Equity Release Council publishes its Spring 2021 Market Report

The Equity Release Council (ERC) has published its Spring 2021 Market Report, with comments from David Burrowes, Chairman.

Summary

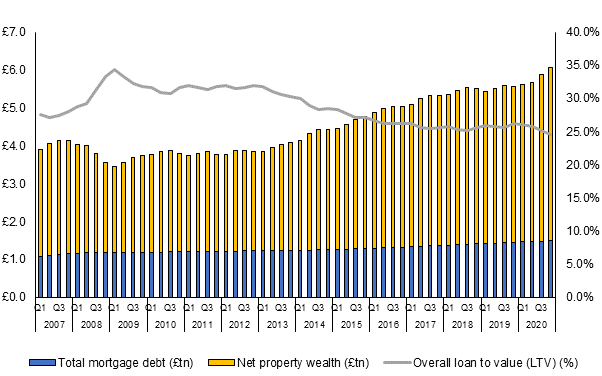

UK property wealth reaches a record £4.6trillion as lifetime mortgage availability and average rates break new ground

- The total value of UK private property passed £6 trillion for the first time at the end of 2020

- Total national mortgage debt continues to rise towards a record £1.5 trillion, but the average loan to value (LTV) falls to the lowest level since before 2007/8

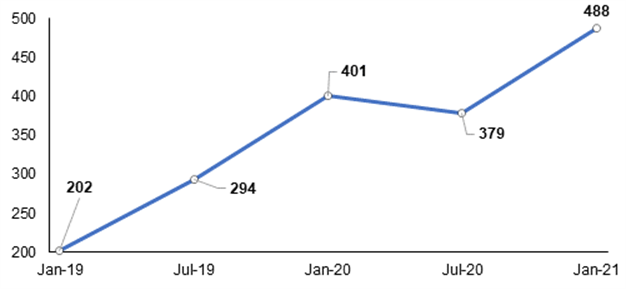

- The number of equity release products available to consumers rose to record highs with 100 new products added in H2 – a total of 488 products were available by the end of 2020

- Access to retirement interest-only mortgages also improved last year with more than 100 products available for the first time

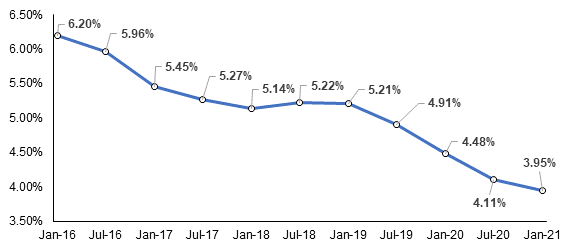

- The average lifetime mortgage product rate reached a record low of 3.95% in January 2021, with a quarter of products now offering rates of 3% or lower

- The volume of new equity release plans taken out rose 19% during H2 2020, compared to the first six months of the year as consumer confidence and businesses showed resilience

- Over-55s withdrew 46p of property wealth for every £1 of flexible pension payments in H2 2020, in line with 2019 as property plays an important role in the retirement funding mix.

David Burrowes, Chairman of the Equity Release Council, comments:

“After the unprecedented upheaval of early 2020, the equity release market showed signs of recovery as households and businesses remained resilient against a challenging backdrop. Property wealth ranks second only to pensions in terms of its importance to household finances across the country. The transformation of later life mortgage products in recent years has given people more opportunities to access property wealth at affordable rates.

“Accessing property wealth will play a vital role in retirement planning, both now and in the years to come. For today’s retirees, it can make the difference between making ends meet or enjoying a more comfortable lifestyle by boosting their pension income, improving or adapting their homes life and paying for domestic care support. For younger generations, it can open up the possibility of receiving a ‘living inheritance’ to support their own financial goals, such as getting on the property ladder.

“2021 is a milestone year that marks the 30th anniversary of the first equity release standards. Today’s market has added choice and flexibility to the robust protections and guarantees that give consumers confidence that modern equity release is safe and reliable. We will continue to work with industry, government, policymakers, regulators and consumer bodies to ensure the products and advice available continue to serve customers’ changing needs.”

