HomeTrack publish their UK House Price Index for July 2022

HomeTrack publish their UK House Price Index for July 2022, which asks the question whether buyer demand is finally starting to weaken.

Key points from publication:

-

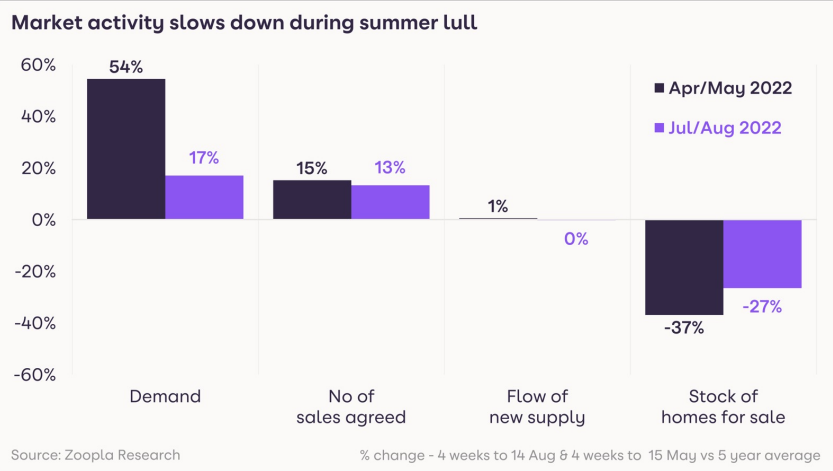

- Demand weakening over summer, more so than last year

- New sales volumes holding up, supporting headline price growth

- Cost of living hitting lower income households hardest, while those that buy homes tend to be on higher incomes

- Higher mortgage rates to have a greater impact on activity in H2

- Mortgage rates for new buyers on track for 4%. The average first-time buyer will need an extra £12,250 in income to buy a home compared to a year ago and up to £35,000 more in London.

- Higher mortgage rates will impact activity and prices in higher-priced, unaffordable markets and less so in lower value markets.

|

+8.3% Current UK house price growth |

£12k Extra income a first-time buyer needs to afford to buy at a 4% mortgage rate |

35% Share of all sales by first-time buyers H1 2022 |

Demand weakening but not falling

UK house prices increased by 8.3% or £19,800 in the past 12 months. The South West and Wales are jointly the best performing regions, with annual house price growth of 10.6%. Strong demand and healthy volumes of new sales agreed in the first half of the year continue to support the headline rate of growth.

New sales agreed remain in line with last year while stock levels have started to rebuild off a low base, boosting choice for buyers. The average UK estate agent has 14 homes for sale, up from a low of less than 12 in the spring but below the pre-pandemic level of 20.

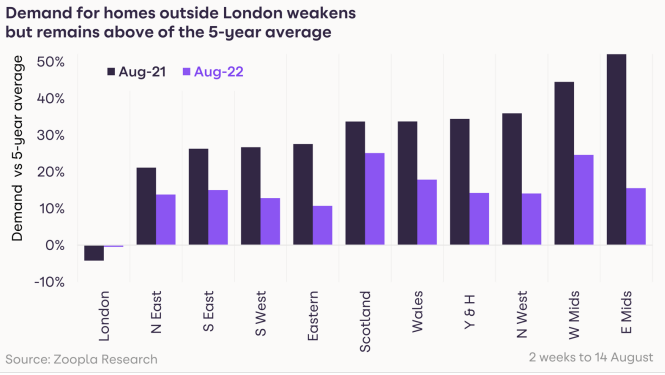

Buyer demand is registering the usual summer slowdown and underperforming last year, as economic uncertainty increases. The chart below compares demand for homes by region against the 5- year average. Buyer interest this summer is weaker than last year but still above the 2017-2022 average. While allowing for seasonal factors, we expect demand to continue to underperform against last year as we move into the autumn.

Demand for homes in London continues to lag the rest of the country due to pandemic and affordability-related factors with annual price inflation (4.1%) less than half the UK average.

Cost of living and the housing market

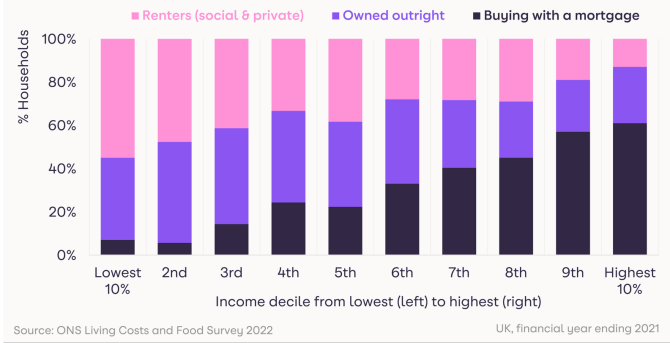

It may feel surprising that sales market activity is not weakening faster, given increases in the cost of living, rising interests and a drop in UK consumer confidence. High inflation and the rising cost of living are hitting those on lower incomes first and will take longer to impact higher income households. The latest spending survey data shows all households have been adjusting spending patterns, cutting back on non-essential areas of spend, while those on higher incomes have more room for manoeuvre.

Home buyers using a mortgage are in higher income bands

Home buyers with mortgages tend to be in higher income bands, compared to lower-income households who are more likely to rent or own their home outright. The chart below illustrates this, showing the tenure mix by income bracket. Those on lower incomes spend a greater proportion of their earnings on essentials, including food and energy costs. Prices in these areas have risen the most, and therefore they’re feeling the cost squeeze more acutely. However, with energy prices set to jump higher in the autumn, the rising cost of living will continue to be felt across all income bands. We expect it to exert an increasing impact on household decisions, including home moves.

