32 million people think Britain’s homes are not “fit for purpose”

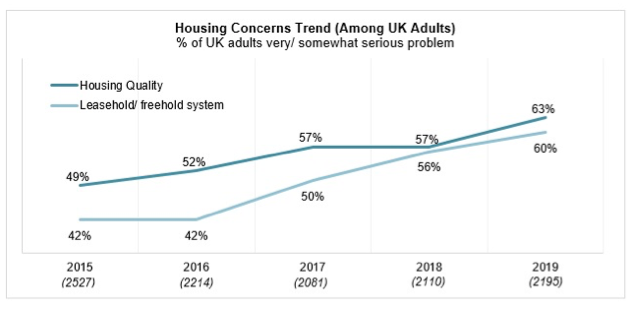

In this year’s HomeOwners Survey, concerns about the quality of Britain’s housing stock and our outdated leasehold system have soared faster than at any point since 2014, so we take a look at worries UK housing isn’t fit for purpose – and other issues keeping us all awake at night….

- 63% of UK adults are worried about the quality of housing stock

- 60% of UK adults say the leasehold system is a serious concern

- 85% say house prices and saving for a deposit are the biggest housing issues

- Concerns mounting over negative equity and gazundering

- Satisfaction with housing highest in Wales and lowest in Northern Ireland

In this year’s HomeOwners Survey, conducted by YouGov and on behalf of the HomeOwners Alliance, BLP Insurance and Resi.co.uk architects, it’s revealed that 32 million people think Britain’s homes are not “fit for purpose”, while the number of people concerned about leasehold and the quality of housing hits an all-time high.

A lack of quality housing

The research found the quality of Britain’s homes is the fastest growing issue. Almost two thirds (63%) of UK adults now cite it as a serious concern, up 6% from 2018, while nearly seven in ten people (69%) living in rented accommodation report serious concerns with housing stock quality.

Leaseholds open to corruption

This year’s survey took a deep dive into challenges facing leaseholders. The much-criticised leasehold system has been the fastest rising housing issue over the past five years. Three in five (60%) UK adults now say the leasehold/ freehold system – including service charges, ground rent and other fees – is a serious problem. This is up from 42% in 2015. The issue registers similar levels of concern across all regions in England.

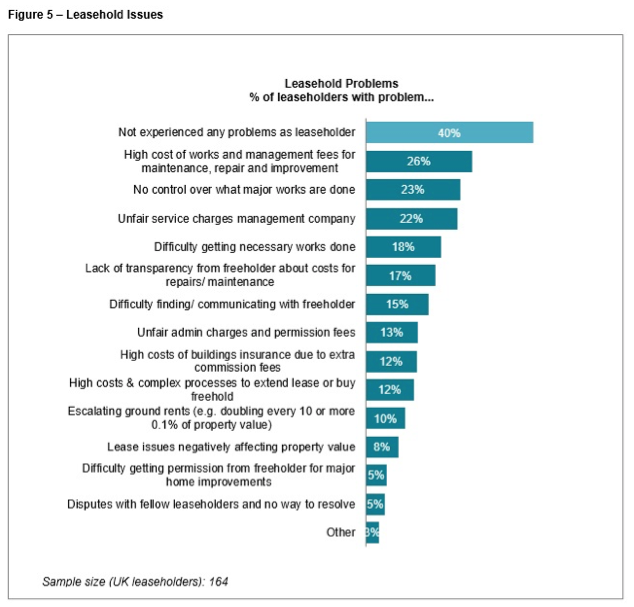

More than a quarter (26%) of leaseholders complained about the high cost of works and management fees while just under a quarter objected to unfair service charges (22%) and a lack of control over which major works are done (23%).

These results follow a Select Committee report last week announcing a crackdown on the leasehold system, which is open to corruption, and the poor value for money it represents.

First-time buyers – or home-owning no hopers?

