Equity Release Council: Q3 2020 equity release market statistics

The Equity Release Council, the representative trade body for the equity release sector, publishes Q3 2020 equity release market statistics.

1. Summary

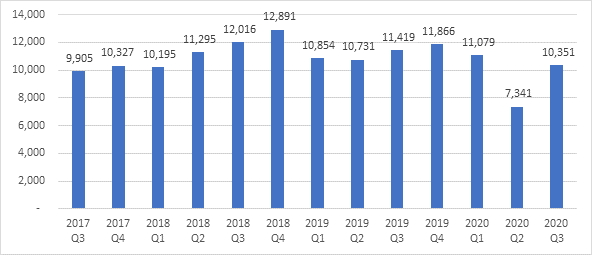

Equity release activity makes a steady return in Q3 with 10,351 new plans agreed

- The number of new equity release plans agreed (10,351) increased by 41% from the previous quarter as national lockdown conditions were eased. This remained 9% down year-on-year from 11,419 in Q3 2019 and the second slowest quarter (after Q2 2020) since Q1 2018.

- There was a gradual increase in new customer activity during the quarter: July saw 3,147 new plans agreed, followed by 3,228 in August and 3,976 in September.

- 6,697 customers returned during Q3 to take extra drawdowns from their agreed reserves – up 19% from 5,608 in the previous quarter but 30% below the 9,605 seen this time last year.

- £963m of property wealth was unlocked in total during Q3 2020 by new or returning customers, up by 38% from Q2, but down 3% from Q3 2019.

- The climb back towards pre-Covid levels of activity was influenced by an extended pipeline and delayed cases from earlier in the year; new plans agreed in the six months from April to September remained 20% below the same period in 2019.

David Burrowes, Chairman of the Equity Release Council, comments:

“These figures show a steady return to something closer to normal activity over the summer, after the market weathered the initial impact of Covid-19. With the country experiencing a break from lockdown, the pick-up was helped by a mix of new enquiries and delayed cases from earlier in the year.

“Equity release is a carefully considered choice, and this year’s unprecedented events make it more important than ever for people to weigh up their decisions through regulated financial advice, independent legal advice and conversations with those closest to them.

“Despite the uncertain climate, the market has adjusted well to the challenges of operating safely in a pandemic. Desktop property valuations have been used selectively, solicitors have taken extra steps to maintain consumer protections when advising remotely, and product pricing has remained competitive.

“Looking ahead, the key market drivers remain in place: people are living longer and retirement finances are increasingly squeezed as generous final salary pensions edge further to extinction. Many older households are already facing a situation where their expenses outweigh their disposable income², which makes access to property wealth an important pillar to support later life living standards.”

2. Key statistics for Q3 2020

Overall activity

- 10,351 new equity release plans were taken out between July and September 2020,up by 41% from the previous quarter (7,341 – Q2 2020), though still down 9% year-on-year from 11,419 in Q3 2019. Other than Q2 2020, Q3 2020 was the quietest for new customers since Q1 2018.

- This return to some degree of normality was likely to be influenced by extended pipelines, as some plans that might otherwise have completed earlier in the year came to fruition in Q3. The six months from April to September saw 17,692 new plans agreed in total, compared with 22,150 a year earlier and 23,311 during the same period of 2018.

- The total number of customers (new or returning) served in Q3 2020 was 18,154, up 33% from the 13,617 in Q2 2020 but down 18% from the 22,131 customers served this time last year.

- £963m of property wealth was accessed in Q3 by new or returning customers – up 38% from the previous quarter (£698m) and down 3% year-on-year (£989m).

Trends among new customers

- September was the busiest month for new plans as there was a gradual increase in market activity from July (3,147) to August (3,228) to September (3,976).

- Among the 4,545 new lump sum lifetime mortgages taken out in Q3, the average loan size remained stable at £99,691. This was unchanged from the previous quarter while increasing by 4% year-on-year.

- Among the 5,806 new drawdown plans taken out in Q3, the average loan size of £70,244 was similar to the previous quarter (up by 2%), and increased by 11% year-on-year. The average amount reserved for future use (£34,877) was slightly down by 7% on Q2 (£37,500) and down 6% year-on-year.

Trends among returning customers

- In Q3 2020, 6,697 customers returned to take extra drawdowns from their agreed reserves. This is compared to 5,608 in the previous quarter – a 19% rise – but still down 30% from the 9,605 seen this time last year.

- The average drawdown instalment taken was £11,424, slightly less (-12%) than the £13,005 seen in Q2 and relatively stable when compared to the £11,169 average from Q3 2019.

- Further advance activity recovered to the levels seen a year ago at 1,106, rising from a low of only 668 in Q2 where the property market was put on hold.

3. Data tables

Graph 1: Total number of new equity release plans taken out by quarter, Q3 2017-Q3 2020

Source: Equity Release Council, Q3 2020 market statistics

4. About the data

The Equity Release Council’s market statistics are compiled from member activity, including all national providers in the equity release market. This latest edition was produced in October 2020 using data from customer activity during the third quarter of this year (July to September). All figures quoted are aggregated for the whole market and do not represent the business of individual member firms.

Equity release products are available to homeowners aged 55+, enabling them to release money from the value of their home following a regulated process of financial advice and independent legal advice to determine whether this is suitable for their individual circumstances and long-term needs. Funds released are typically used for a range of purposes including providing additional retirement income, funding one-off expenses and lifestyle purchases, consolidating debts, meeting homecare costs and gifting a ‘living inheritance’ to family or friends.

Kindly shared by The Equity Release Council

Main article photo courtesy of Pixabay