Brexit uncertainty slashes confidence in housing market

While more than half of the population (53%) see Brexit as the biggest risk to the housing market in 2019, a rise in the cost of living (38%) and a rise in interest rates (36%) are also seen as a risk by consumers.

Raising a deposit remains the biggest barrier to home ownership (62%).

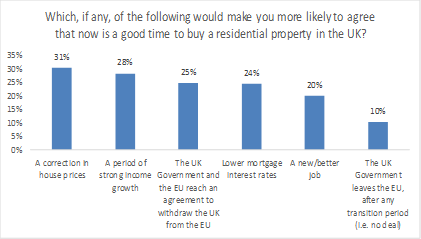

There is a growing concern about future falls in prices as a barrier to property purchase (28% – up from 18% in September). Amongst those who don’t see now as a good time to buy, 31% say a correction in house prices might make them change their mind. Other factors that would improve the feelgood factor are a period of strong income growth and the UK Government reaching an agreement to leave the EU.

Commenting, Paul Broadhead, Head of Mortgage Policy at the BSA said:

“It is unsurprising that Brexit is a key factor in the subdued mortgage market. More than half of the population see it as the biggest risk to the market, and a quarter said an agreement with the EU would make them more confident.

“However, dominant negative media coverage and the pessimistic forecasts will be affecting people’s views. If we get some sort of clarity soon, this could cause a shift in sentiment.

“Looking past Brexit, the fact remains that raising a deposit is the biggest barrier to buying property. For decades, successive Governments have failed to get a grip on the deficit in housing supply. This has led to house price increases far exceeding wage growth, particularly for the young. The current Government has bold plans, but bold actions are needed to narrow the gap between house prices and earnings.”

Kindly shared by Building Societies Association (BSA)