Sales market more sensitive to higher mortgage rates

Despite higher living costs, pandemic factors – such as the increase in working from home and a growth in retirement – continue to stimulate demand for homes. This is shown by the ‘new sales agreed’ measure, which is on a par with this time last year.

What is yet to fully impact market activity, is higher mortgage rates, which have more than doubled in the last few months. While those buying homes with a mortgage may be on higher incomes, the jump in mortgage rates for new buyers will add to cost of living increases, impacting sales market activity into Q4 and 2023.

While outright owners account for 1 in 4 purchases, rising living costs are likely to be increasing the proportion of households considering downsizing to help reduce running costs and/or extract equity from their home. We see the growing pressure on household budgets and the ongoing re-evaluation of housing by homeowners, brought about by the pandemic, supporting to overall sales volumes. This does not necessarily mean higher prices, as higher costs will make consumers more conscious on what they are spending – not only on mortgage costs, but also on the overall cost of running a home.

Higher mortgage rates to impact demand over H2

In January 2022, new mortgage rates were still ultra-cheap at less than 2%. This has now jumped to 3.5% and is set to reach 4% as we move into the autumn. This level of mortgage rates is still low by historic standards, but homebuyers have become used to very low mortgage rates. This means any reversal is likely to have some impact on demand, especially when combined with cost of living pressures.

Impact on first-time buyers and renting v buying

Higher mortgage rates increase the monthly cost of repayments for all new home buyers. First-time buyers (FTBs) are the most sensitive group, alongside existing owners looking to buy a bigger home using more debt, and therefore extending the size of their current mortgage. The impact will be less for those downtrading or moving to a similar-value home with the mortgage carried over – ‘ported’ – at the same rate.

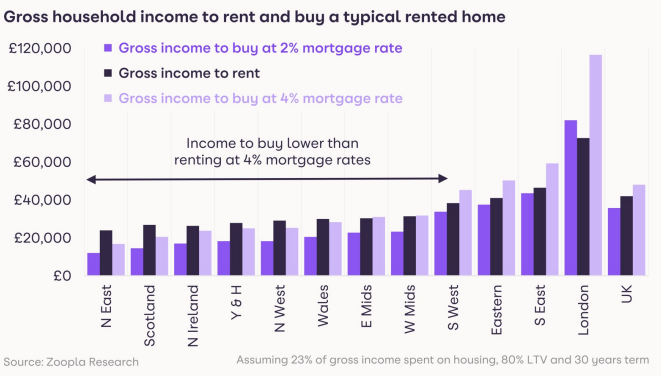

Higher mortgage rates for FTBs mean larger monthly repayments and the need for a greater household income to meet the increased costs. The chart below shows the income to rent and buy a typical rented home at 2% and 4% mortgage rates. Moving from a 2% mortgage rate to 4% means the average FTB will need an extra £12,250 in income, compared to when rates were lower. In London, the highest value market, this increases to over £34,500. The increase is less than £6,000 in markets with lower house prices.

However, compared to the income needed to rent, the income needed to buy at a 4% mortgage rate would remain lower, or on a par with renting, in all areas outside of southern of England. These are affordable markets where FTBs have tendency to buy larger, higher-value homes as they have the buying power to enable this. The lack of a material over-valuation in UK home values means mortgage rates of up to 4% are not, on their own, sufficient to result in UK-wide price falls.

Higher rates impact demand in higher value markets

The higher the income needed to buy a home, the more households are priced out of the market which, over time, reduces the pool of demand for homes. The impact of rising mortgage rates will be felt most acutely in high-value markets in southern England where affordability is already a drag on market activity. Our data shows demand for homes is already weakest in higher-value areas such as London, a trend that is likely to worsen for those looking to buy their first home as mortgage rates move higher.

FTBs can respond to higher borrowing costs by using a bigger deposit to reduce the size of the mortgage, as well as by looking to buy cheaper homes or stepping back from the market altogether. In order to fully offset this increase in mortgage rates FTBs would need to almost double the size of the average deposit.

So far, there are few signs of weaker demand and our analysis shows FTBs made up an increased share of all sales in H1 2022 – up to 35% compared to 32% in 2021. Greater flexibility on where people can work and rising rental costs are supporting FTB demand, with buyers looking further afield for better value for money. However, we expect FTB behaviours and buying patterns to shift further in H2 in response to higher costs and the increasing possibility of FTBs being priced out of the market.

Housing outlook

The headwinds for the sales market are building but the market is in a much better place to weather these than during previous economic cycles. History shows that it is the sudden changes in levels of spending on housing that are most closely linked to changes in house price inflation and sales volumes.

The downsides for prices and sales are most common during recessions, when consumers need to rapidly adjust what they spend in response to unemployment or higher mortgage rates. A high proportion of today’s mortgagees are on fixed-rate loans and stress-tested to see if they can afford a rate of up to 7%. This has baked resilience in the market that will limit the downside for prices.

That said, it’s clear UK households are facing a squeeze on incomes and living standards on multiple fronts, which will filter through into housing market activity and house price growth into 2023. The primary risk remains in further increases in the base rate in order to control inflation control inflation, which will have a knock-on impact on mortgage rates.The higher rates move above 4%, the greater the impact on prices and sales volume and where homeowners have plenty of equity to cushion any future price falls.

Kindly shared by HomeTrack

Main photo courtesy of Pixabay