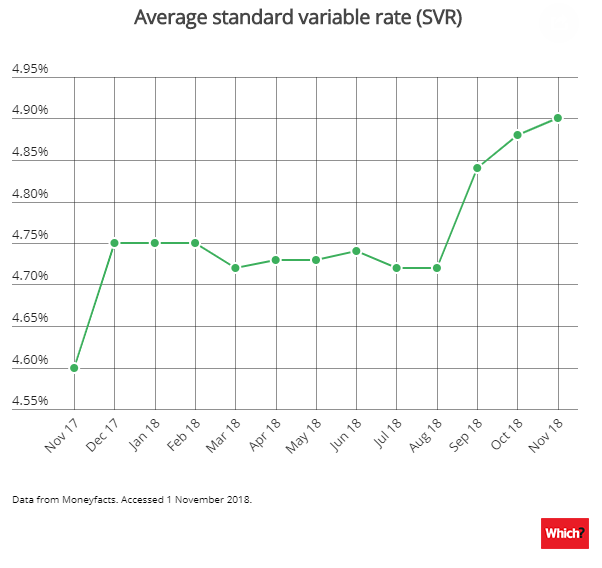

We recently investigated how much more you’ll pay when you’re transferred on to your lender’s standard variable rate (SVR); it’s as much as £4,000 a year. Yet that figure could rise even further as SVRs creep up.

After the first base rate increase last November, the average SVR increased by 0.15% and then stayed flat, but since the second rise in August they’ve continued to creep up, increasing by 0.12%, 0.02% and 0.02% in the last three months, respectively.

The chart below shows that while lenders have only passed on 0.3% of the total 0.5% base rate increase in the last year, rates are still going up. So it remains important to switch if you’re coming to the end of your fixed term.

What does this all mean?

Historically low rates may be consigned to the history books. Although mortgage rates are still relatively low, it’s highly unlikely we’ll see a return to the historically low rates we saw at 75% and 80% a little over a year ago. This is for two reasons: a higher base rate equals higher swap rates (the cost of borrowing between banks); and lenders are now focusing on markets with higher margins (such as 95% mortgages).

First-time buyers can get a better deal. If you can save a big enough deposit to get on to the ladder, you’ll have more choice than before at 95% and 90% LTV. While smaller lenders continue to offer the bulk of the best rates at 95% loan-to-value, don’t be surprised if bigger fish continue to join this market in 2019.

You might want to consider fixing for longer. Five-year fixes are more attractively priced than before, so if you’re not planning to move, it’s worth protecting yourself against any future base rate rises. Do your research before jumping in and make sure you choose a deal that isn’t subject to expensive early repayment charges.

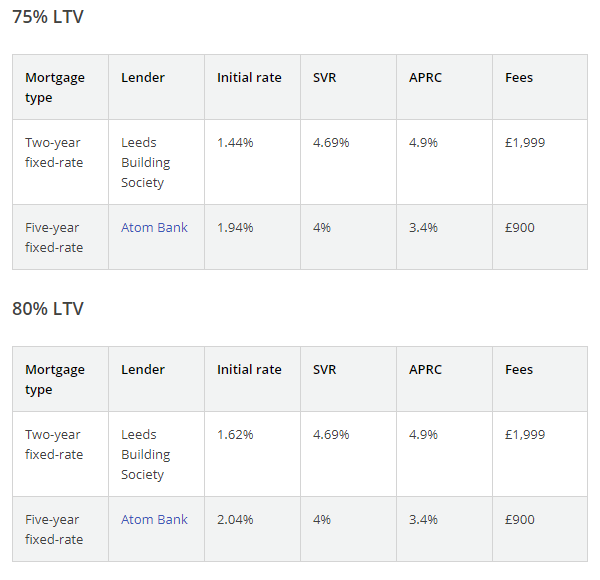

Lowest priced deals at different LTVs

If you’re looking for a mortgage right now, there are still plenty of good deals available at different LTVs.

For buyers and home movers with a deposit of 25%, Leeds offers a product priced at just 1.44% (APRC 4.9%), but beware of the large £1,999 fee.

Buyers considering fixing for longer, meanwhile, can still enjoy sub 2% rates.

At the other end of the scale, borrowers with a 5% deposit can save an extra 1% if they can save for longer and get a 90% mortgage.

Data from Moneyfacts, accessed 1 November 2018. Repayment mortgages only.

Kindly shared by Which?