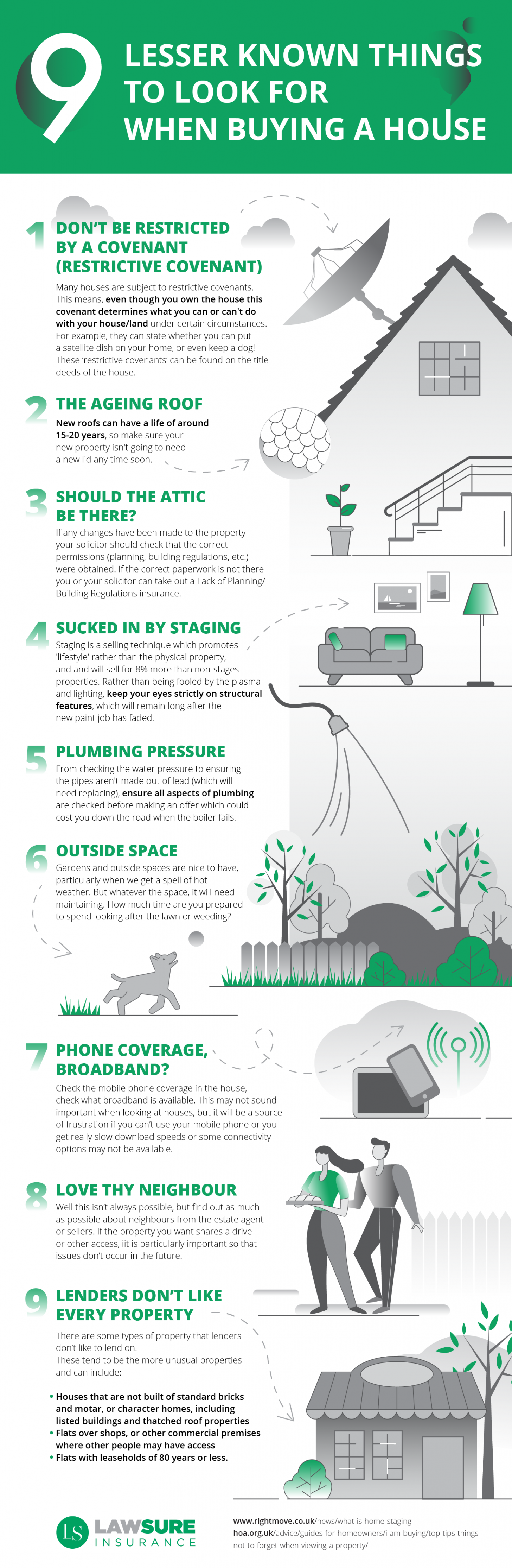

Lesser-Known Things to Consider When Buying a Home

When looking for a new home, no matter how experienced the buyer is, it can be a daunting process, so Lawsure have created a list of lesser known things buyers do not always look for to help alleviate disappointment and issues for potential buyers throughout the transaction.

Below is a reflection of these points that are relevant to those in the industry and how you can aid clients to make the right choice.

-

Mortgages

Even if an offer in principle has been made, lenders will not release an advance on all types of property. From leases with less than 80 years to thatched roofs, lenders will take every step to make sure their investments are safe, even if that means refusing a loan.

When dealing with an unusual property, inform clients as soon as possible they can not always rely on their current lender and may need to factor in time to look for a new mortgage.

-

Restrictive Covenants

Restrictive covenants can make a real impact on how you live in your property. Many clients have never heard of these restrictions and it can come as a huge shock.

If possible, make clients aware of these before an offer is placed or as early in the transaction as possible. Some of these restrictions may seem trivial and irrelevant but you never know exactly how others use their homes. Report everything, no matter how small, so your client can make an informed decision before they are too financially, emotionally and legally invested.

-

Neighbours

Agents have a perfect opportunity to get to know neighbours. Don’t be afraid to knock on the door of adjoining properties to get a scope on who lives there. This can help clients with their choice and can also be a great selling point if the neighbours suit potential buyers.

You can also use neighbours to help with questions the vendor may not be so candid on. Especially with leaseholds, neighbours are usually willing to voice their opinion on managing agents and landlords.

-

Planning Permission

The consequence of not obtaining planning permission can be catastrophic for a new owner, likewise, trying to obtain the proof of permission can waste time during conveyancing.

As an agent, when the vendor puts a property on the market ask them to collate this documentation so as soon as an offer is accepted, this can be sent to the conveyancer.

If these documents cannot be found, make your clients aware of lack of planning permission indemnity insurance and that they may be liable to pay for this. If they are aware at the beginning, it will make the transaction smoother and they won’t be hit with a surprise cost.

Check if any nearby properties have been approved for planning permission and if so, what is to be done. Views may be a selling point of the property but may be interrupted by new buildings. Check the right to light is there and if not, make your clients aware.

-

Connectivity

Estate agents are essential to the conveyancing process and it is them who can really help buyers make the best decision.

When showing buyers a property, suggest they try their phones throughout the house. It is not often considered but, especially in rural areas, networks may not give good coverage.

It is also worth asking the vendor what broadband provider they are currently using and what speeds are available so this can be relayed to prospective buyers.

-

The Roof

A roof generally has a lifespan of 15-20 years. If the vendor has not replaced the roof in this time, encourage your clients to have an inspection by a reputable roofing company.

Many companies can offer a free quote for any repairs that may need doing, this could help to have a retention, or an allowance written into the contract.

This way, the buyer will have peace of mind and you won’t experience issues post-completion from disgruntled clients.

-

Staging

Staging is very common by sellers, trying to sell a lifestyle instead of the structure itself.

Conveyancers should keep a close eye on the property particulars to be able to raise any visual issues.

If you client isn’t buying with a mortgage, you should always push for them to have a survey and searches done.

-

The Garden

Leaseholds often have a shared garden but can be one of the last things people think about when placing an offer.

Ask your client if they are aware of who is responsible for maintaining this and if there are any restrictions on how you can enjoy this space.

Although this can be raised further on, knowing from the offset can greatly help. You don’t want clients finding out they are not allowed to have summer BBQs or can’t let their dog out for a run.

-

Plumbing

One of the most common complaints from clients after completion is that boiler or plumbing isn’t working.

Unfortunately, it can be a bit of a grey area as to who is responsible for this.

When your clients are organising surveys, encourage them to have a specialist in to check boilers and plumbing and alert them of the consequences of not doing so.

Many clients are less likely to kick up a fuss when greeted with a broken boiler if they are aware it is their responsibility.

Although it is ultimately the clients’ responsibility to seek advice and have all aspects of a property checked, taking these few extra steps can really help all those involved in a transaction.

Thoroughly combing through issues before they can arise will keep clients happy, ease the process for yourself and ensure returning business for the future.

Kindly shared by Lawsure Insurance