Buyers and sellers don’t respond to continued uncertainty – residential market survey

The September 2019 RICS UK Residential Market Survey shows housing sales remaining subdued, and buyer demand and supply slipping into negative territory.

Download this month’s survey report (0.46MB)

Key findings:

- New instructions across the UK (net balance) slip to weakest in three years

- Buyer enquiries fall as uncertainty deters house purchases

- Prices still expected to rise at a national level over the coming twelve months

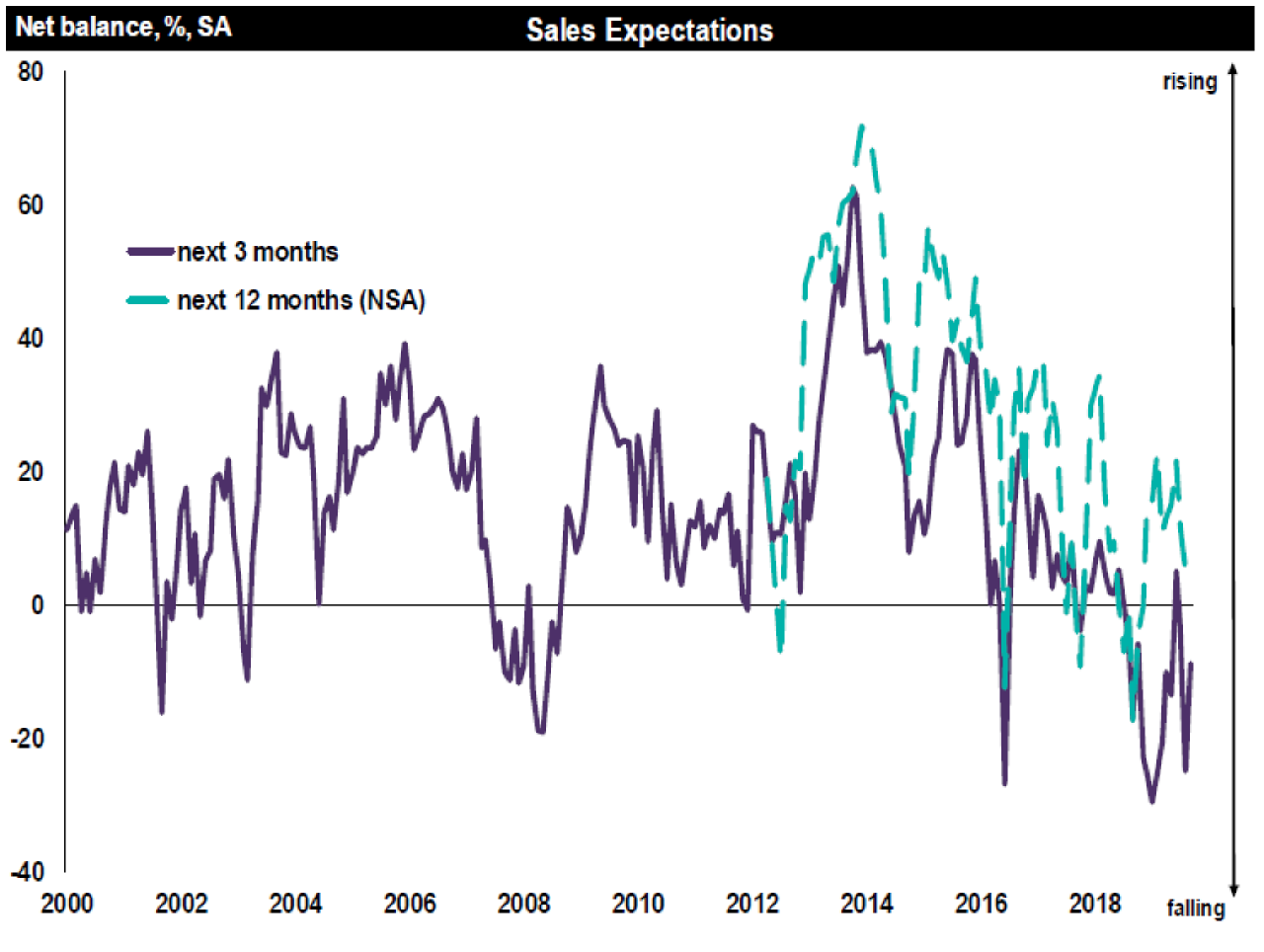

Much of the anecdotal commentary from the survey respondents working in the market blames heightened economic and political uncertainty. The market seems unlikely to gain impetus over the next three months, though sentiment for a year ahead is more resilient.

In September, following three consecutive months of a stable trend, a decline is reported in home listings coming on to the housing market. Comments from contributors are suggesting that the Brexit impasse is dissuading vendors. The new instructions net balance fell to -37% in September, the weakest reading since June 2016.

