Average UK rent rises to another record high of £1,078 p.c.m.

Average UK rent rises to another record high of £1,078 p.c.m., up 8.7% year-on-year, with Scotland seeing the highest annual variance.

HomeLet has released the Rental Index figures from March 2022, with another record high price recorded, now up to £1,078 PCM.

The headlines from this month’s report are:

- The average rent in the UK reaches another record high of £1078, up 8% on last month

- When London is excluded the average rent in the UK is now £910, up 9% on last month

- Average rents in London have risen again to an average of £1,770 PCM – an increase of 7% on last month’s figures

- All regions across the UK have witnessed an increase in annual variance

- The South-West saw the largest monthly variance, up 1.8% to an average of £1,017 PCM.

- Scotland saw the largest annual variance at 12.9% – the average rent in Scotland is now £770.

The HomeLet Rental Index provides the most comprehensive and up-to-date data on rental values in the UK.

The trends reported within the HomeLet Rental Index are from data on actual achieved rental values for just-agreed tenancies arranged in the most recent period – providing an in-depth insight into the lettings market and what’s happening right now across the UK.

Commenting on the latest data, Andy Halstead, HomeLet & Let Alliance Chief Executive Officer, said:

“As predicted in recent Rental Index commentary, demand will continue to outstrip supply, and when that is the case, rent prices will surely continue to grow. The March figures are a perfect example of this, with the average rental price for the UK rising almost an entire percentage point in the space of a single month.

“Issues surrounding the cost of living and energy prices have been widely reported in recent weeks, and it will be in absolutely no one’s interest if a lack of supply means that rental properties continue to be so hard to come by for consumers. The country is reliant on a strong rental market, a fact that was underlined again and again throughout the peak of the pandemic.

“Our group will complete over a million checks for new tenancies in 2022; we’ve seen the level of fraudulent applications triple in the last few years. As demand and rental prices rise, fraudsters are trying to obtain access to properties to support criminal activity or illegally sublet it. Selecting suitable tenants is crucial for a successful tenancy, and we’re seeing the sophistication increase with fraudulent activity.

“The need for trusted checks that use technology with the support of experienced referencing professionals has never been more critical. Landlords are becoming more aware of the risks, with the need for trusted checks and the support professional managing agents can provide in today’s market.”

Table: Final Rental figures from the March 2022 HomeLet Rental Index:

| Region | March-2022 | February-2022 | March-2021 | Monthly Var | Annual Var | |||||||

| Scotland | £770 | £760 | £682 | 1.3 % | 12.9 % | |||||||

| Greater London | £1,770 | £1,757 | £1,586 | 0.7 % | 11.6 % | |||||||

| North West | £871 | £860 | £788 | 1.3 % | 10.5 % | |||||||

| South West | £1,017 | £999 | £936 | 1.8 % | 8.7 % | |||||||

| North East | £589 | £583 | £542 | 1.0 % | 8.7 % | |||||||

| Yorkshire & Humberside | £743 | £730 | £688 | 1.8 % | 8.0 % | |||||||

| West Midlands | £804 | £800 | £746 | 0.5 % | 7.8 % | |||||||

| Wales | £726 | £727 | £677 | -0.1 % | 7.2 % | |||||||

| East Of England | £1,044 | £1,037 | £987 | 0.7 % | 5.8 % | |||||||

| South East | £1,148 | £1,139 | £1,086 | 0.8 % | 5.7 % | |||||||

| Northern Ireland | £718 | £718 | £681 | 0.0 % | 5.4 % | |||||||

| East Midlands | £749 | £745 | £718 | 0.5 % | 4.3 % | |||||||

| UK | £1,078 | £1,069 | £992 | 0.8 % | 8.7 % | |||||||

| UK excluding Greater London | £910 | £902 | £847 | 0.9 % | 7.4 % | |||||||

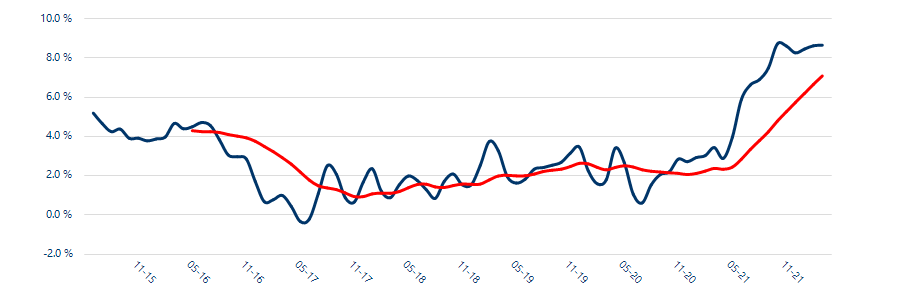

Chart 1: Annual Variance in UK Rent:

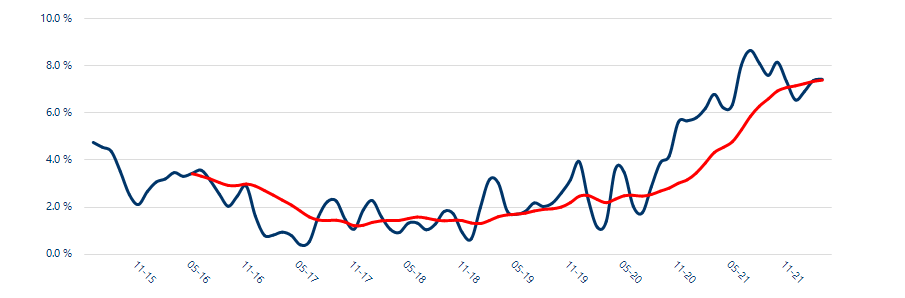

Chart 2: Annual Variance in UK Rent (Excluding Greater London):

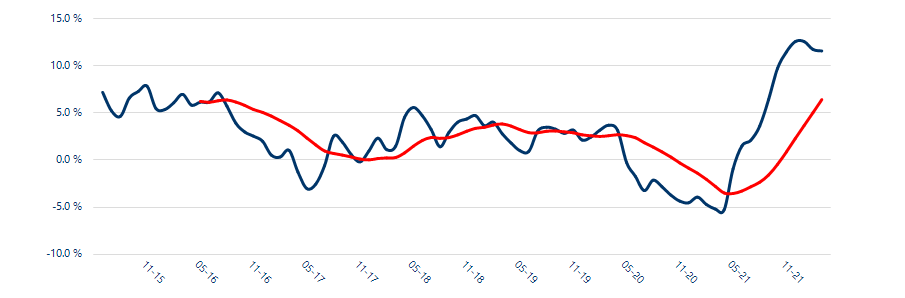

Chart 3: Annual Variance in Greater London Rent:

Head to here for more information.

Kindly shared by HomeLet

Main photo courtesy of Pixabay