Demand for Help to Buy and Shared Ownership higher than ever

18 February 2021: The Help to Buy and Shared Ownership demand is higher than ever, according to reallymoving.com’s analysis, which shows that 17.2% of FTBs used schemes in 2020.

More First Time Buyers than ever before are using government schemes to help them onto the housing ladder, as house price inflation and the large deposits required by lenders narrow their options.

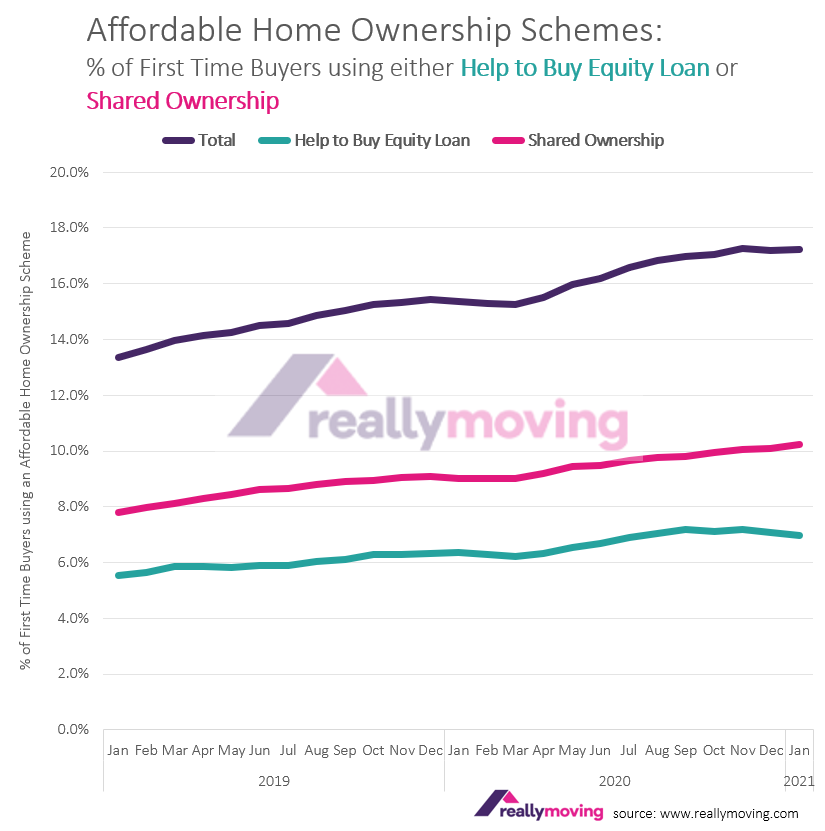

According to reallymoving’s data, 17.2% of First Time Buyers used either a Help to Buy Equity Loan or Shared Ownership to step onto the housing ladder in 2020, compared to 15.4% in 2019 and 13.1% in 2018. Shared Ownership is the most popular option, accounting for 10.1% of all First Time Buyer transactions last year, compared to 7.1% opting for a Help to Buy loan (see graph below).

Facing the combined challenges of rising prices post-lockdown and the shrinking of the First Time Buyer mortgage market in response to the pandemic, First Time Buyers are required to raise an additional £10,800 according to Halifax, bringing the average deposit paid by new buyers in the UK up to £57,279 compared to £46,449 in 2019. Consequently, demand is being funnelled into the new build market where government schemes require a deposit of just 5%.

Changes to the schemes

Changes to both Help to Buy and Shared Ownership will come into force at the beginning of April 2021, although the current Help to Buy scheme has also been extended until the end of May to allow for delays to the construction of new house as a result of the pandemic, giving buyers more time to complete.

The new Help to Buy scheme, running until 2023, will be restricted to First Time Buyers only and will operate with regional price caps in place. This will help target help to where it’s needed most, but buyers should also bear in mind that strong demand for Help to Buy homes can mean they come with an asking price ‘premium’, increasing the risk of negative equity if prices fall. Developers offering Help to Buy under the revised scheme will be required to sign up to the new Property Ombudsman, providing greater assurance of high building standards and sustainability.

The new Shared Ownership scheme will allow buyers to purchase a minimum share of just 10% compared to 25% previously, making it far more accessible, and will permit staircasing in instalments of 1%, rather than 5% or 10% currently. A new ten-year period will be introduced for maintenance and repairs, whereby the landlord or Housing Association will be required to cover costs rather than homeowners, allowing them to staircase more quickly.

New online valuations service for Shared Ownership and HTB homebuyers

To make life easier for users of both schemes, reallymoving has launched a new price comparison service for property valuations, enabling homeowners who have bought through Shared Ownership or Help to Buy Equity Loans to arrange a RICS valuation of their home.

Buyers who have used Shared Ownership require an up-to-date valuation when they come to sell or if they wish to staircase, in order to ascertain the current market value. Similarly, buyers who have used a Help to Buy Equity Loan require a new independent valuation if they wish to pay off part or all of the loan, or if they wish to sell the property, since the amount they pay back is based on the current market value.

Alongside price comparison tools for conveyancing, surveying, removals and EPCs, the new valuation service will allow users to compare the fees of up to 4 RICS-regulated Chartered Surveyors in their local area, from a panel of experienced professionals.

Rob Houghton, CEO of reallymoving, said:

“Based on the current average First Time Buyer purchase price of £249,000 in the UK, buying a 10% stake in a shared ownership property could require a 5% deposit of just £1,246 – an attractive prospect for those looking for an affordable way onto the housing ladder.

“We’re now seeing record levels of First Time Buyers using either Shared Ownership or Help to Buy, with the impact of the pandemic boosting demand further as buyers struggle to raise even larger deposits required by lenders, on top of higher house prices.”

Kindly shared by reallymoving.com

Main article photograph courtesy of Pixabay