Buyer demand at end of March was double normal level (Reallymoving)

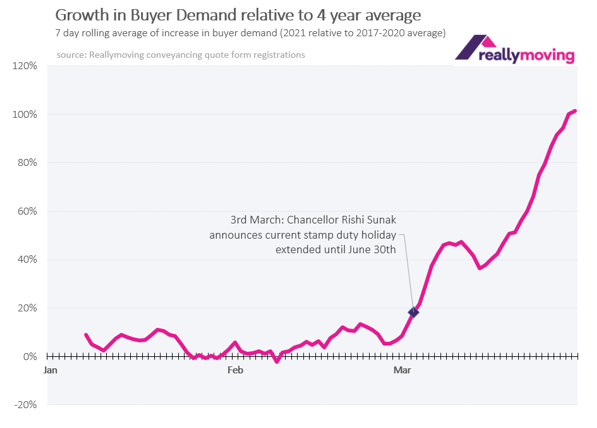

Buyer demand for conveyancing quotes was 101% higher at the end of March (30/03/21) than the average for the same date during the previous four years (2017 – 2020) according to data from reallymoving, the comparison site for home movers.

Key points from data:

- Volume of conveyancing quotes on reallymoving was 101% higher than usual at end of March

- Rapid acceleration in demand began on 3rd March, following stamp duty holiday extension

- Increase in First Time Buyer quote volumes at end of March was even greater (+111%)

- Tax saving, lifestyle changes and the rise of home working is driving housing market activity

Demand from homebuyers for conveyancing quotes was 101% higher at the end of March (30/03/21) than the average for the same date during the previous four years (2017 – 2020) according to data from reallymoving, the comparison site for home movers.

Conveyancing quote volumes began to accelerate around Budget Day (3rd March) when the Chancellor announced an extension to the existing stamp duty holiday and a tapering of the tax saving to the autumn, as well as news of a mortgage guarantee scheme for 95% loans. By mid-March (19th), quote volumes had reached 51% higher than the average and continued to accelerate to reach 101% higher by the end of the month (see graph below).

First-Time Buyers leading the charge

Despite the fact that they benefit the least from the stamp duty holiday extension, the volume of First-Time Buyers seeking conveyancing quotes has also accelerated sharply in the last month. Demand accelerated throughout March, rising to 111% higher on the 30th March than the average for the same date during the previous four years (2017 – 2020).

A survey by Canada Life in November 2020 found that a third of adult children had moved back in with their parents during the pandemic, providing many with a unique opportunity to save for a deposit. They will also be encouraged by several high street lenders signing up to the government’s new mortgage guarantee scheme, meaning a greater choice of high loan to value mortgages will soon be available – and fears of a further surge in prices prompted by the stamp duty holiday extension.

Households feeling flush

Households have accumulated £125 billion in excess savings throughout the pandemic, according to the Bank of England’s Monetary Policy Report published in February 2021, equating to an average of £5,000 per household. While many households have been hit hard, a large proportion have seen their financial position improve dramatically as income as remained secure with little opportunity for spending.

At the same time, spending more time at home, including working, has prompted families to reconsider their home and whether it meets their current needs – and whether a relocation may now be a viable option as some element of home working becomes the norm.

Advice to homebuyers

It’s a seller’s market at the moment, with demand for property outstripping supply, meaning homebuyers need to be more organised than ever to secure the property they want. Reallymoving has compiled the following tips for those hoping to buy a property this spring.

Get your ducks in a row. Get your mortgage offer agreed in principle before you begin house hunting – taking special care if you’re self-employed or have bad credit, which could make it harder to find a loan.

Research the market thoroughly online, using virtual viewings and 360° tours, and speaking directly to agents. Understand what’s available in your price range and whether you could get more for your money by looking slightly further afield or buying a property you could improve.

Be prepared to make your best offer early – and know your limit if it goes to sealed bids. In a strong seller’s market, you need to move fast to secure a property and the longer it’s open to viewings, the higher the chance of being outbid.

Download Reallymoving’s Moving House Checklist, helping you keep track of all the important steps along the way.

Be flexible on move-in dates. Be prepared to move into rental or stay with friends if necessary to accommodate the other parties in the chain.

If you’re selling too, make sure you’re on the market or ideally under offer. Many agents aren’t conducting in-person viewings currently unless the buyer is ready to agree a deal.

Reallymoving is running a series of free webinars hosted by property expert Kate Faulkner, to inform and support homebuyers. The next one, taking place at 7pm on 13th April, will focus on whether now is the right time to buy or sell, answering questions about the impact of the recent Budget and the current state of the property market.

CEO Rob Houghton said:

“It’s a strong seller’s market and demand is continuing to grow as we head further into spring, encouraged by the launch of government-backed 95% loans and the stamp duty holiday extension. Many homebuyers have cash in the bank, money is cheap to borrow and, with the end of lockdown in sight, people are feeling optimistic about a future where they may be less tied to an office-based 9 to 5, giving them greater freedom to live where they choose.

“The housing market is usually a reliable indicator of consumer confidence and if this level of demand is anything to go by, the Chancellor may get the summer consumer spending spree he’s hoping for.”

Kindly shared by reallymoving.com

Main photo courtesy of Pixabay