Key statistics

Market context [page 4]

- The total value of UK private property passed £6trillion for the first time on record at the end of 2020 as market activity recovered from the first coronavirus lockdown

- Discounting mortgage debt, the amount of UK property equity which is privately owned reached a record £4.6trillion

- The average loan-to-value of UK property reduced to 24.6%, the lowest level seen since before the 2007/8 financial crisis

- On an individual basis, the average UK property owner held equity of £189,549 alongside an average loan of £61,951

- Mortgage holders made an unprecedented £5.1bn of overpayments in Q4 2020, but regular repayments remain below pre-pandemic levels as some households continue to rely on mortgage holidays to manage their loan commitments

- Over-55s withdrew 46p of property wealth for every £1 of flexible pension payments in H2 2020, in line with 2019 as property plays an important role in the retirement funding mix.

Overall customer activity [page 6]

- The volume of new equity release plans taken out rose 19% during H2 2020, compared to the first six months of the year

- Although new customer activity remained 6% below pre-pandemic levels in H2, it showed signs of underlying market resilience by surpassing 20,000 plans agreed between July and December

- In the face of economic uncertainty, new plans were down 10% year-on-year compared with an 11% fall in further advances and a 21% fall in returning drawdown customers

- Across the whole of 2020, 72,988 new and returning customers were served, collectively accessing £3.89 billion of property wealth to support their finances.

Product features and pricing [page 7]

- The number of equity release products available rose by 100 in the second half of 2020 to reach 488 in total. This is more than double the 202 products available two years earlier

- Access to retirement interest-only mortgages also improved last year with more than 100 products available for the first time

- Over three fifths of lifetime mortgages now allow voluntary partial capital repayments with no early repayment charge

- The average lifetime mortgage product rate reached a record low of 3.95%, more than half a percentage point lower than in January 2020

- early three in five (58%) lifetime mortgages now offer rates of 4% or lower, including one in four (26%) priced at 3% or less

Customer trends [page 11]

- The average age of new customers remained stable in H2 2020 at 69.9 for new drawdown customers and 68.3 for new lump sum customers

- Jointly held plans contributed to a growing share of new lump sum lifetime mortgage activity – 60% compared with 55% in H1 2019

- Customers in the second half of 2020 had higher average house prices and accessed smaller percentages of their property wealth than in 2019

- Returning drawdown and further advance activity was quieter in H2 2020 than a year earlier, as customers refrained from drawing on additional funds in response to the pandemic

- Average withdrawals of property wealth are largely consistent with previous periods, with drawdown customers reducing extra reserves.

Data tables

UK trends in private property wealth [see page 4]

Source: Equity Release Council, Office for National Statistics

Average equity release interest rates, January 2016 to January 2021 [see page 9]

Source: Moneyfacts Plc, January 2021

Number of products available in the equity release market [see page 7]

Equity release product features [see page 8]

| 48% of products are potentially available to customers living in sheltered accommodation, subject to individual lender requirements | 30% of products allow customers to make regular full or partial interest payments |

| 64% of products allow voluntary capital repayments with no early repayment charge | 45% of products enable downsizing repayment options, so the loan can be repaid with no early repayment charge if the customer opts to downsize in future |

| 56% of products offer fixed early repayment charges | 50% of products offer drawdown facilities |

| 16% of products offer an inheritance guarantee, to ringfence part of the property’s value as a minimum protected amount to leave behind | 3% of products allow customers to receive regular income payments |

Source: product data supplied by Key, February 2021

Please note: At the end of 2019, Key launched a new advice delivery platform which alters how product data is collated and provides a more in-depth look at product specifics and variants. As such this year’s figures are slightly different compared to last year’s figures due to the use of this new system. Any queries please get in touch with Key’s Press Office.

The full Equity Release Council report can be downloaded here.

Kindly shared by The Equity Release Council (ERC)

Main photo courtesy of Pixabay