Average stock levels on estate agents’ books, unsurprisingly therefore, remain near record lows. As contributors are reporting that appraisals are down compared to a year earlier, there is little prospect of a pick-up in the immediate future.

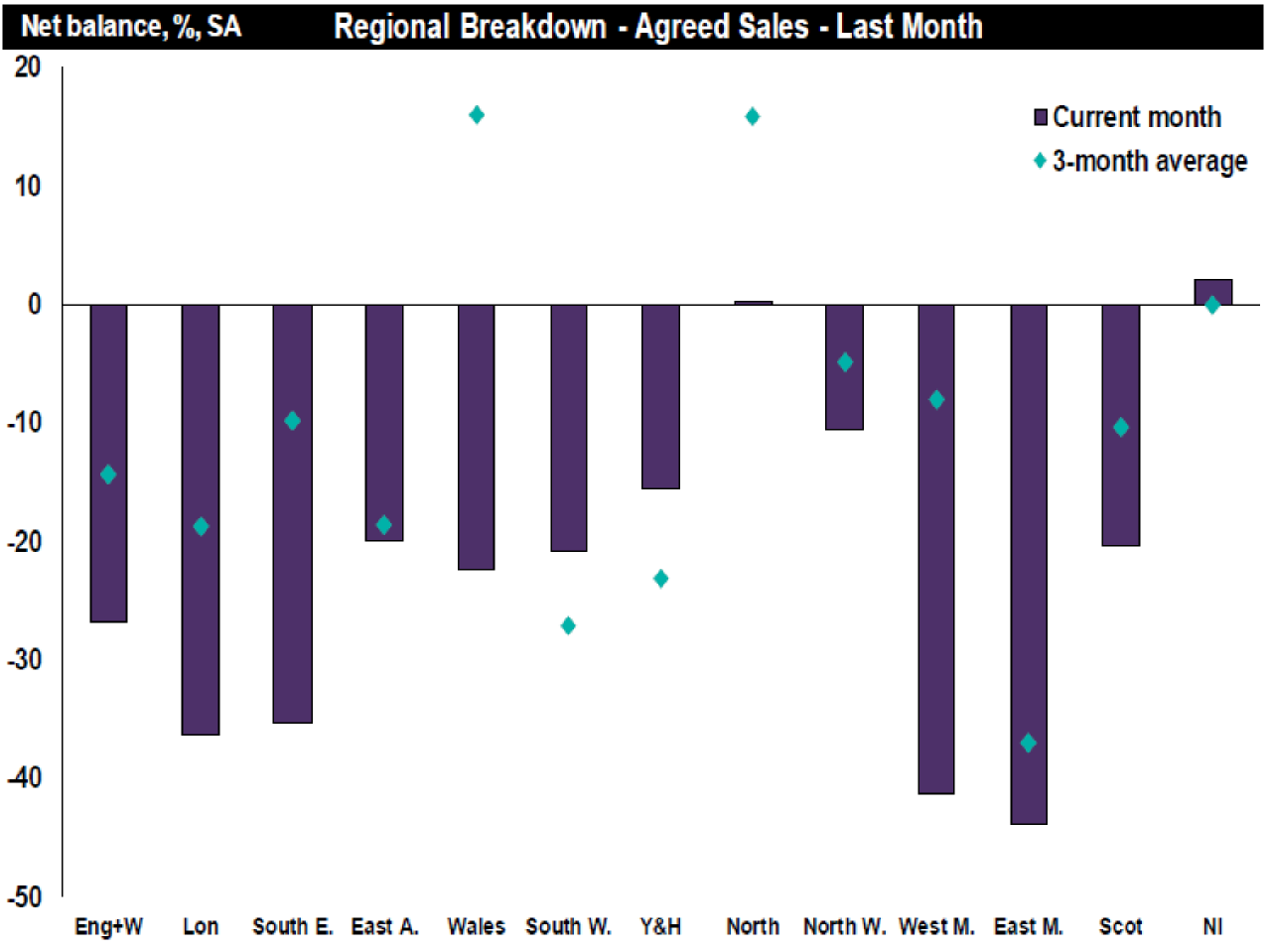

Alongside this, a more cautious approach from buyers is visible in the September results. After holding steady in the last four months, the new buyer enquiries net balance fell to -15%. In keeping with this, newly agreed sales fell, with a net balance of -27% (from -11% previously), with activity reportedly slipping in virtually all parts of the UK.

As far as the near-term outlook is concerned, sales expectations stand at -9%, suggesting sales will remain subdued in the coming three months.

