Annual House Price Growth Rises to 3.3% in July, according to Halifax

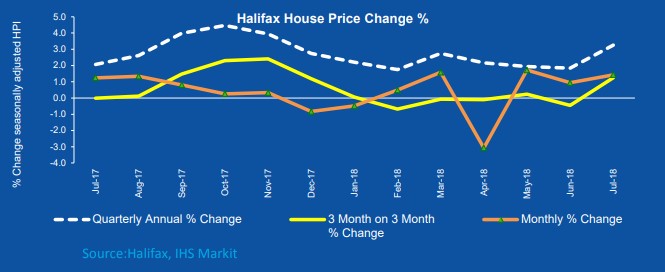

House prices in the three months to July increased by 3.3% against the same period a year earlier with the average house price rising to hit a new record of £230,280.

On a monthly basis, prices rose by 1.4% in July, while in the latest quarter (May-July) prices were 1.3% higher than in the preceding three months (February-April 2018)

Summary:

- +3.3% Annual change

- +1.3% Quarterly change

- +1.4% Monthly change

- £230,280 Average Price

Russell Galley, Managing Director, Halifax, said:

“House prices picked up in July, with the annual rate of growth rising from 1.8% in June to 3.3% in July, the largest increase since last November. The average house price is now £230,280, the highest on record. House prices in the three months to July were 1.3% higher than in the previous quarter, the fastest quarterly increase, again, since November.

“While the quarterly and annual rates of house price growth have improved, housing activity remains soft. Despite the recent modest improvement in mortgage approvals, the latest survey data for new buyer enquiries and agreed sales suggest that approvals will remain broadly flat until the end of the year.

“In contrast, the labour market remains robust, with the numbers of people in employment rising by 137,000 in the three months to May with much of the job creation driven by a rise in full-time employment. Pressures on household finances are also easing as growth in average earnings continues to rise at a faster rate than consumer prices. With regards to the recent rise in the Bank of England Base Rate, we do not anticipate that this will have a significant effect on either mortgage affordability or transaction volumes.”

Fall in housing activity in June. UK home sales fell by 3% to 96,340 in June. In the three months to June sales were unchanged from the previous three months. The volume of residential transactions has been broadly flat over the past year and is likely to remain so in the coming months. (Source: HMRC, seasonally-adjusted figures)

Mortgage approvals rise again for second successive month. Bank of England industry-wide figures show that the number of mortgages approved to finance house purchases – a leading indicator of completed house sales – grew by 1.4% between May and June to 65,619 – the second highest monthly level this year. There are some encouraging signs with mortgage approvals up 4.1% since April, however, demand remains weak. (Source: Bank of England, seasonally-adjusted figures)

Housing activity remains steady. New buyer enquiries have been flat or falling for 18 consecutive months, whilst agreed sales deteriorated between May and June. On past evidence, both sets of data point to mortgage approvals holding broadly flat until the end of 2018. On the supply side, new instructions, which had fallen for 26 consecutive months have now edged up in the past two months. (Source: Royal Institution of Chartered Surveyors’ (RICS) monthly report)

Kindly shared by Halifax