First-time buyer stamp duty relief starts to make an impact – but more help is needed

Sales to first-time buyers rose in February, with the help of stamp duty relief, while the number of house-hunters fell in line with the supply of available properties, and NAEA Propertymark is today issuing its February Housing Report.1

Sales to first-time buyers (FTBs) and sales per branch

- The Chancellor’s FTB stamp duty relief seems to be having the desired effect, as sales to the group rose to 29 per cent in February, from 27 per cent in January

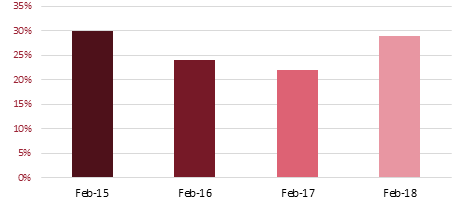

- Year on year, FTB sales were the best since February 2015. Last year they stood at 22 per cent and in 2016, only 24 per cent of sales were made to the group [see figure 1]

- The average number of sales agreed per branch rose from seven in January to eight last month – the highest amount since October 2017.

Figure 1: Year on year sales to FTBs since February 2015

Demand for housing

- The number of prospective house-hunters fell by 16 per cent in February – from 367 registered per branch, to 309

- Year on year this is down by 28 per cent, as agents had 425 house-hunters registered per branch in February 2017.

Supply of properties

- In line with demand, the number of properties available for sale per branch dropped from 36 in January to 35 in February.

What properties sold for

- 74 per cent of properties sold for less than the original asking price in February, with only four per cent selling for more than the asking price

- The rate of properties which sold at asking price stood at 22 per cent – the highest level since June 2016, when 26 per cent of properties went for asking price.

Mark Hayward, Chief Executive, NAEA Propertymark said:

“Since the Chancellor cut stamp duty for first-time buyers, there have been a good level of sales to the group, but they haven’t rocketed. As we said in last month’s Housing Report, our members have noticed FTBs holding off on making purchases since the rule was introduced – typically outside of London – opting instead to save for longer to maximise the full stamp duty relief. This may be one reason why sales are up but not as high as we might expect; the other reason is that the cost of buying is still very high, and FTBs are still finding it difficult to save for their deposit. As the cost of living continues to rise – with consumer price inflation standing at 2.5% in February – we still have a long way to go to make the dream of owning a home accessible to all, but this is definitely a step in the right direction.”

1 All figures from NAEA Propertymark’s February Housing Report – full NAEA Propertymark February Housing Report available on request

Kindly shared by NAEA Propertymark