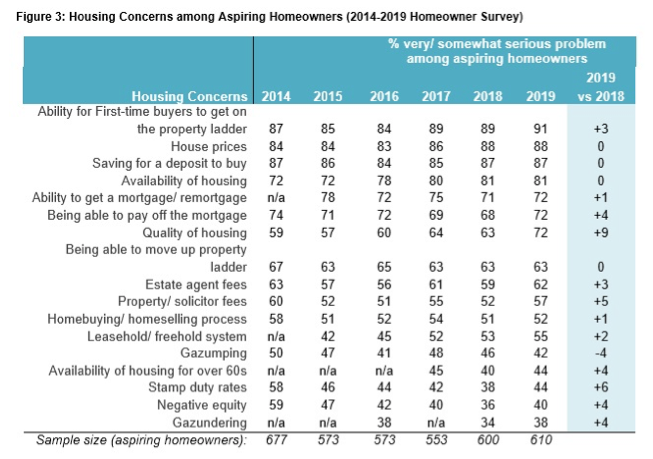

Meanwhile the crisis for first time buyers has reached the largest recorded levels. More than nine in ten (91%) aspiring first-time buyers saying the ability to get on the property ladder is a serious problem, while 88% say house prices and 87% say saving for a deposit are serious problems.

This comes against a backdrop of Government initiatives, such as the abolition of stamp duty for first time buyers and higher levels of lending for them.

House sale and value nightmares

Two trends indicate a lack of confidence in house prices:

- Gazundering has risen as an This is when buyers drop their offer price just before the sale. It has escalated from 40% last year to 45% in 2019.

- Likewise anxieties about negative equity have mounted. Some 45% of UK adults have described this as a problem.

In the regions

While levels of happiness among homeowners were highest among the Welsh, who also voted in favour of Brexit, and lowest among the Northern Irish, who voted to remain in the EU.

Two-thirds of those in Northern Ireland (69%) say they are really worried about negative equity. Northern Ireland is yet to fully recover from the 2008-9 credit crunch and house price crash, it has had no functioning devolved government since 2017 and is set to be the UK region most badly affected by Brexit because of its border with the Republic of Ireland.

What does all this mean?

Co-sponsor of this year’s survey, Kim Vernau, Chief Executive Officer, BLP Insurance, says:

“The results of this survey cast another dark shadow over a housing industry rife with systematic faults. The Government and the housebuilding industry have come under severe pressure to meet targets and boost housing volumes. This has resulted in a noticeable drop in both the practical design and build quality of new houses, as well as poorly thought through schemes, such Help-to-Buy.

“The government scheme has buoyed the residential sector, keeping prices artificially high, but cracks have started to appear, and its collapse could leave thousands of first time buyers stranded in negative equity. In an already stagnating market, where harmful practices like guzundering are commonplace, poor quality of build and the plausible threat of depreciating asset value are compounding pre-existing caution from potential buyers and investors. To restore confidence in a faltering sector, more emphasis needs to be placed on improving quality of build and resisting short-term populist solutions to our deepening housing crisis.”

While fellow co-sponsor Alex Depledge, CEO of Resi.co.uk, says:

‘Housebuilders keep churning out badly-built boxes. They prioritise profit rather than the living environment. This poorly-designed housing stock is having an increasingly profound effect on the nation’s mental health and productivity. It’s scientifically proven that people respond well to beautiful facades and large windows, which is why Georgian and Victorian properties are so enduringly popular and expensive. But everyone has the right to live in a well-designed property. Solving the issue of poor housing stock would address so many other issues in society.”