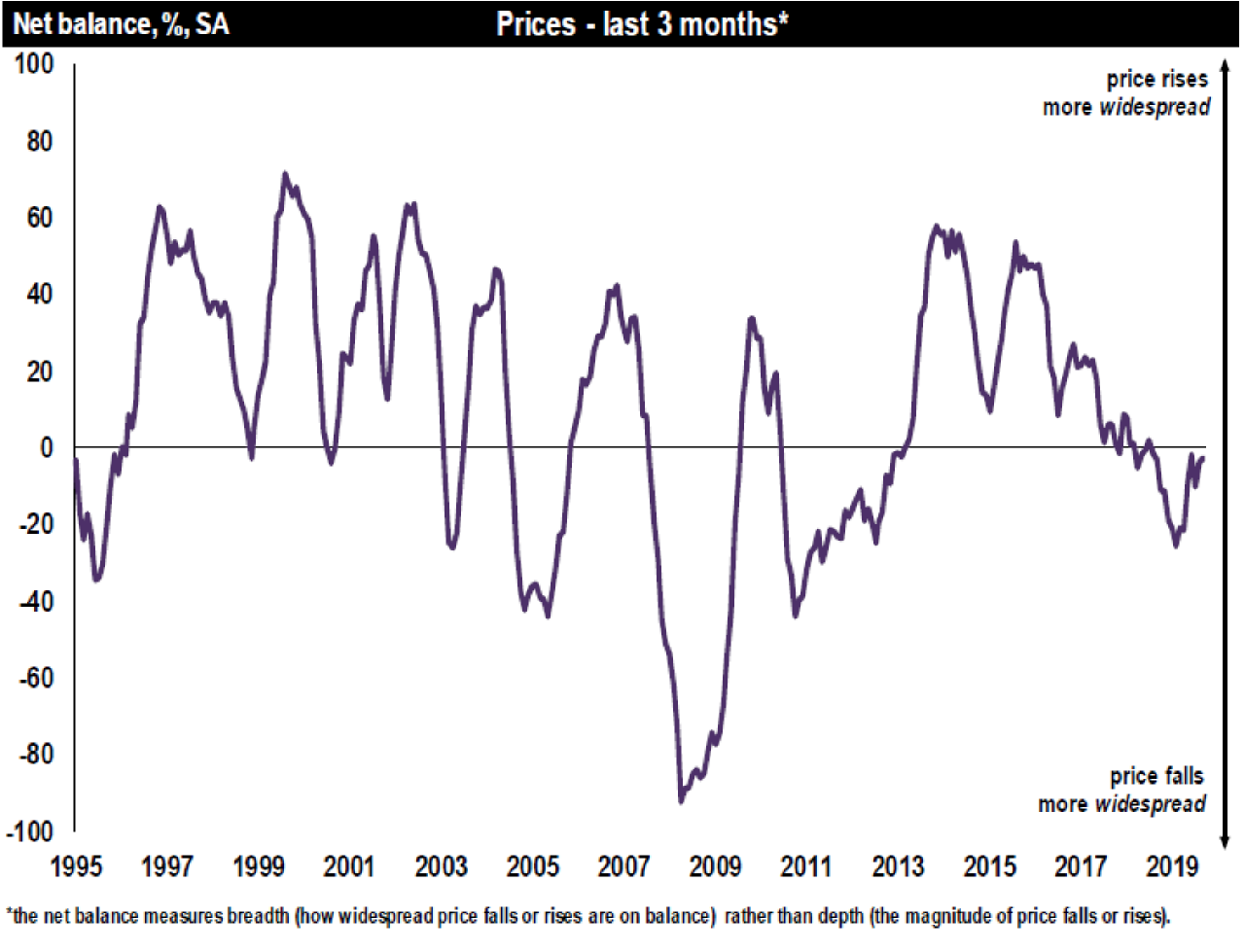

Turning to prices, the headline price balance sees a flat trend in house price inflation. However, there is once again a mixed picture across the UK with negative momentum in London and the South East, and solid gains in Northern Ireland, Scotland and the North West.

Looking ahead, price expectations for the coming three months stand at -16% pointing to a modest decline on a UK-wide basis. However, the twelve-month outlook points to a turnaround, with +18% more respondents expecting prices to rise (rather than fall) over the coming year.

In the lettings market, the latest set of results (which form a part of non-seasonally adjusted series) see demand from prospective tenants rising firmly for an eighth month in a row. Alongside this, landlord instructions remain in decline. With demand still outstripping supply, rent expectations for the coming three months remain positive (net balance of +24%).

Simon Rubinsohn, RICS Chief Economist, said:

“There are good reasons for thinking the latest dip in both buyer enquiries and vendor instructions is a response to the endless wrangling about Brexit, as the October 31st deadline approaches.

“Indeed, much of the commentary from respondents based further away from London and the South East remains relatively sanguine, which is also reflected in some of the metrics capturing expectations.

“However, unless there is a speedy resolution to the ongoing impasse it does seem inevitable that the stand-off between purchasers and sellers will deepen making it harder to complete transactions. This will not only be a direct hit on the housing market itself but could have ramifications for the wider economy as the normal spend on furniture, fittings and appliances that typically accompanies a house move is also put on hold.”

Kindly shared by Royal Institution of Chartered Surveyors (RICS)