Could 2019 be the year of the 100% (no deposit) mortgages?

Mortgages that don’t require a deposit could make a return in 2019 – but does a 100% home loan put first-time buyers at risk?

The Building Societies Association (BSA) recently said that lenders should consider bringing back the controversial loans, which disappeared after the financial crash in 2008, to prevent first-time buyers relying exclusively on the Bank of Mum and Dad.

Critics, however, believe a return to 100% mortgages would be incredibly risky, especially in the current financial climate.

Here, we explain how 100% mortgages could work and offer advice on the options for buyers with no deposit.

What is a 100% mortgage?

A 100% mortgage is a loan for the entire purchase price of a property.

Rather than saving a deposit, the buyer only has to pay stamp duty, mortgage and legal fees, and the cost of a house survey.

While this might sound appealing, mortgages at 100% (or even in excess of 100%) loan-to-value (LTV) played a part in the housing market crash during the financial crisis a decade ago.

Where deposit-free mortgages are available today, they all require a family member to act as a guarantor or provide financial security.

Could 2019 be the year of the 100% mortgage?

With high house prices and low wage growth keeping property out of reach for many prospective first-time buyers, lenders must consider ways to improve affordability.

That’s according to the BSA, which claimed in November that lenders should ‘push harder in the direction of 100% LTV products‘, by considering deposit-free deals for borrowers who fit certain criteria, such as working in specific professions or likely to receive a large inheritance.

100% mortgages have support from the wider public, too. A recent YouGov poll found that nearly half (48%) of 9,713 respondents said they think 100% mortgages would be a good idea. At the same time, 32% of respondents were against the idea and 20% were unsure.

100% mortgages and economic uncertainty

There’s no doubt that 100% mortgages are risky for buyers. If house prices drop before you’ve paid down a substantial portion of the loan, you could be left in negative equity, facing a huge bill to sell and unable to remortgage.

That fear is keenly felt by critics who cite the financial crisis of 2008.

Back then, many lenders offered mortgages of 100% LTV and above, with some even offering 125% deals. The crash resulted in many households being stuck in negative equity or defaulting on their loans.

With house prices now stagnating and confusion reigning over the UK’s withdrawal from the European Union, these concerns are rearing their heads again.

And in this time of economic uncertainty, some question whether 100% deals could be offered at competitive rates.

Don’t we already have 100% mortgages?

You might have seen mortgages advertised at 100% LTV, but these aren’t comparable to the products offered before the financial crisis.

Indeed, all the ‘100%’ mortgages currently on the market require a parent or family member to act as a guarantor, be named on the mortgage agreement or use their savings or property as security.

While the specifics of these deals vary significantly from lender to lender, they broadly fit into the categories below.

| Type of mortgage | How it works | Pitfalls | Example mortgage |

| Traditional guarantor mortgage | A family member acts as a guarantor on the buyer’s mortgage debt. | In the worst-case scenario, the guarantor could lose their home. | Aldermore allows buyers to borrow 100% of the property’s value, with a parent or grandparent guaranteeing the amount above 75% LTV. |

| Family deposit mortgage | A family member deposits 10-20% of the property value into a special account, to act as security against the mortgage. These deposits earn interest. An alternative is family offset mortgages, where the buyer pays interest on the difference between their loan and the account balance. These deposits don’t earn interest. | The family member could lose savings if the buyer defaults. | The Barclays Family Springboard Mortgage involves a family member providing 10% of the purchase price as security. If the buyer makes their payments as agreed, the family member gets their money back within three years. |

| Family link mortgage | The buyer gets a 90% mortgage on the home they’re buying, and a 10% mortgage is taken out on the family member’s home. | A loan is secured on family member’s home, so this can be at risk if the buyer defaults. | The Post Office offers these mortgages. They involve the buyer paying two separate repayments in the first five years – an interest-free payment on the family member’s 10% mortgage and a repayment on their 90% mortgage. |

We recommend taking independent legal advice before financially linking yourself with another person.

Joint borrower, sole proprietor mortgages

Some lenders are also offering so-called ‘joint borrower, sole proprietor’ (JBSP) mortgages, which allow parents to join their child’s mortgage.

The big benefit for parents is that their child will get a better rate and, because the parent isn’t named on the deed, they avoid the 3% stamp duty surcharge for people who buy a second home.

Older parents may find it difficult to get accepted for this type of mortgage, and although the number of products available is rising, there’s still not a huge amount of competition.

Can’t we change affordability criteria instead?

In theory, one alternative to 100% mortgages is for lenders to loosen the criteria that first-time buyers must meet to qualify for a home loan.

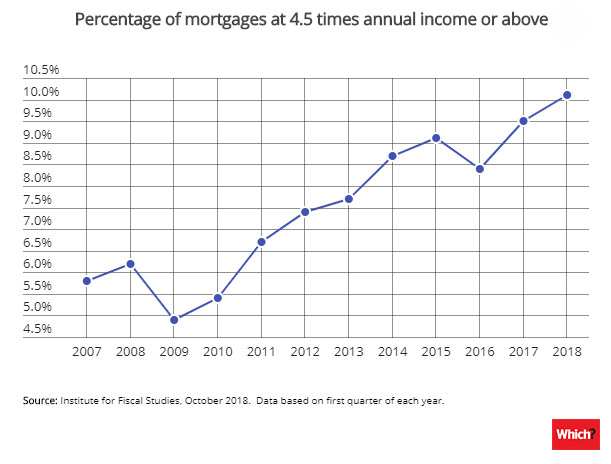

Currently, the Bank of England sets limits on how many mortgages lenders can grant at 4.5 times annual salary or above.

While this helps to keep a lid on risky lending, it means that for some buyers on limited incomes, even the cheapest home in their area remains unobtainable.

Some lenders, such as Darlington Building Society and Hinckley & Rugby Building Society, have begun offering loans at 6 and 5.5 times annual income respectively, albeit only to buyers in certain professions.

The chart below shows how the percentage of mortgages granted at 4.5 times income or more has increased over the last decade.

What’s wrong with 95% mortgages?

While 100% mortgages theoretically allow buyers with no deposit to get on to the property ladder, there are some great deals available right now for buyers who can save a 5% deposit.

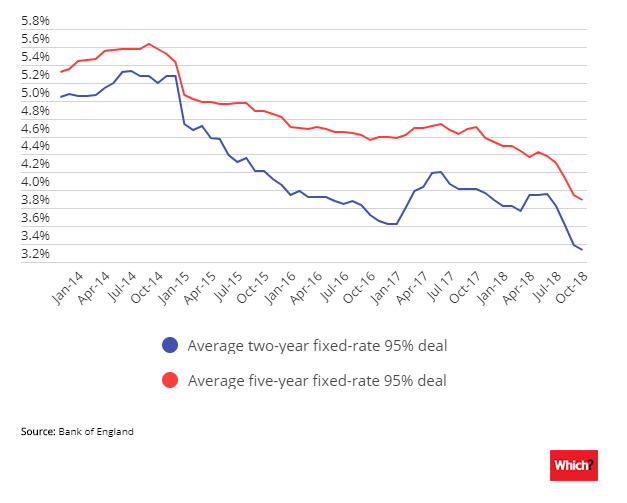

Indeed, 95% mortgages have hit record low levels, averaging just 3.33% for a two-year fixed-rate deal or 3.89% for a five-year fix.

Kindly shared by Which?