First-Time Buyers need to save for 76 months to get on the housing ladder

First-Time Buyers need to save for 76 months – or nearly 6.5 years – to get on the housing ladder, according to reallymoving research.

Key points from research:

-

- Putting aside 10% of salary each month, it takes 76 months to save £25,554 to buy a first home

- First Time Buyers need to raise a minimum 10% deposit (£23,400) plus £2,154 in moving costs

- Saving into a Lifetime ISA shaves 16 months off the time to save, reducing it to 5 years

- FTBs in London need to save for almost twice as long as those in the North East

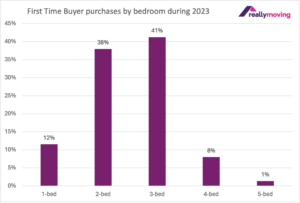

- Half (50.5%) of FTBs in 2023 purchased a 3-bedroom property or larger

First-Time Buyers (FTBs) buying as a single person need to save for nearly 6.5 years (76 months) to raise a 10% deposit and cover moving costs including conveyancing, surveying and removals, according to new research by reallymoving.

On average, First-Time Buyers pay 25% less for a property than buyers in the wider market. To buy a property at the UK average FTB purchase price of £234,000, a 10% deposit of £23,400 needs to be saved in addition to £1,314 for conveyancing, £420 for a survey and £420 for removals, bringing the total to £25,554.

Assuming they are able to put aside 10% of their salary each month, it would take 76 months to save enough to cover all upfront costs. Despite the considerable challenges they face, no support was announced the Spring Budget to help First-Time Buyers get onto the housing ladder.

During 2023, just over half (50.5%) of First-Time Buyers bought a 3-bedroom property or larger, indicating that as the average age at which people achieve home ownership has risen to 33, the needs of First-Time Buyers have changed to factor in growing families. The cost of moving may also be encouraging them to jump the traditional first rung of the housing ladder, a one or two-bedroom property, in a bid to reduce their number of overall moves.

Buying as a couple turbocharges savings

Not everyone is in the more fortunate position of being able to buy with another person, be it a partner, friend or sibling. But those than can club together will see their time to save halved to 38 months (just over 3 years) to buy the average First-Time Buyer property, assuming they are both earning the national average wage.

Saving into a LISA shaves 16 months off the time to save

Anyone between the age of 18 and 40 can open a Lifetime ISA, a tax-free savings account designed to help people save to buy a first home or for retirement. A First-Time Buyer can save up to £4,000 per year and receive a 25% annual state bonus on top, reducing the time to save by 16 months to 5 years (60 months) for those buying alone.

Londoners must save for twice as long as FTBs in the North-East

The stark North/South divide in property prices and earnings means that First-Time Buyers in London face the daunting task of saving for 104 months (8 years and 8 months) in order to raise the £45,012 needed to get on the housing ladder. In comparison, those in the North-East need to save for around half the time (55 months) to raise £14,962.

On average, First-Time Buyers in the South of England need to wait around 2.5 years (31 months) longer to get on the housing ladder than those in the North.

Reallymoving founder and CEO, Rob Houghton, says:

“Mortgage affordability has been a big focus over the last two years, but raising a deposit and covering the cost of moving is still the biggest challenge facing most First-Time Buyers who don’t have access to the Bank of Mum and Dad.

“With the cost of living, and rents, still so high, putting money aside every month is extremely difficult and even for those who are able to do that consistently, the average First-Time Buyer is still looking at a minimum 6.5 year wait to get on the ladder.

“Clearly tackling access to home ownership is not a top priority for the Conservative Government, with no support whatsoever for First-Time Buyers in the Spring Budget.

“We can only hope that as the parties publish their manifestos in the run up to the general election, we will finally see meaningful action to increase housing supply, including social housing, which would filter through to lower house price inflation for the rest of the market.

“With net migration into the UK of 670,000 in 2023, increasing supply is the only way to make home ownership more affordable in the long term.”

Table showing how much FTBs buying alone need to save (by region) and the time to save:

|

Region |

Deposit (10%) |

Moving costs |

Total to save |

Time to save (Months) |

|

London |

£42,500 |

£2,512 |

£45,012 |

104 |

|

East of England |

£27,800 |

£2,285 |

£30,085 |

88 |

|

South-East |

£30,000 |

£2,276 |

£32,276 |

87 |

|

-West |

£25,000 |

£2,272 |

£27,272 |

84 |

|

East Midlands |

£19,500 |

£2,129 |

£21,629 |

76 |

|

West Midlands |

£20,700 |

£1,976 |

£22,676 |

72 |

|

Wales |

£17,500 |

£2,088 |

£19,588 |

63 |

|

North-West |

£17,500 |

£2,076 |

£19,576 |

63 |

|

Northern Ireland |

£15,013 |

£1,480 |

£16,493 |

62 |

|

Yorks & Humber |

£16,525 |

£1,967 |

£18,492 |

61 |

|

North-East |

£13,000 |

£1,962 |

£14,962 |

55 |

|

Scotland |

£16,000 |

£1,654 |

£17,654 |

55 |

|

UK |

£23,400 |

£2,154 |

£25,554 |

76 |

Kindly shared by reallymoving