Key Findings from the 2019 Annual Homeowner Survey

TOP ISSUES

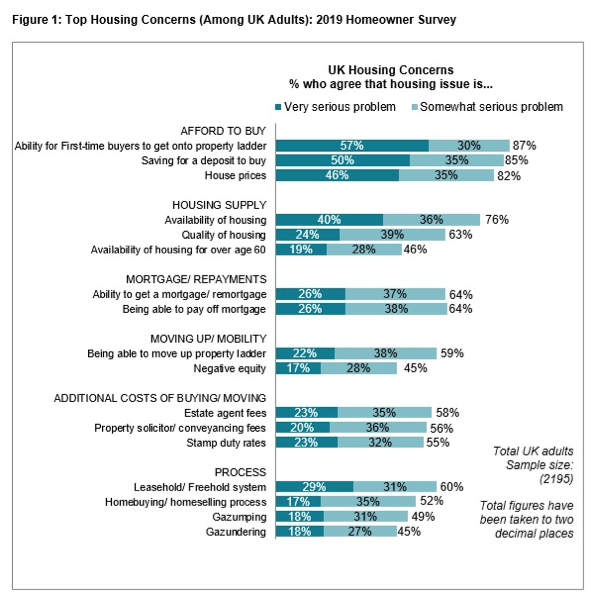

- Difficulties related to buying your first home top the list of UK housing problems. 87% of UK adults say the ability to get on the property ladder, 85% say saving for a deposit and 82% say house prices are serious problems. Figure 1 Top Housing Concerns

- Top and rising housing issues are echoed among aspiring homeowners. Ability to get on the ladder, housing quality and problems with the leasehold system are at record highs. Among aspiring first-time buyers 91% say the ability to get on the property ladder is a serious problem – the highest level recorded since tracking began six years ago. Other top issues for aspiring first-time buyers include house prices (88%) and saving for a deposit (87%). Also on the rise among aspiring homeowners is concern about the quality of housing (72%) – up 9% year on year and the leasehold/ freehold system (55%, steadily on the rise since 2015 then 42%). Figure 3 Housing Concerns & Trend among Aspiring First-Time Buyers

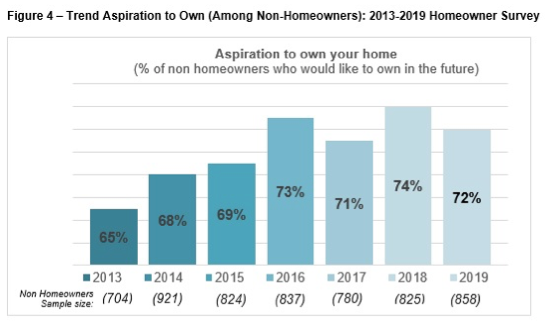

- Aspiration to own remains high. More than seven in ten non-homeowners (72%) would like to own their home one day. Figure 4 Trend Aspiration to Own

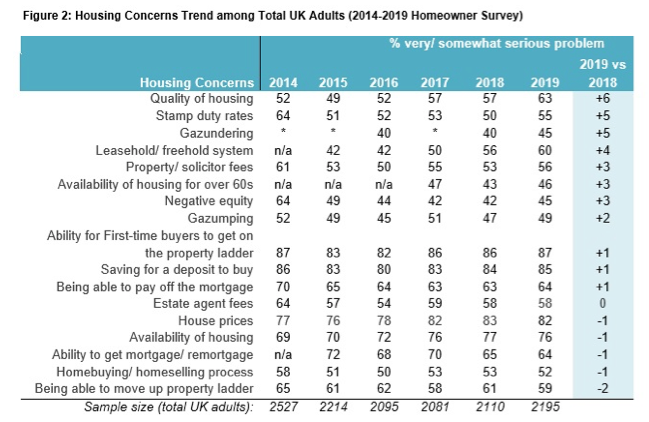

RISING ISSUES Figure 2 Housing Concerns Trend among UK adults

- Housing quality is the fastest rising issue in 2019, now at a five-year high. Nearly two thirds (63%) of UK adults say housing quality is a serious problem up 6% from 57% in 2018 and up from 49% five years ago.

- The leasehold systemhas been the fastest rising issue over the past 5 years. The proportion of UK adults saying the leasehold/ freehold system is a serious problem at 60% is up 4% in 2019 and up 18% since 2015 from 42%.

- Gazundering and negative equity are up year on year.Possibly in response to a more price sensitive selling climate, both gazundering and negative equity are up as issues. Up 5% year on year, 45% say gazundering is a problem. Up 3% year on year, 45% say negative equity is a problem.

- The cost of stamp duty has been described as more of a problem over the past year with 55% of UK adults – up from 50% in 2018. The HOA is calling for action on this inefficient tax.

LEASEHOLDER ISSUES

- Concern with the leasehold/ freehold system has risen sharply over the past 5 years and is shared throughout England.Three in five (60%) now say the leasehold/ freehold system including service charges, ground rent and other fees is a serious problem. Concern has risen persistently over the past five years (up from 42% in 2015/2016).

- The most common leaseholder problems relate to costs, control, communication and transparency. Among all UK leaseholders, 40% report no problems, while others report high cost of works and management fees (26%), unfair service charges (22%) and lack of control over what works are done (23%). Nearly one in five leaseholders (18%) report difficulty getting necessary works done. Others find a lack of transparency about costs (17%) or difficulty finding or communicating with their freeholder (15%). Figure 5

DIMINISHING ISSUES

- Getting a mortgage or remortgaging is declining as an issue over time. 64% of UK adults say the ability to get a mortgage/ remortgage is a problem (down from 72% in 2015).

REGIONAL ISSUES

Regional Findings from the 2019 Annual Homeowner Survey:

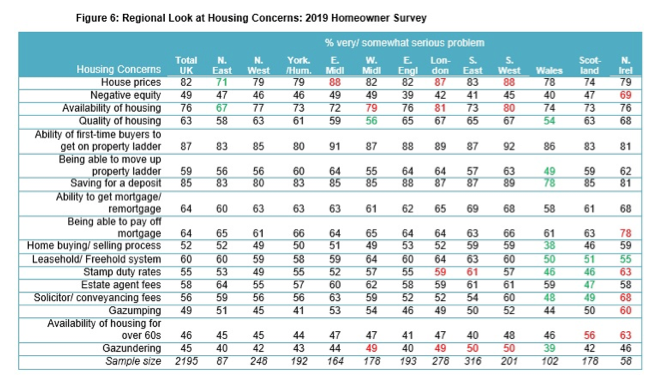

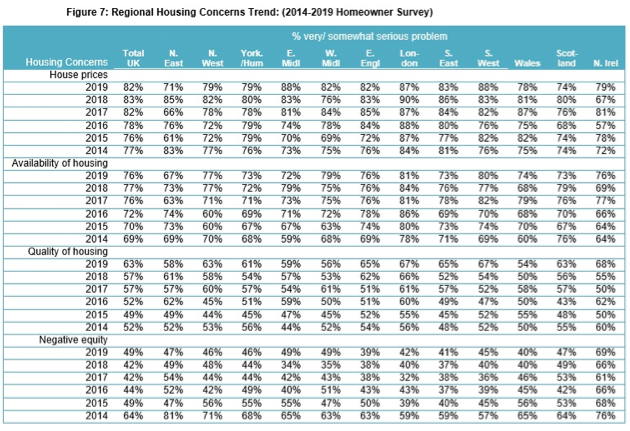

Figure 6 & 7 2019 Regional Housing Concerns & Regional Housing Concerns Trend

- In Northern Ireland there are higher levels of concern versus the UK generally for negative equity (69% vs 45%) and, related to this, being able to pay off the mortgage (78% vs 64%).

- The Welsh seem more positive overall with a lower proportion registering as issues: homebuying and selling process (38% vs 52%), gazundering (39% vs 45%), leasehold/ freehold system (50% vs 60%), stamp duty (46% vs 55%), solicitor fees (49% vs 56%), being able to move up the ladder (49% vs 59%), quality of homes (54% vs 63%).

- In the North East, fewer people than the UK overall have an issue with house prices (71% vs 82%) or the availability of homes (67% vs 76%).

- In Scotland, the proportion saying stamp duty rates (46% vs 55%), estate agent fees (47% vs 58%) and solicitor fees (49% vs 56%) are a problem is lower than the UK overall.

Kindly shared by HomeOwners Alliance (HOA)